Editor's introduction

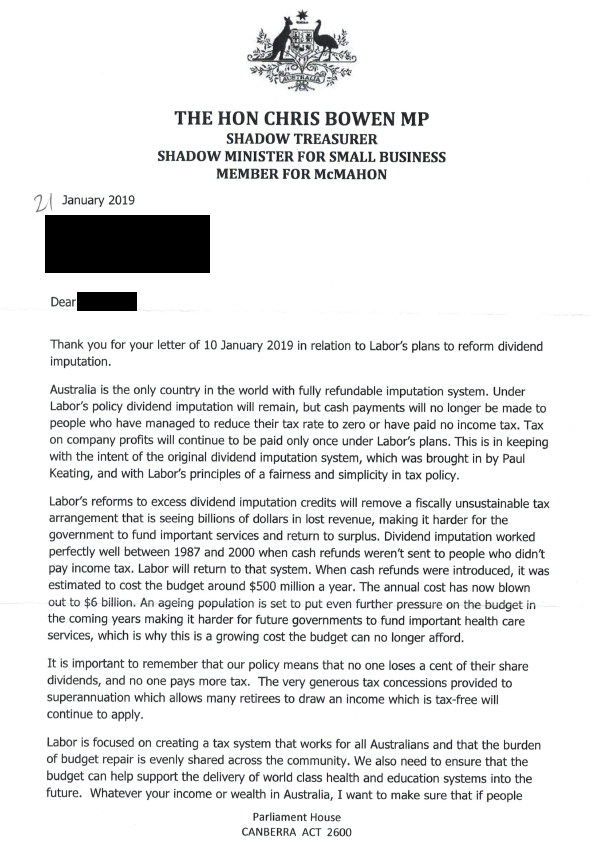

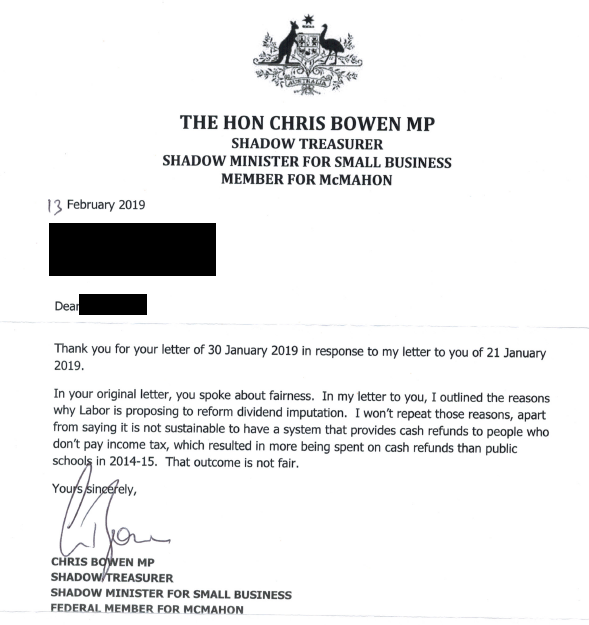

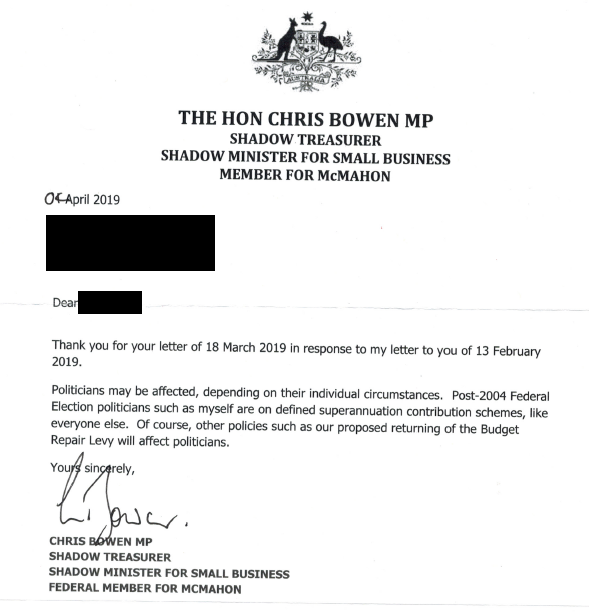

Someone I have known for 30 years sent me this exchange with Shadow Treasurer, Chris Bowen (and we should acknowledge it was good that Bowen responded). The 'fairness' of the franking credits policy has become a major issue for Labor. It was a few days after the initial announcement that the 'pensioner guarantee' was introduced, requiring an arbitrary date of 28 March 2018 for a pensioner in an SMSF to qualify for franking credits.

