In 2019, charities and not-for-profits will benefit from around $20 million in donations as charity-supporting investment vehicles come of age. The beauty of it? No investor has to write a cheque while the money is effectively and efficiently managed to the benefit of a wide range of stakeholders.

What is a charity-supporting investment vehicle?

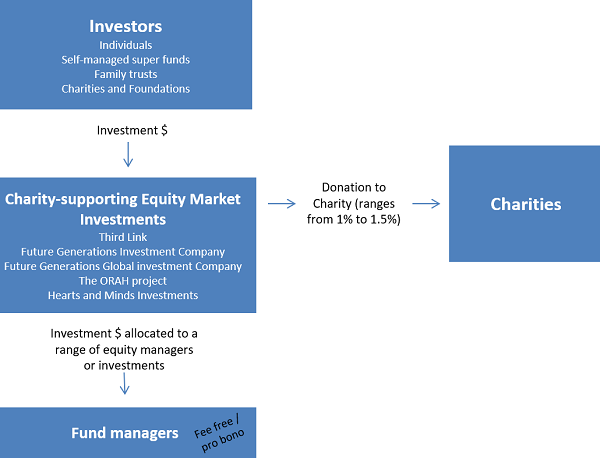

Rather than the fund managers receiving a management fee, it is redistributed directly to charities, providing them with a sustainable and growing income source. This year more than $1.6 billion worth of investments have gone through the five existing vehicles in Australia, serving the dual purpose of delivering investments returns as well as social returns via charitable donations.

Click to enlarge

Consider the three main stakeholders in the structure.

1. From the fund manager's point of view

The costs to a single fund manager of investing additional funds or sharing intellectual property is negligible, although the access and knowledge are valuable. To date more than 30 fund managers have embraced the opportunity to support one of the charity-supporting equity investments in Australia. They ‘give back’ to the charitable sector through a mechanism other than writing a cheque.

2. From the investor's point of view

In our role as advisers, we stress that first and foremost an investment product needs to be considered on its merits and be appropriate in the context of a client’s overall portfolio and investment objectives.

The charitable donation tail does not wag the investment dog. That said, the investment managers who sit behind these vehicles are generally good quality and, in some cases, include managers who have otherwise reached capacity and are no longer taking new money from investors.

When this type of investment fits with a portfolio, the investment serves two purposes: it is part of an investment portfolio and it is effectively ‘passive giving’. This is beneficial for investors who have a portfolio of assets serving charitable purposes such as Private Ancillary funds, other Foundation or purpose-driven organisations, but only when it fits with their existing investment strategy.

3. From the charity's point of view

The income stream from this type of donor can be a reliable source of income with a growth prospect in line with the investment. Furthermore, the charity is tapping into a new world of passive donors who may have invested on the merits of investment product alone and who would not otherwise be an active or engaged donor.

History of charity-supporting investment vehicles in Australia

Cuffelinks co-founder Chris Cuffe AO was at the forefront of this innovation. He was the key driver in the creation and ongoing success of the first investment vehicle that generated donations to charities, Third Link, in 2008. By 31 December 2018, Third Link had donated over $10 million to Australian charities.

The structure of Third Link is an unlisted unit trust investing in domestic markets. It has an investment track record of market outperformance and supports children’s charities recommended by Australian Philanthropic Services. Although initially an open-ended unit trust, it is now closed for new investments having reached its target size. Fund managers also waive performance fees, which can otherwise be high, and many of the managers are not easy to access directly.

Wilson Asset Management Chairman Geoff Wilson AO created Future Generation Investment Company (ASX:FGX) and its sibling the Future Generation Global Investment Company (ASX:FGG) both under the Listed Investment Company (LIC) structure.

The fund of funds model sees FGX and FGG invest with leading Australian and global fund managers respectively. The management and performance fees waived by the fund managers exceed the companies’ annual investment in charities representing 1% of assets, to the benefit of investors. The two companies have donated $21 million since 2014 to youth at risk and mental health causes respectively.

Investments in FGX and FGG are diversified across Australian and global equity managers respectively, with managers each covering three broad types of strategy – long equities, absolute bias and market neutral. At times it will take cash positions to minimise volatility.

FGX and FGG differ to other charity-supporting investments available today in one key area. Where investors hold more than 1 million shares in either company, that investor can decide which charity the donation goes to. In the case of a charity investing their corpus, the ‘fee’ can be returned to the charity in the form of a donation – effectively giving fee-free investment management.

The ORAH fund (an unlisted managed investment scheme) is specifically aimed at supporting Jewish causes. As a relatively small fund of funds, it has been able to invest with specialist equity managers including some that are otherwise capacity-constrained.

The most recent innovation is the LIC, Heart and Minds Investments (ASX:HM1). This offering is unique because instead of offering a diversified mix of managers and funds, it holds a more concentrated portfolio of around 25 high conviction securities selected by leading fund managers in Australia and overseas. Donations from Hearts and Minds Investments are directed to Australian medical research institutes. At its current size of about $600 million, it will give away about $8 million a year. Chris Cuffe is the Chair and Geoff Wilson is also on the Board.

A potential win-win for all

The generosity of the funds management community combined with the innovation and drive of committed individuals in the financial sector has been the key to the success of these investment products.

For all investors, the potential returns from the investment and an understanding of the risks are paramount but having made the investment decision the ability to generate both an investment return and a social return is compelling.

Bernie Connolly is Executive Director and Financial Adviser at Morgan Stanley Wealth Management. This article is general information and does not consider the circumstances of any individual.