Australia’s superannuation industry is obsessed with accumulating account balances. The industry has confused or complicated the primary purpose of providing for retirement by fostering the following claims:

- Members need much more financial literacy

- The 4% withdrawal rule is (or isn’t) safe

- Retirees suddenly run out of money

- Sequencing risk is a real issue

- Retirees need a new breed of investment products

We argue that changing the focus of superannuation to retirement outcomes is essential, and will make superannuation meaningful to members. In doing so, we need to retain critical thinking.

Some of these claims do not seem to stack up, but are they myths?

1. More financial literacy

The industry is a victim of its own design. It is obsessed with account balances and what happened over the past year. What does this babble have to do with retirement outcomes?

How many superannuation practitioners can translate a member’s account balance and future contributions to what the member may receive in retirement? Very few, as the calculations are complex. If we find it hard, no wonder members don’t understand superannuation.

In the defined benefit days, members were simply informed of retirement outcomes. If this was re-introduced as a simple statement for defined contribution members such as,

“Your superannuation account and future contributions have a good chance of delivering $1,000 per week when you retire.”

… then we are expressing the outcome of superannuation in language that most members should understand, their pay cheque.

Result: Myth busted.

2. The 4% withdrawal rule

The often quoted Trinity Studies found 4% of the initial account balance at retirement could be safely withdrawn each year, inflating annually thereafter. Critically, this analysis incorporated the impact of investment volatility to arrive at a safe withdrawal rate.

But to our knowledge, no fund in Australia informs members of their safe withdrawal rate. Worse, some funds provide estimates that ignore investment volatility. Even ASIC’s methodology under Class Order 11-1227 (see ASIC’s Consultation Paper 203) has been found to be simplistic and misleading.

Using our retirement income calculation engine with moderately conservative investment assumptions (such as ignoring valuation reversions), we found that in many cases, the 4% rate (ignoring ATO allocated pension minimums) is safely funded from a typical balanced strategy. The ‘4%’ rule of thumb is not bad, but each member’s circumstances are different. Retirees shouldn’t be relying on rules of thumb.

Result: A controversial myth which needs context.

3. Retirees suddenly run out of money

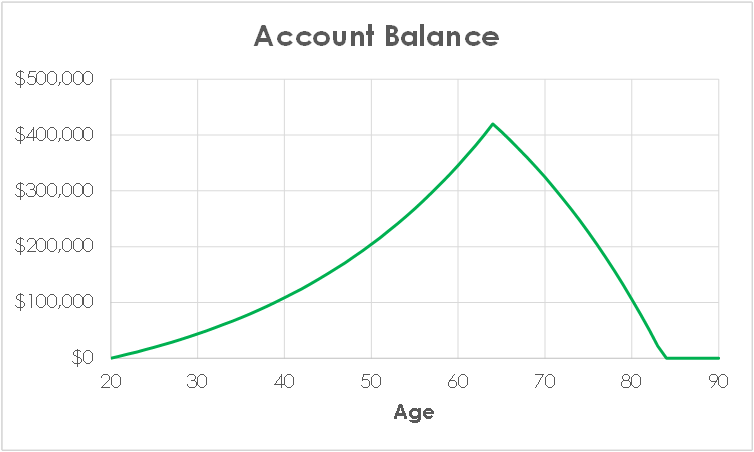

Do they? How often have you seen a chart like this?

The authors of such charts are incredibly patronising. They assume that retirees do not adjust behaviour in light of changing circumstances. Of course, if you don’t watch the road when driving a car, then you are likely to crash. The same applies to retirement account balances, they need to be monitored and withdrawals managed.

But it is true that retirees have inadequate tools to help them stay on the road.

