The world is in a state of flux. Concerns about the outcome of the US presidential elections are mounting and geopolitical risks escalate elsewhere around the globe.

Against such a backdrop, it is prudent for investors to focus on a value approach to finding stocks and to look for compelling opportunities at a company level.

It also can be helpful to consider 'out of the box' investment approaches and a proactive approach to engaging with underlying companies.

This has long been the approach of private equity investors – they find and then invest in promising companies for the long haul.

It’s an approach that can also serve investors in listed equities well, particularly with regards to small cap equities. Adopting an approach of ‘friendly activism’, can reap strong benefits over the long term.

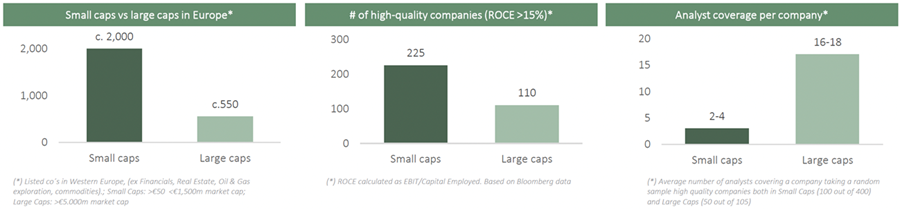

Small cap companies everywhere offer investors the opportunity to get in at ground level and benefit from the growth that happens as companies mature. They are also generally an under-researched sector of the market, with most analysts focussing on larger cap companies. This creates potential for those analysts willing to do the research.

An important consideration, however, is where a potential investment is domiciled. While growth in many regions of the world is desirable, not every jurisdiction offers the regulatory and legislative certainty of Europe. A focus on European listed companies – not as a European play, but rather investing in companies that have exposure to other parts of the world – can be a strategy that adds value.

Finding the dislocations

There are many structural issues at play around the world that can work to the benefit of small cap investors.

If we look to Europe as an example, the introduction of more rules to increase transparency in markets has resulted in lower broker coverage of small caps in Europe. That now presents an opportunity for those still in the space. Those willing to do the research can find European listed companies that are poised to gain from their investments and activities in global markets.

Figure 1: Limited coverage by analysts/investors - leads to opportunities for mispriced assets

Friendly activism

Like a private equity investor buying out a company and transforming it, the small cap space is a good sector to try and encourage change within a company. The relationship where a company board supervises a management team on behalf of the shareholders, is what we call the agency relationship. Ultimately, we believe active ownership can reduce agency costs. By virtue of being a significant relevant owner and having a shareholder oversight, we believe you can help companies to function better.

But it is better for all involved if this kind of engagement is done on a 'friendly' basis. More benefits accrue to the company, and it is always favourable to work alongside management rather than against it.

Often, we find that the small cap companies we are researching and investing in are headed up by first time CEOs. They might be an executive that comes from the first or second level of a large corporation but didn’t make it there so wants to start over. They are usually strong at managing people and products but have never been responsible for final capital allocation decisions. Unlike large cap CEOs who constantly have advisers knocking on their door, the small cap CEO is sometimes starved for this type of assistance and advice, and very keen to engage with a 'friendly activist' investor.

We also promote sustainability with a pragmatic and customer centric approach. This is another tool to boost operational performance and terminal value across our companies, typically increasing the total addressable market, margins, or improving capital allocation. Complementing this, our ESG framework helps us to monitor risk.

