“Stupidity is our destiny.” Acadian Asset Management

The painful experience of Greenlandic stamps

In my younger days (much younger), I collected stamps, more specifically stamps from Greenland. A well-meaning uncle had convinced me that there are so few Greenlandic stamps around that, over time, prices can only go up. Little did he realise that the arrival of the iPhone would dramatically reduce the appetite for spending long winter evenings with your stamp collection. Nor did he foresee the arrival of the digital era, where physical mail, thus the need for stamps, would virtually disappear, as it has in the Kingdom of Denmark (which we are supposed to call our country when talking about it in the context of Greenland or the Faroe Islands).

Now, my poor stamps collect dust in a safe. I still try to convince myself that, one day, they will turn into the homerun my uncle ‘promised’ me, but my conviction has all but gone. The other day, a client of mine asked me about wicked asset classes, which he defined as asset classes that don’t fit into one of the mainstream boxes (mostly cash, bonds, equities, property and gold). He asked me why they often perform the best in the latter stages of economic cycles, which is precisely where we are now, and I immediately thought of my stamps again. Maybe they are not wicked enough?

How wicked is wicked?

Now, the list of wicked asset classes is long – very long – but my client is right; the more obscure asset classes often (but not always) perform better after years of outstanding returns in mainstream asset classes, and it doesn’t stop there. They also tend to perform (relatively) well in years where mainstream asset classes stink.

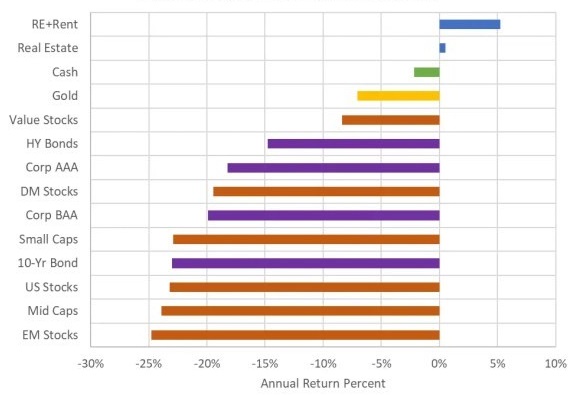

Take for example 2022 which was an extraordinarily challenging year. Nearly everything fell out of bed – at least on an inflation-adjusted basis. Returns were already quite poor when measured on an absolute basis; however, when adjusting for inflation, many asset classes delivered outright ugly returns (Exhibit 1). Having said that, the poor environment for mainstream asset classes did not deter investors from throwing plenty of money after fine wine and other not-so-mainstream asset classes.

Exhibit 1: Inflation-adjusted 2022 asset class returns

Source: mindfullyinvesting.com

This brings up the obvious question – where in the sand should you draw the line between mainstream and wicked asset classes? One could argue that everything which is not mainstream is wicked. Following that logic is problematic, though, because it turns many alternative asset classes into wicked asset classes, which they clearly aren’t. Is infrastructure wicked? Clearly not. Is corporate private debt? Only my old mum would think so.

In no particular order, I would include more obscure asset classes such as stamps, coins and notes (particularly those that have expired), fine wine, cryptocurrencies, football debt finance, classic cars and potentially also royalty rights although the latter, in recent years, have become more accepted amongst institutional investors; i.e., today, it is probably more alternative than wicked. I should also point out that the list above is far from complete. As long as there is a secondary market (well-functioning or not so well-functioning), in my book, it becomes an asset class in which you can make a profit or, in the case of stamps, a loss.

When do wicked asset classes do best?

As pointed out earlier, effectively, you have two environments where wicked asset classes tend to do particularly well:

- In late-stage economic cycles where investors are often disincentivised to invest (more) in equities because of the high P/E multiples on offer. NVIDIA trading at 62x LTM earnings doesn’t really feel like a dream ticket.

- In years like 2022 (see Exhibit 1 again), where many private investors are tempted to invest in asset classes they would otherwise pay little attention to.

In the first case, after years of solid profits, many investors have plenty of gravy to play around with. In the second case, as the overall environment is pretty hostile, many (mostly private) investors often choose to look into the distant corners of financial markets, where they can find opportunities not on offer elsewhere. The problem is that wicked asset classes are mostly unregulated, i.e. unscrupulous salespeople promise the impossible to get their hands on investors’ hard-earned capital without running much risk of ending up behind bars.

The underlying motives in (i) and (ii) above may be different, but the net effect is the same. Having said that, as many investors with experience from dabbling in wicked asset classes will know, it is much easier to get in than it is to get out again. Liquidity is extremely one-sided in most wicked asset classes.

Wicked asset classes in a portfolio context

When establishing a portfolio, the typical starting point, either explicitly or implicitly, is the efficient frontier, and where on the frontier the investor wants to be. In Exhibit 2 below, you can see the returns various financial assets have delivered over the last approx. 30 years. A relatively simple conclusion you can draw from that chart is that it has indeed been possible to move the efficient frontier up by including alternatives, i.e. your returns would have improved for the same amount of risk taken (SD of returns), had you included alternative asset classes in your portfolio.

Exhibit 2: The expanded efficient frontier, 1990-2019

Source: CION Investments

Some investors are of the opinion that you can move the efficient frontier up a bit further by including wicked asset classes in your portfolio, i.e. you can improve your risk-adjusted returns by adding for example a classic car to your portfolio.

I have three problems with that line of thinking:

- Correlations between the returns of the asset classes in question must be relatively stable for the analysis above to make any sense, and correlations between mainstream and wicked asset classes are anything but stable.

- Facts are often misrepresented when marketing wicked asset classes. If you go back to the early days of bitcoin, it was portrayed as a currency. Guess what – bitcoin trades more or less like the Nasdaq index these days. Such volatility is far too high for bitcoin to be classified as a currency.

- When wicked asset classes are often portrayed as purveyors of superior returns, the illiquidity premium is usually ignored, but the illiquidity premium is a major source of returns in this corner of the market.

Final few words

By writing about this topic, I am not suggesting you should never invest in any wicked asset classes. Not at all, but you need to be very clear in your mind as to what the purpose is, and you should never invest any money that you cannot afford to lose. Wicked asset classes are typically very illiquid, and they are almost always very risky. That said, they can also be great fun. If you follow a few simple rules, which I forgot to do in my younger days, you should do better than me.

PS. If you find this topic fascinating, I suggest you click on this link. Christopher Chappell et.al. have written an insightful, and relatively short, paper on the risks in new asset classes and how to introduce them to your portfolio. The paper is quite mathematical (actuaries like to show off); however, all you need to read is the executive summary and the conclusion, which will take you less than five minutes.

Niels C. Jensen is the Chief Investment Officer of Absolute Return Partners. This material is provided for information purposes, is intended for your use only and does not constitute an invitation or offer to subscribe for or purchase any of the products or services mentioned. The information is not intended to provide a sufficient basis on which to make an investment decision. ARP accepts no liability for any loss arising from the use of this material.