It is important to understand the different tax treatment of ‘superannuation income streams’ and ‘superannuation lump sums’. Whilst in most instances, the tax free component will be received tax free whether a lump sum or income stream, the treatment of the taxable component can vary greatly. It is often advantageous for this component to be taxed as a lump sum.

Accessing $195,000 tax free before age 60

For those pension recipients at least 60 years of age at the time of the pension payment, there will be no tax applicable, irrespective of the components. However, those aged between preservation age and 59, the taxable component, if taxed as a ‘superannuation income stream’, will be taxed at their marginal tax rate (MTR), plus Medicare Levy, less a 15% tax offset.

In contrast, those aged between preservation age and 59, if they have satisfied a relevant condition of release, can receive the first $195,000 of the taxable component as a lump sum tax free.

A payment made from a pension can be treated as a lump sum for income tax purposes. Under the Income Tax Assessment Act 1997 (ITAA 1997) and associated regulations, payments from superannuation are defined as follows:

- Superannuation lump sums (taxed using the low rate cap/maximum rate of 17% (above the low rate cap) for those between 56 and 60), and

- Superannuation income stream benefits (taxed at normal marginal rates less the 15% tax offset for those between 56 and 60).

The default position is that any payment from a superannuation income stream is a pension. Regulation 995-1.03 of the Income Tax Assessment Regulations 1997 (ITAR 1997), however, states that a payment is not a superannuation income stream benefit if it comes from an income stream that allows flexible payments and the person to whom the payment is made elects, before a payment is made, for that payment not to be treated as a superannuation income stream benefit. Any payment not considered a superannuation income stream benefit is by default a superannuation lump sum (s307-65 ITAA (1997)).

Therefore, a payment can be treated as a lump sum and taxed as such. An important requirement is this election must be made prior to the payment being made. An election made after the date of the payment will not be valid and the benefit will be treated as a superannuation income stream.

The superannuation legislation implications

From a superannuation perspective (SIS Regulations), the payment will be considered a partial commutation of the income stream, but counts against the minimum pension requirements set out in the SIS Regulations. For clients under the age of 60, it is possible to use this interpretation to provide a lower rate of tax when compared with the benefit being taxed as an income stream (or even zero tax).

Of crucial importance is the taxpayer must have satisfied a condition of release, making their benefit in the SMSF Unrestricted Non-Preserved. Such a condition of release would be retirement on or after preservation age. This then begs the question – can this strategy be used for a Transition to Retirement Income Stream (TRIS)?

The answer to this question is yes, provided the TRIS pension has Unrestricted Non-Preserved benefits at least equivalent to the amount of the partial commutation. Many TRIS pensions are usually commenced with benefits that are Preserved; which means they can only be cashed as a lump sum (partial commutation) when the member satisfies a condition of release with a nil cashing restriction.

Let’s look at an example

Sandy is 56 and is looking to start a TRIS pension. She has a member balance in her SMSF of $600,000, all a taxable component. She has an Unrestricted Non-Preserved benefit of $105,000 and she has not used any of her low rate taxable threshold. If Sandy draws the minimum amount from her TRIS pension (4% or $24,000), how much tax does she have to pay?

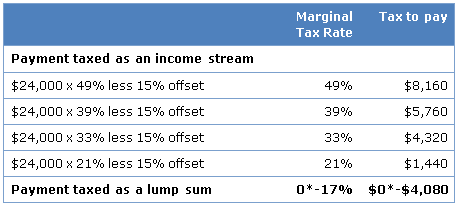

The table below illustrates the outcome if the benefit is taxed as an income stream at various marginal tax rates, or taxed as a lump sum (this applies to the taxable component only).

*In Sandy’s case no tax is payable, as she has not used any of her low cap taxable threshold.

As can be seen from the table above, if an income stream benefit can be taxed as a lump sum, the tax savings can be significant, especially if the low cap taxable threshold is available. In fact, as Sandy has not used any of the $195,000 cap, she can draw the full $105,000 Unrestricted Non-Preserved benefit from the fund and pay no tax.

Financial planning opportunities

This creates the following opportunities for Sandy:

- The $105,000 taxable component withdrawn as a pension but taxed as a lump sum can be re-contributed to the SMSF as a non-concessional contribution. Sandy has turned $105,000 taxable component to $105,000 tax free. This would then preclude the 17% lump sum tax payable if these funds were to be paid to independent adult children on Sandy’s death.

- Sandy could reduce her overall tax by increasing her salary sacrifice contributions to superannuation, replacing her wage taxed at her marginal tax rate with tax free pension payments. The salary sacrifice contributions are only subject to the 15% concessional contributions tax.

- The assets in the fund used to pay the pension will become exempt from tax. This could be considerable if the fund realises assets held for a significant period of time to help fund the pension payments.

- The $105,000 re-contributed as a non-concessional contribution could be quarantined into a second 100% tax free pension, where all earnings will also be considered a tax free component. This could provide valuable tax savings if the benefit was paid to independent adult children on Sandy’s death.

Issues to watch with this strategy

Special care is needed with this strategy:

- To have the benefit not treated as a superannuation income stream benefit, the election must be made before the payment.

- The election is only effective whilst the income stream is in place. If the income stream is fully commuted to a lump sum, the payment will not count towards the minimum pension requirements.

- There was some confusion as to whether this strategy applied to TRIS pensions, but the ATO has clarified the view that a member can make the election but only if they have an Unrestricted Non-Preserved benefit in their account.

- The payment will be considered a partial commutation of the pension, so any Unrestricted-Non Preserved benefit in the member account will need to be at least the value of the payment made.

- The account balance of the TRIS pension account immediately after the partial commutation must be greater than or equal to the remaining required minimum payment for that financial year (less pension payments already made) for the lump sum to be counted against the minimum pension standards.

Whilst this strategy has some distinct advantages, it is important clients seek advice with regard to their own personal circumstances. For example, it may be of benefit to only apply the Preserved benefit in the member account to the TRIS pension, leaving the Unrestricted Non-Preserved benefit to be maintained for other purposes (such as an account based pension or lump sum). It is also important the fund’s governing rules provide flexibility with regard to pension payments (such as the ability to make an 'in-specie' lump sum from a TRIS).

Nicholas Ali is Head of Technical Services & Education at SuperIQ and SuperConcepts. The strategies described in this article are complex and should only be attempted using professional advisers with the requisite skills. It is accurate at the time of writing but rules or interpretations may change.

For more articles and papers from SuperConcepts, a sponsor of Firstlinks, please click here.