Example opportunities

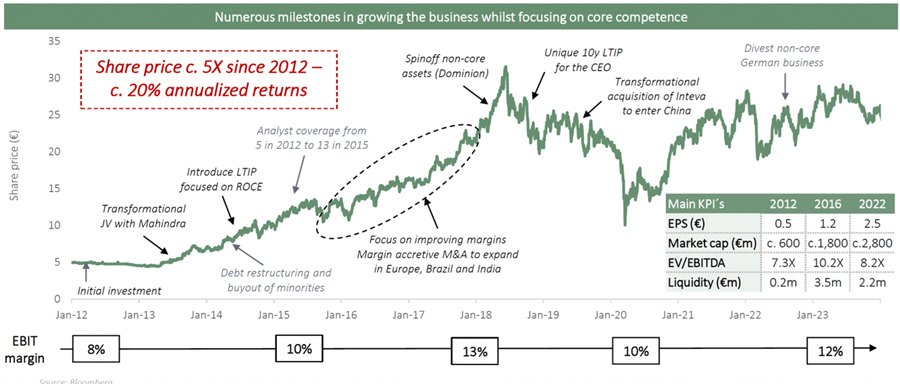

CIE automotive

CIE automotive specialises in supplying automative components and subassemblies, and is based in Spain. It represents a global play with 42% of its sales sourced from the Americas, 24% from Asia and 34% from Europe.

It has been in our portfolio for over 10 years and has performed extremely well during that time.

When we made our first investment in CIE Automotive it was primarily servicing just the local market of Spain, but it has since become one of the largest 35 companies listed in that country.

We recognised the potential early on when they were starting to expand internationally. We've worked with them to grow by both acquisition and through organic growth to the point where they are now a $3 billion mid cap company.

We helped them with investor relations, internationalisation, diversifying their business, and shareholder structure. Because of our engagement with their management team, and in turn management's willingness to work with us, we have assisted with activities such as spinning off non-core divisions to focus capital allocation on the core business and introducing new analysts to cover the company by encouraging management to increase investor roadshows.

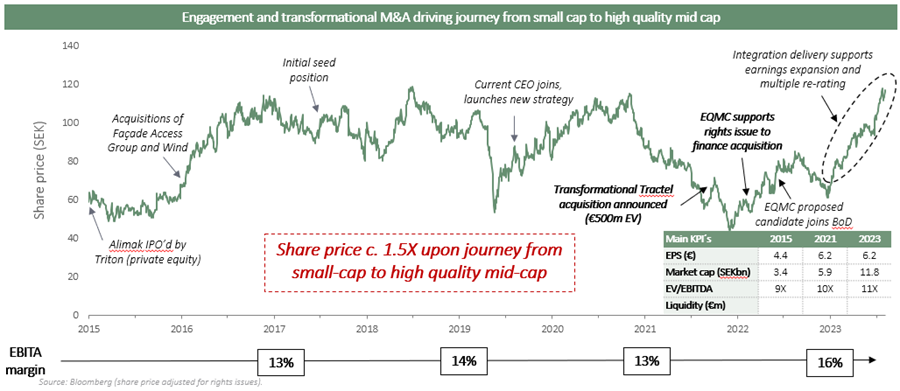

Alimak

This Swedish company is the global leader and industry standard in vertical access solutions, including lifts, hoists, and related equipment, catering to the industrial, wind, building maintenance, and construction sectors. In total, 34% of its sales are from the Americas, 22% from Asia and 43% from Europe.

Our involvement with Alimak culminated in 2022 when we played an instrumental role, together with top-owner Latour and a few others, in securing additional funding for the transformational acquisition of Tractel, its largest competitor. This acquisition, which we had advocated for over several years, marked a significant turning point for the company.

The strategic merger created a highly profitable and dominant market leader, unlocking substantial cost and revenue synergies. The increased scale of the business is also likely to attract greater investor interest and improved analyst coverage, resulting in enhanced liquidity and higher valuation multiples.

Think outside the box

There is no doubt that there are opportunities to be had in finding market dislocations and taking advantage of cheaper prices to buy outstanding companies.

European small-cap stocks are currently trading at a substantial discount compared to both their historical averages and their large-cap counterparts. Brexit, the war in Ukraine and the general political turmoil in Europe have exacerbated this discount, as investors have broadly devalued European assets without distinguishing between companies focused on domestic markets and those with significant global operations.

Jacobo Llanza is Executive Chairman and Francisco de Juan is a Managing Partner and CIO of the EQMC Fund at Alantra EQMC Asset Management, a fund manager partner of GSFM, a Firstlinks sponsor. The information included in this article is provided for informational purposes only.

For more articles and papers from GSFM and partners, click here.