Our research highlights that family/founder-owned businesses pursue a longer time horizon in their investment strategy, delivering more stable and superior through-cycle profitability, and ultimately driving significant excess returns for all shareholders.

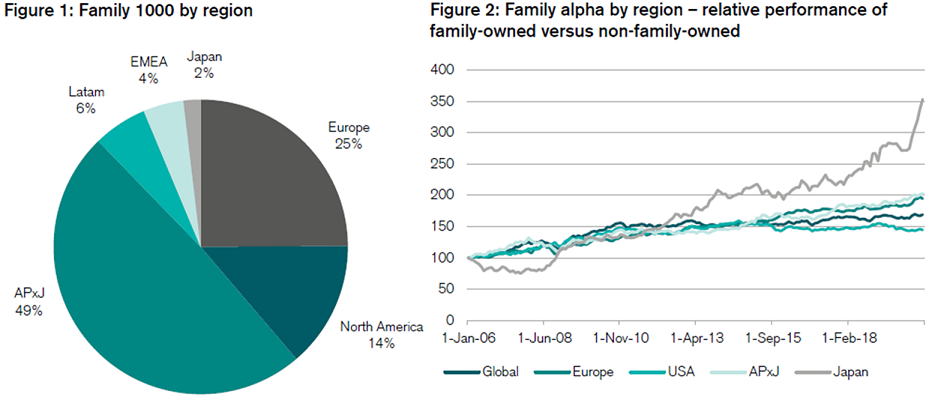

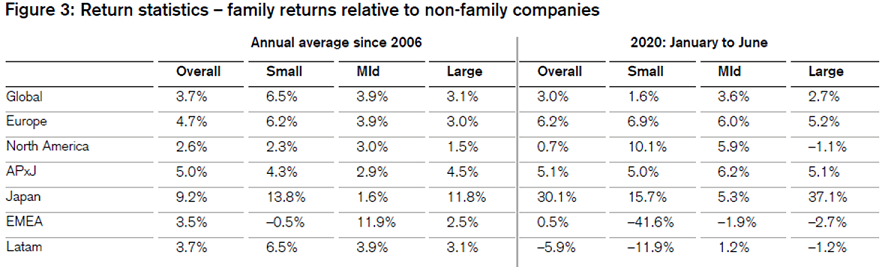

Using a proprietary ‘Family 1000’ database of more than 1,000 publicly-listed family or founder-owned companies, Credit Suisse has found that since 2006, the overall ‘Family 1000’ universe has outperformed non-family-owned companies by an annual average of 3.7%. Asia Pacific (APAC) ex-Japan has seen the most pronounced effect, with compound excess returns of more than 5% per annum, followed by Europe, at 4.7% basis points.

Within APAC, Australia has the highest excess return.

APAC family-owned companies continue to dominate the universe

The report covered 12 markets in APAC including Japan that continue to dominate and represent a 51% share of the universe, with a total of 540 companies and a market capitalisation of over USD5.56 trillion.

The universe includes six Australian family-owned companies, with a total market capitalisation of USD63.3 billion. They are Fortescue Metals Group, Crown Resorts, TPG Telecom, 7 Group Holdings, Flight Centre and Wisetech Global.

Within the region, China, India and Hong Kong dominate. These three jurisdictions combined comprise 63% of the APAC universe of the CSRI’s database, with a combined market capitalisation of USD3.9 trillion (or 70%) of the market share of the APAC universe.

Source Figures 1–2: Credit Suisse Research, Thomson Reuters Datastream

The family alpha is strongest in Australia, with an annual average outperformance of 23% since 2006, compared to 12.0% by their Chinese peers and 9% by their Japanese peers.

However, the universe of Australian and Japanese family-owned companies makes up only a small portion of the overall universe.

Family alpha factor during the COVID-19 pandemic

The COVID-19 pandemic has had a significant impact on equity market returns and volatility this year. Family-owned companies tend to have above-average defensive characteristics that allow them to perform well, particularly during periods of market stress.

Return data for the first six months of this year supports that view, given an overall outperformance of around 3% relative to non-family-owned companies. This outperformance was strongest in Europe and APAC ex-Japan, at 6.2% and 5.1% respectively. Family-owned companies in Japan outperformed their non-family-owned peers by 30.1% during this period.

Source: Credit Suisse Research, Thomson Reuters Datastream

Key findings on family-owned companies

Higher growth and profits – The analysis suggests that, since 2006, revenue growth generated by family-owned companies has been more than 2% higher than that of non-family-owned companies for both smaller and larger companies. At the same time, the analysis also suggests that family-owned companies tend to be more profitable. These superior returns are observed across all regions globally.

Perform better on ESG scores – Family-owned companies on average tend to have slightly better environmental, social and governance (ESG) scores than non-family-owned companies. This overall superior performance, which has strengthened over the past four years, is mostly led by higher environmental and social scores as family-owned companies appear to lag their non-family-owned peers in terms of governance. From a regional perspective, European family-owned companies have the highest ESG scores. Family-owned companies in APAC ex-Japan are scoring better than those located in the US and their scores are rapidly converging with those generated by their European counterparts.

Older family-owned companies have better ESG scores than younger firms – This performance is seen across all three ESG areas. Perhaps the fact that older family-owned companies have more established business processes in place allows them to incorporate or focus on areas of their business that are not directly related to their production processes, but that are relevant in terms of maintaining overall business sustainability.

COVID-19 impact – In order to better understand the ESG characteristics of family-owned companies, a survey of more than 200 companies was conducted. The companies were asked how much of a concern COVID-19 is to them going forward. Despite the impact on revenue growth this year, it seems that the family-owned companies surveyed view COVID-19 as slightly less of a concern to their firm’s prospects than non-family-owned companies. Family-owned companies have also resorted less to furloughing their staff than non-family-owned companies (46% versus 55%). Among family-owned companies, support programs have been set up most often in APAC Ex-Japan rather than in Europe or the US. This might reflect a greater availability of government-sponsored support programs in these regions.

Social impact – The survey showed that while family-owned companies have focused more on social policies since the outbreak of the COVID-19 pandemic, they seem to lag non-family-owned peers on several ESG-related factors, most noticeably human rights and modern slavery-related policies. Family-owned companies on average have less-diverse management boards, fewer of them have support groups for the lesbian, gay, bisexual and trans (LGBT) and black, Asian and minority ethnic (BAME) communities, or have made public statements concerning respect for human rights or the related United Nation principles.

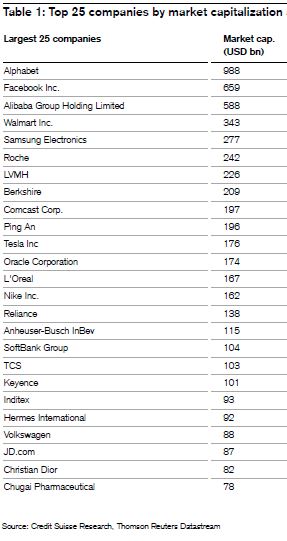

The largest 25 family companies in the database are:

Andrew McAuley is Chief Investment Officer for Credit Suisse Australia Private Banking. This article is general information and does not consider the circumstances of any investor.

A copy of the full report can be found here.