The policy carries 'horizontal equity' problems, for example, where an investor in a public fund receives a full franking refund while an identical investor in an SMSF loses the refund. Regardless of how people feel about refunding credits, if a policy is based on an important basic principle, why are there so many exemptions or examples of no impact? Among other groups, the wealthiest will retain their franking.

NO LOSS OF FRANKING REFUND

- Members of public funds (industry and retail) where the fund has enough taxpaying accumulation members to outweigh the pension members

- Large SMSFs in both accumulation and pension phases

- SMSFs where a member was a Centrelink pension recipient on 28 March 2018

- Personal shareholders with a marginal tax rate above 30%

- Foreign investors (who could never claim franking)

- Companies

- A range of special exemptions such as charities and the Future Fund

- Other welfare recipients who qualify under the 'pensioner guarantee'

LOSS OF FRANKING REFUND

- SMSFs in pension phase (except when qualify for the 'pensioner guarantee')

- Personal shareholders with a small portfolio of Australian shares who are not 'pensioners' but have limited sources of other taxable income (and may have a marginal tax rate of zero)

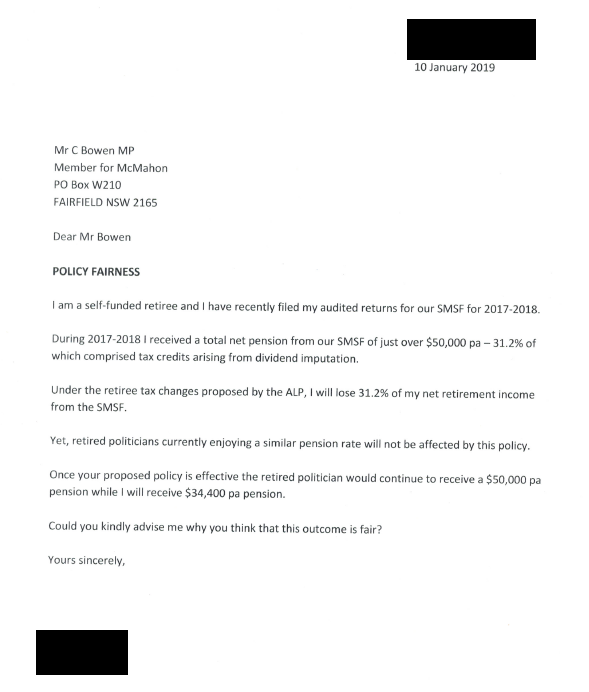

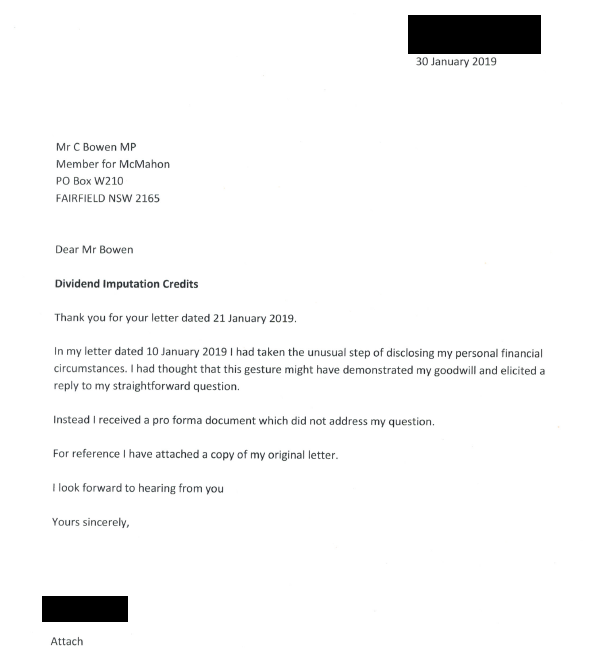

Here is the reader's cover note, followed by the exchange with Chris Bowen. The sender's name has been blacked out.

"I enjoy your commentaries in Cuffelinks – keep up the good work.