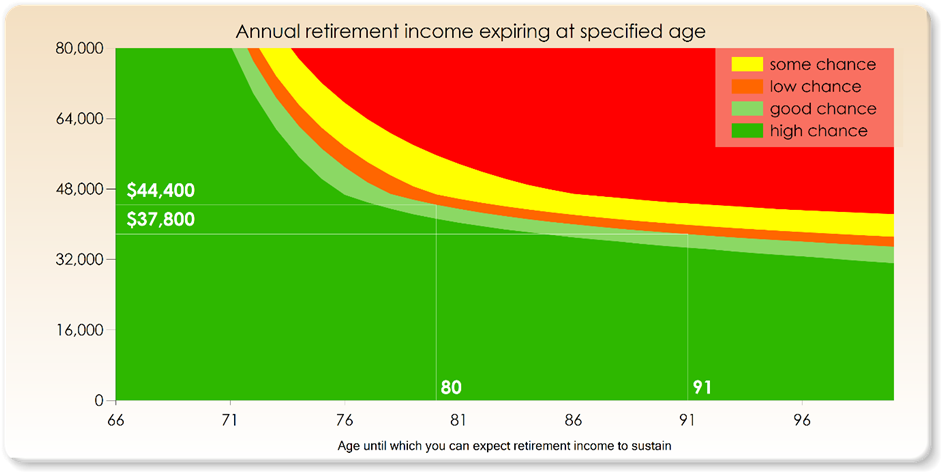

Better controls are available. For example, the following chart shows the three-way trade-off between the level of withdrawals, the age that they are likely to last and the impact of investment risk.

Provision of information extracted from this chart can form the basis of a retirement monitoring and management ‘control panel’ assisting retirees to manage the changing requirements through retirement.

Result: Myth busted.

4. Sequencing risk

This is the risk that the worst returns at the wrong time will greatly impact a member’s retirement outcomes. A paper by Drew and Walk identifies a ‘retirement risk zone’ as approximately 20 years around the retirement date.

We believe the following points put sequencing risk in context:

The income and assets tests of the age pension make it an excellent hedging instrument for the risks of an eligible retiree’s investment portfolio. Falls in asset values and withdrawals will result in an increase in the age pension. Hence the age pension provides some hedging of the impact of sequencing risk for those receiving a partial age pension.

Valuation measures (e.g. PE ratios) tend to revert to the mean over the medium term (7-10 years). Whether you enjoy or suffer from this reversion will depend upon (a) your pace of saving or dissaving, and (b) changes to investment strategy. This is real, but the impact is idiosyncratic. Much hand waving about sequencing risk ignores this reality and can result in inappropriate scaremongering and poor investment decisions.

- Through retirement, not to

Obsession with account balances leads many to make dramatic changes in investment strategy at retirement, such as selling equities to purchase a fixed rate income stream. This creates unnecessary sequencing risk. It runs the risk of a double hit: selling equities after a crash and buying bonds when interest rates are low. On the other hand, if the retiree is managing THROUGH retirement, then this self-generated sequencing risk is avoided, and the benefits of mean reversion can be enjoyed.

Prompt, relevant and objective feedback is the best way to learn about anything. With the tools discussed earlier, a retiree can understand the consequences of their investment and drawdown decisions. If this is provided regularly in terms they understand (i.e. future sustainable retirement ‘pay cheque’), then they will make sound decisions. Imagine the peace of mind that retirees would derive from seeing that their projections of safe retirement rates have not moved much in times of market volatility.

Result: Put myth in context.

5. Need for new retirement investment products

It is not surprising that financial service providers are touting new retirement investment products: this is how much of their revenue is derived.

But, as is evident from our earlier comments, we believe that the key missing component is useful information in a language that retirees understand. Indeed, most superannuation funds already have a comprehensive range of diversified investment options. This range will often be sufficient (perhaps with some tweak for tax etc), provided retirees can assess each investment option in terms of safe withdrawal rates.

So do retirement products such as lifetime annuities have a place? Yes, but not as much as you might think.

Members with low account balances at retirement already have a significant lifetime indexed annuity from the Government. And members with substantial balances can live off dividends and income. In between, members can obtain financial flexibility and longevity through a retirement ‘control panel’. Sure, lifetime annuities and deferred annuities may play a partial role, but they are not the total answer. And they can be expensive and inflexible.

Result: Myth busted.

Conclusion

Myths and confusion have been perpetuated by the industry’s focus on the journey through the accumulation phase, together with a lack of understanding or use of the impact of investment volatility. The industry must communicate with members in the language they understand, i.e. their sustainable retirement ‘pay cheque’. Providing retirees with a ‘control panel’ that they understand will stop them driving off the road (i.e. running out of money) thus empowering them with the right information to make sensible decisions.

Chris Condon and Peter Vann have been in the institutional investment industry for over 25 years. CV Solutions, a partnership between Chris Condon Financial Services Pty Ltd and Peter Vann, provides retirement adequacy services to superannuation funds.