In January 2021 vaccines were rolling out, people were starting to travel again, and the share market had flipped back from ‘stay at home’ stocks to the ‘re-opening trade’. That was when we attended the Needham Growth Conference in New York and found one of our best stocks of the last few years.

The Needham Conference is one of the biggest small-cap investment conferences. Fund managers were lining up to meet the management of companies primed to capitalise on the tidal wave of services spending as consumers emerged from hibernation.

So, what did we do?

We asked the conference organisers: “What are the companies at the conference with the least requested number of meetings by fundies?”

The company that no one wanted to see was Stride (NYSE:LRN). Stride provides online education solutions to kindergarten through Year 12 students in the U.S. and their solutions are used in the classroom. But originally and still, they are used by students homeschooled for various reasons including bullying, parental preferences; even for child actors.

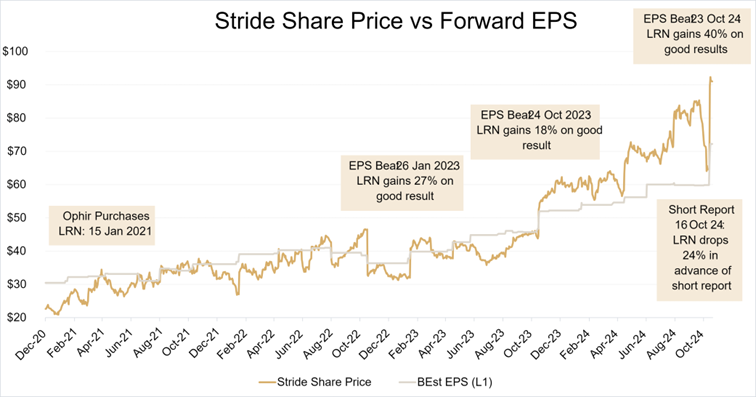

When we were all going to ‘work from home’ during COVID, students were going to ‘learn from home’. Stride’s share price rocketed from around US$20 to over US$50 between March and August 2020 as demand, and expectations of demand, for their products and services ballooned.

But by January 2021, the time of the Needham Conference, the balloon had popped. As students returned to school, investors thought there’d be no durable increase in demand, so Stride’s share price returned to US$20. In any case, fundies had turned their attention elsewhere.

What we found when we decided to dance with the ‘wallflower’ Stride

Stride was the proverbial ‘wallflower’ at the prom. But we decided to dance with Stride and we found:

- A company structurally benefitting from increasing adoption of virtual schooling more generally (despite schools having been reopened), which could lead to sustained growth in a market in which Stride was a leader.

- Defensive revenue growth of 8-10%, underpinned by state government budgets that fund the 70 schools across 35 US states in which Stride had solutions.

- High incremental profit margins, driving what we expected would be 20%+ earnings growth.

- A depressed EV/EBITDA (Enterprise Value to Earnings Before Interest Tax Depreciation and Amortisation) valuation multiple of just 5x.

Of course, we never just take what the company says at face value, so we got to work. We checked data around individual schools' login traffic; called enrolment centres for intel, including the number of open enrolment applications; spoke to public and private school peers around market share changes; and spoke with school district budget allocators to ensure the funding was rock solid.

We initially bought Stride in January 2021 between US$22-25. We have held ever since, building our conviction and knowledge around the business. And boy, has it delivered. From financial year 2020 through to 2024 it has:

- Doubled revenue from US$1.04 billion to US$2.04 billion

- Improved EBITDA margins from 11% to over 18%

- 10x’ed profit from US$24.5 million to US$240 million (12 months to Sept 2024)

Fuzzy Panda tests our conviction

But then, last month, our conviction was really tested.

Fuzzy Panda (FP) – no not a Sesame Street character, but a well-known short-selling organisation – released a report on the 16th of October dubbing Stride “the last COVID over earner”.

The stock tanked by over 9% on the day but Stride was down -24% if you include the falls leading up to the report, when FP was clearly putting on their short position.

FP was essentially claiming that Stride was a big beneficiary of the US$190 billion in Federal emergency relief funding program for U.S. schools during COVID. The funding was ending in September 2024 and FP warned Stride’s profits were about to “fall off a COVID cliff”.

Australian investors in ASX-listed companies probably aren’t that used to ‘short reports’ as they’re not that prevalent domestically. However, they are big business in the U.S. and par for the course if you’ve been investing there long enough. The playbook is simple.

Take a short position, put out a scary report questioning the company’s profits, and many investors will dump the stock (regardless of the merits of the short report). The shorter then closes the short by buying back the stock at the now lower price, pocketing a tidy profit. Sometimes there is merit to the short report, sometimes it’s just hot air.

Over the three years we have owned the stock, we have spoken with Stride’s management on multiple occasions each quarter. We have found them diligent, trustworthy and conservative.

But we also did more work.

We already knew from the publicly available individual school budgets that the federal COVID funding was used to offset funding from the states during COVID. But we also went through the corresponding state budgets in detail. These showed that the states were increasing their education spend to offset the federal grant funding that was ceasing.

This gave us comfort there was no big looming funding shortfall from state schools for Stride’s offering. And it gave us the conviction to hold through the short report.

When Stride reported its September quarter results aftermarket on the 22nd of October, it blew the market’s expectations away. Both at a revenue and profit level. The next trading day the stock popped around +40%!

Source: Ophir & Bloomberg. Data as of 31 October 2024.

The future of Stride

So where to next for Stride?

Even though they are the largest online education provider in the U.S. by enrolment, they are still very underpenetrated across schools. They can also fuel growth by entering or expanding into education verticals including:

- Experiential learning: Through extended, augmented and virtual reality modes; AI voice and chat learning software; and games and simulation teaching solutions.

- Learning support: Building out their tutoring business which we think could add 30-40%+ to today’s earnings over the medium to longer term, given their existing relationships with students and teachers.

- Workforce and talent development and acquisition: Providing certifications to the increasing number of U.S. high school leavers who are shunning four-year college degrees and opting instead to directly enter jobs. Stride already owns a business called Tallo, which connects students from Stride-powered schools to opportunities (the Tallo app has 1.7million users already!).

A long career ahead

Today, Stride is still growing earnings at 20%+. That’s two to three times the market’s growth. Yet it operates in a defensive end market with a large share of its revenues underpinned by state government education budgets. It’s a great all-weather stock.

But its valuation is lower than the market. Stride trades on a still cheap 13x price to earnings ratio. Most of the share price move since we have owned it has actually been driven by earnings growth and not valuation expansion. We think it could still be a 20x P/E business.

So while it’s been a great performer for our Funds, we still think there is a long ‘career’ ahead for Stride.

…the hard work pays off

It would have been easy to crack during the Fuzzy Panda shorting drama and sell Stride.

The only way to know whether to ‘keep the faith’ or to ‘fold’ is to put in the work and back yourself. It won’t always work out on your side, but if you go the extra mile, it will more often than not.

We are proud of the team and the work they have done which allowed us to keep our conviction in Stride.

We’re also glad we took that meeting that no one else wanted back in 2021!

Andrew Mitchell and Steven Ng are co-founders and Senior Portfolio Managers at Ophir Asset Management, a sponsor of Firstlinks. This article is general information and does not consider the circumstances of any investor.

Read more articles and papers from Ophir here.