COVID-19 is taking a harsh toll on the economic wellbeing of many retirees with new research showing it has shaken their confidence in the quality of their retirement and how long their money will last.

Shortcomings in retirement outcomes

Many Australian retirees are downgrading their retirement expectations, spending less on luxuries, and are fearful and confused about the safety of their investments.

The Allianz Retire+ survey collated the views of over 1,000 current and prospective retirees nationwide in May 2020, to understand how COVID-19 was affecting their lifestyle, investment actions and retirement perceptions.

Only one-third of retirees feel confident in their financial position. In addition to health concerns about the virus and not being able to see family and friends as much, retirees are yet again suffering the sharemarket rollercoaster.

A total of 66% do not agree that Australia’s superannuation system will provide them with a dignified retirement. It suggests the Australian superannuation system, which is lauded as one of the best globally, is not working for a great deal of the people it’s designed for.

Moreover, COVID-19’s impact has exposed systemic issues in the drawdown phase of retirement, highlighting shortcomings in retirement product design, access to financial advice and superannuation education.

In a previous study, ‘The Next Chapter’ undertaken by Allianz Retire+ in 2019, retirees reported feeling nervous and uncertain about what’s ahead and lacked in investing confidence. Unfortunately, COVID-19 has taken that to a new level. On both occasions the research indicated retirees want safe, simple, low-cost retirement products with certainty a key feature. Unfortunately, the investment industry is not generally meeting that need.

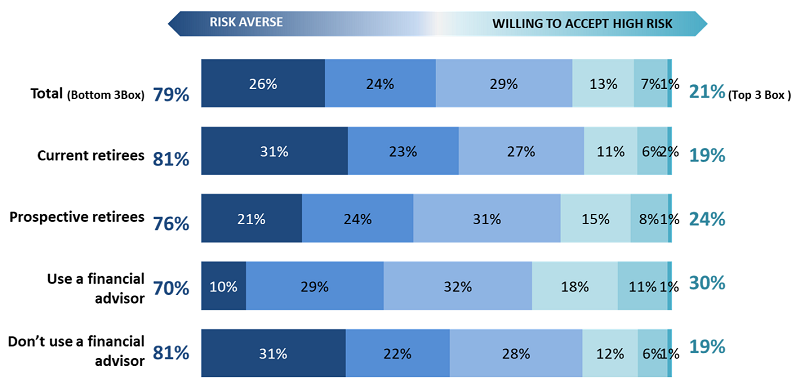

The current survey found that three in four retirees are not confident about how long their money will last in retirement and when asked about their investments during the pandemic, only 18% felt their investments would be safe in case of economic downturn. They also reported being largely risk averse, seemingly exacerbated by the pandemic.

Source: Allianz Retire+, ‘Black Swan Research’, May 2020

Nearly half of respondents said they were monitoring their investments much closer due to COVID-19 and just under a third of those surveyed were happy with the federal government’s response to COVID-19 policies that affect their retirement.

The pandemic has brought many of the systemic issues back to the surface and there needs to be a greater sense of urgency in delivering change to the system.

Prospective retirees most at risk

The economic impact of COVID-19 was greater on prospective retirees (within seven years to retirement) than current retirees, the survey found.

Source: Allianz Retire+, ‘Black Swan Research’, May 2020

Vulnerability close to retirement

About 40% of prospective retirees said they lost money to date during COVID-19. Just over one in five said their employment status has (or may) change due to the economic downturn.

Falling retirement savings and rising job insecurity is a toxic combination. Around one in three prospective retirees now have more negative expectations of their retirement. And 77% of prospective retirees do not believe superannuation will provide them with enough money in retirement.

Those nearing retirement have been particularly hurt by the downturn. These investors tend to have more funds allocated to shares, so have higher susceptibility to market crashes. Typically, they are still working and need that income to build retirement savings.

This is where the impact of COVID-19 has shown the danger of ‘sequencing risk’, where the timing of poor market returns can permanently damage retirement savings. Prospective retiree investors can ill afford to have the share component of their superannuation crushed by market volatility. Many do not have enough time left in the workforce to rebuild their wealth.

With COVID-19 reinforcing the need for retirement-savings products that have a low-cost protection mechanism, around one in three prospective retirees said they would consider an investment product that ‘insured them from market downturns’. Investing in retirement is very different to accumulation and retirees are realising diversification and asset allocation is no panacea to protect wealth during crises.

Lack of advice during the pandemic

Remarkably, the survey found 79% of retirees did not seek financial advice during COVID-19.

Only one in five retirees felt that they had easy access to professional financial advice and approximately a third felt financial advisers were ‘for the rich’. Almost two-thirds of those without an adviser said they would not use one because the service was too costly.

The advice proposition is proven to be an integral part of providing individuals with confidence and certainty in retirement, with those who use an adviser stating more confidence and security in their financial position. And 68% of those who were advised during COVID-19 said they are sticking to their financial plan, meaning advice is definitely deterring people from making sub-optimal investment decisions based on fear or a lack of understanding. That fact alone proves there is a clear need to change the perception of financial advice among retirees and increase access to affordable advice.

About the survey

Allianz Retire+ commissioned research surveying 1,007 retirees in May 2020 to understand how the economic impact of COVID-19 was affecting them. The sample was split equally between current and prospective (retiring in the next seven years) retirees, and equally between men and women. Most respondents were aged 60 to 75 or over. The survey included responses from retirees in each State and Territory. About two thirds of respondents had an annual household income below $79,000.

Innovative retirement income products with in-built protection from sharemarket losses include Future Safe from Allianz Retire +.

Matt Rady is Chief Executive Officer of Allianz Retire+. This material is for general information purposes only. It is not comprehensive or intended to give financial product advice and does not take into account your objectives, financial situation or needs.