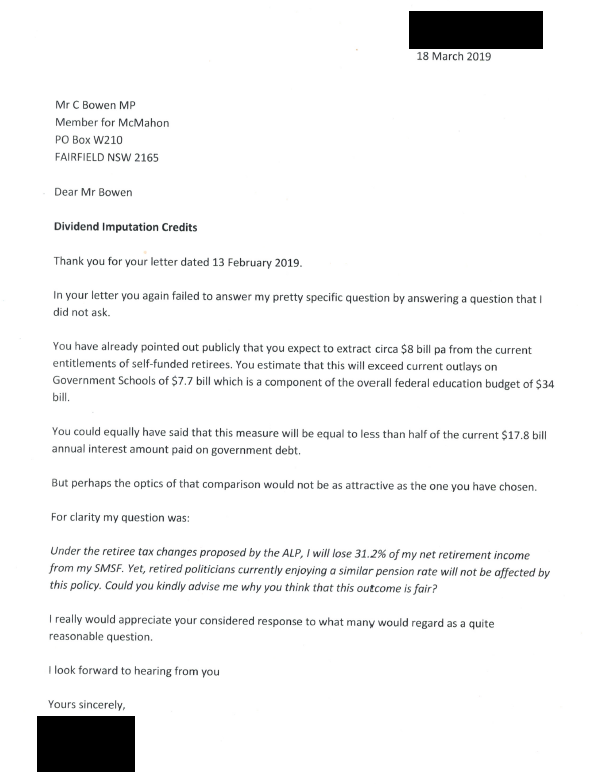

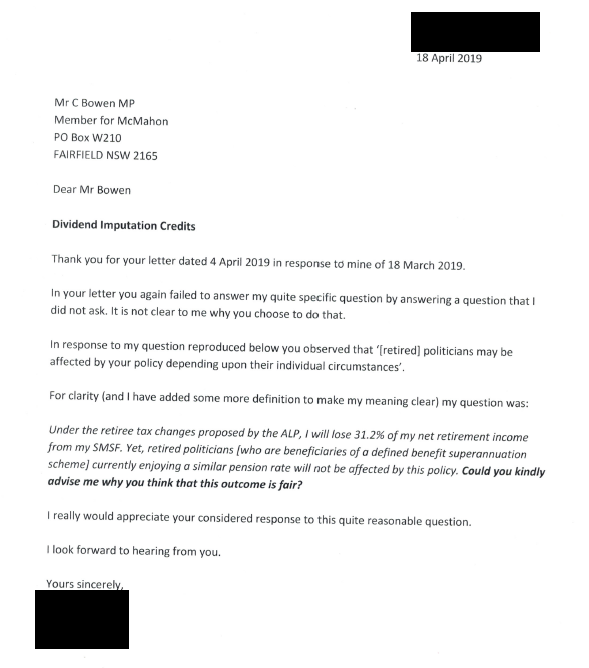

I came to the conclusion long ago that use of the terms dividend imputation and franking credits would not resonate with people whom I needed to alert about the flaws in the ALP policy. It needed to be more simple and pick up on the misleading claims of fairness upon which the ALP bases its pitch.

So the loss of 30% of my SMSF pension is a concept people can grasp although the size of the claimed percentage loss makes them a bit sceptical.

But when I point out that retired politicians (and many others) on a similar pension are unaffected by the ALP policy they become very interested as it appears unfair. This is a very important issue that will have consequences for many vulnerable retirees apart from the ALP’s stated target population.

Instead of just grumbling about it I decided to do some of my own politicking! To take my message further I spent some of the pension money that I clearly stand to lose in producing some banners and street signs – see photograph.

fairness

However, within 24 hours of installation, these advertisements are usually removed, presumably by people who disagree or who don’t want the issue highlighted.

I wrote to Chris Bowen pointing out the problems with the policy and that there were alternative and fairer ways to raise $8 billion in a budget of $500 billion. I even suggested simplistic policy alternatives, if you have to go after retirees, like a regressive tax on pension income (however sourced) at a low rate (say 3%) on amounts in excess of $80,000 as a means of raising revenue. At least this would be fair and consistent with income tax being calculated upon income amount rather than source of income.

People approaching retirement had every right to rely upon the prior arrangements in planning their retirement.

Even the Grattan Institute and the Parliamentary Budget Office acknowledge that the ALP policy, while targeting the wealthy, will also severely affect many people with modest assets and income. These are the less well-off people for whom the ALP used to stand – but now they are getting it in the neck when they are most vulnerable.

There was a time when I used to work at polling booths for the ALP in western Sydney. But Bowen has invited those who disagree with his flawed policy not to vote ALP. I will be taking him up on his proposal and suspect that thousands more who are feeling ALP hands in their pockets will do likewise.

Having got nowhere, I tried the 'fairness' test with him and copies of correspondence are attached for your information."