Investment grade (IG) portfolios can offer returns of 7-8% and, importantly, the likelihood of any significant default cycle appears small.

Australian bond and fixed-income managed funds saw strong net fund inflows over 2023 and that trend has continued into the early part of 2024. That does not happen very often but when it does, it can produce equity like returns from fixed interest assets and with a much lower risk of capital loss. I believe investors are starting to understand that, and that's the real attraction of investment grade (IG) rated portfolios.

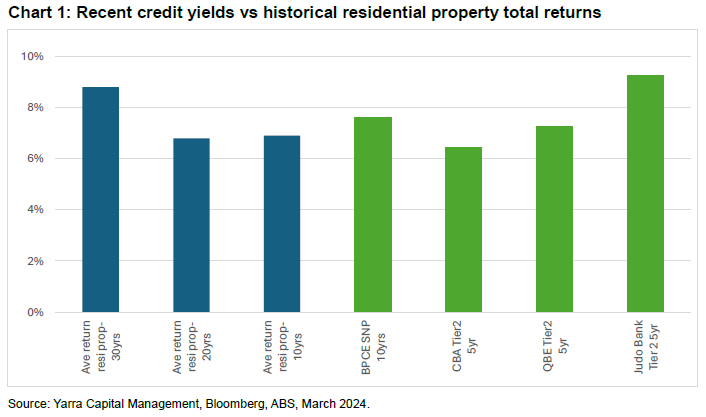

One interesting trend we have increasingly observed is that IG deals coming to market are offering better returns than so called ‘safe haven’ asset classes, in particular the Australian residential property market (refer Chart 1).

The challenge is delivering compelling risk-adjusted returns. Here we take the view that global governments will focus on maintaining stability in their economies, resulting in higher-for-longer inflation and interest rates. Under this scenario, the cost of debt would remain higher for an extended period - an excellent backdrop for credit investors. The return prospects look increasingly attractive: investors can lock in higher yields than cash and with limited interest rate or spread risk. While recent IG credit returns compare favourably to the average total returns available from equities, comparing with residential investment property paints an especially stark picture.

Credit opportunities

In terms of our investments across the Australian multi-asset credit universe, key positions have been in bank-issued Tier 2 hybrid debt (T2s) and residential mortgage-backed securities (RMBS). The market is increasingly comfortable that we’re not going to have a house price crash and is factoring in an environment where central banks stop hiking and eventually start easing rates (from as early as August in Australia). We’re seeing credit spreads performing very strongly because of the attractiveness of the outright yields and the comfort investors have with those IG corporates and issuers. It’s a thematic that is likely to continue.

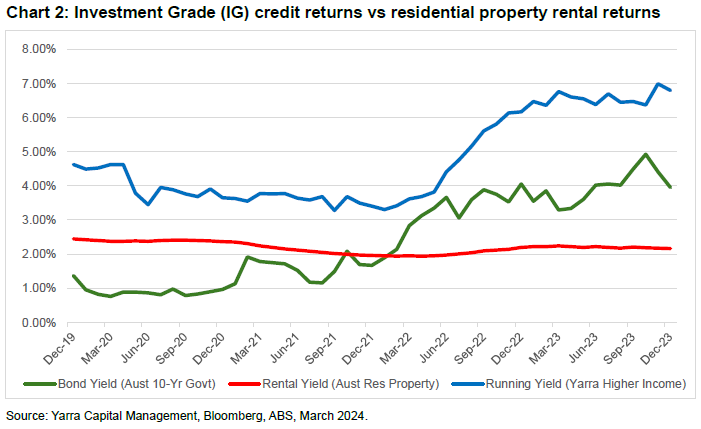

Compared specifically to residential property, we believe IG credit offers an appealing and hassle-free alternative for stable and attractive income, without the headaches associated with owning investment property. Yields of 6-7% across T2s and RMBS compare to residential property rental yields of just 2% (refer Chart 2).

While we’re not suggesting holders of Australian investment property should all rush for the exits, it is worth contemplating the go-forward return profile for what is one of Australia’s long favoured asset classes.

With such a significant gap in return profiles, investment property owners would need to see significant capital growth to make up the difference. And with a stable outlook for house prices, it’s difficult to see that happening. Meanwhile, taxes are rising for Australian property investors and there is clearly some uncertainty around the future of negative gearing.

The outlook for investment grade credit

Looking forward, we think bank issued hybrid capital, particularly T2s, are still attractively priced and that they will continue to provide a source of strong outperformance. RMBS is still a robust sector, as we continue to see households prioritising their mortgage repayments over discretionary spending. With house prices having essentially returned to their previous peaks, and borrowing capacity determined by income capacity, it is difficult to imagine a scenario where the next leg up for house prices comes from. Finally, combined with uncertainty around the government’s future tinkering to both negative gearing and capital gains tax, potential for still higher land taxes in some States, and the increasing rights of tenants, it’s understandable why many property investors are more likely to be thinking of selling up rather than buying.

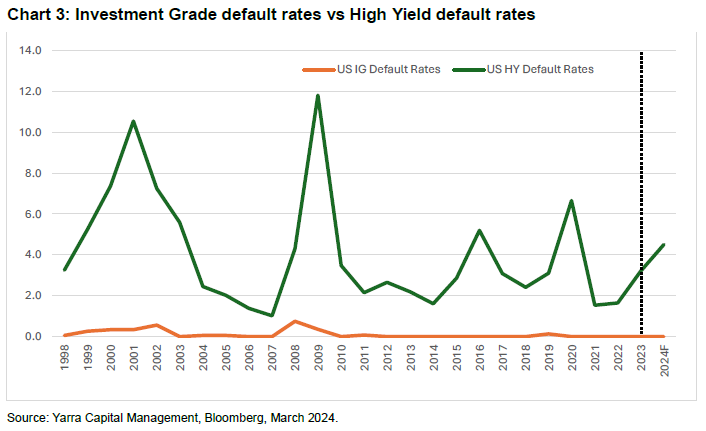

It’s clear that investors see IG credit as a defensive play and as a security that should perform well in a recession. History has shown that rate hiking cycles by central banks often lead to a recession and so it must remain a consideration. However, even in a recessionary environment with mild negative growth, IG credit offers a compelling alternative to cash. There are parts of the credit market that are more vulnerable in the event of recession, but IG credit ratings underscore companies that can more easily service debt and, therefore, are better able to weather the negative impact of a recession on profitability.

Phil Strano is a Senior Portfolio Manager at Yarra Capital Management. This article contains general financial information only. It has been prepared without taking into account your personal objectives, financial situation or particular needs.