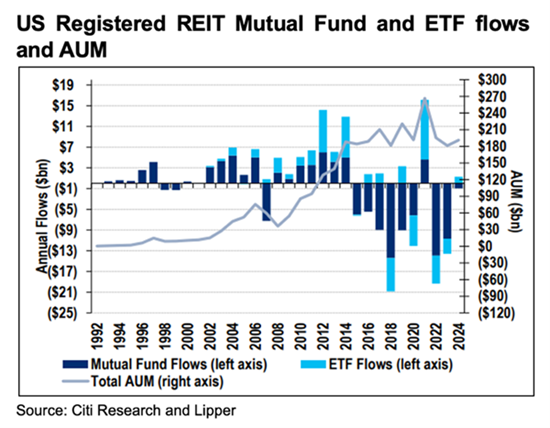

It’s fair to say REITs have not been flavour of the month for some time. The lacklustre investment flows into U.S. REIT mutual funds and ETFs shown in the chart below says it all.

You have to go back quite a way to find the last period the sector was truly in vogue. Curiously, it was arguably in the lead up to the GFC.

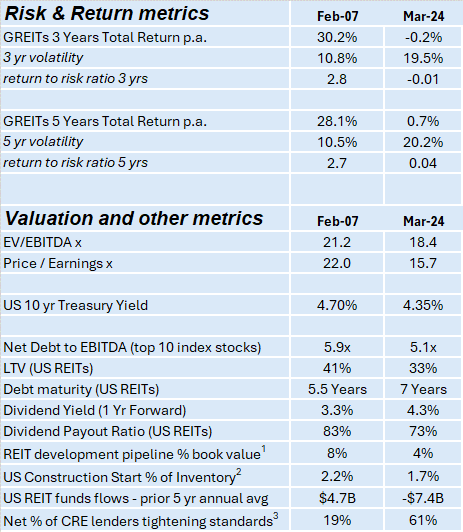

Reflecting on this period, the table below shows interest rates in 2007 were broadly similar to current levels, yet REITs at that time enjoyed materially higher earnings multiples.

Whilst in 2007 major parts of the REIT industry were on unstable footings thanks to higher exposure to property development, higher financial leverage, shorter term debt profiles, and greater reliance on bank lenders.

Today, as the table below highlights despite a stark difference in sentiment surrounding the sector, broadly speaking, REIT fundamentals are very clearly in better shape than in 2007.

Source: Factset, NAREIT, FTSE EPRA NAREIT, US Federal Reserve, Citi

Notes:

1. REIT development pipeline as % of undepreciated book value

2. US Construction Start % of Inventory (prior 10 yrs avg pa)

3. Net % of lenders tightening standards for CRE loans (last 4Q avg)

Over the past quarter, many REITs provided guidance for calendar 2024 earnings. On average we see the REIT sector positioned to deliver approximately 3-4% earnings growth in 2024, ranging from over 10% for US healthcare and logistics REITs, to -10% for office REITs and Hong Kong residential developers.

But what’s more significant is that REIT portfolios continue to demonstrate elevated occupancy levels (often above overall industry levels) which we believe points to superior quality real estate and operating platforms.

Most REITs report only modest levels of new supply impacting leasing conditions. U.S. sunbelt apartments and industrial are the exceptions where supply has been in response to elevated tenant demand in recent years.

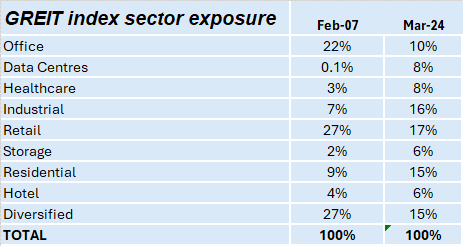

The significant increase in avenues to sector diversify within listed REITs also shouldn’t be overlooked when reflecting on the 2007 period. Active investors can now increase portfolio exposure to once-considered niche areas such as healthcare and data centre and move away from the riskier office building segment (which accounted 22% of the GREIT index in 2007 and now accounts for just 10%).

Source: Factset, FTSE EPRA NAREIT

What about the uncertainty surrounding interest rates?

Interest rates may remain elevated, but if this is attributable to better-than-expected economic growth, landlords should benefit from greater pricing power in a more constrained environment for development.

The strong performance of Japanese property companies in advance of and after the first interest rate rise that country has seen in 17 years is a notable testament to these dynamics.

We are not factoring in a return to the very low interest rate regime that prevailed in the QE and post pandemic era.

More importantly, for the most part, real estate demand and supply fundamentals remain favourable. Better than expected economic growth underpins tenant demand, and supply is constrained by rising construction costs, higher costs of debt and equity capital – or an outright a lack of developer finance.

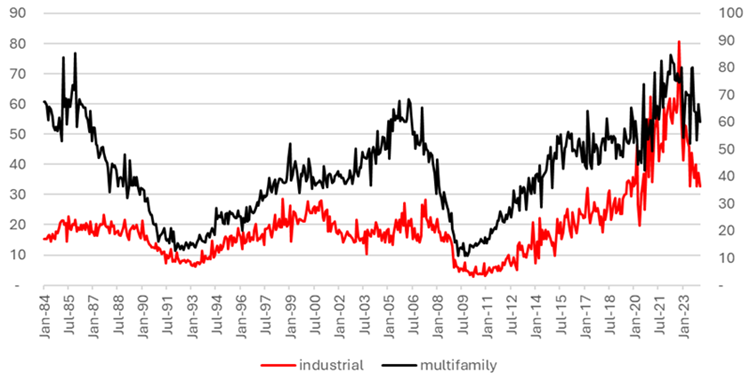

While 2024 will see elevated levels of completions in the US industrial and sunbelt multi-family sectors, construction starts in these segments have fallen materially as the following chart illustrates. This should bode well for landlord pricing power, provided demand conditions do not deteriorate.

Construction starts – US industrial and multifamily

Source: Citi Research, Dodge

And when it comes to financing, the past quarter has again demonstrated that debt and equity capital remain available for REITs, enabling them to play investment offense and take advantage of the distress of others.

Perhaps the best example of profitably taking advantage of duress is evident in the Resolution Capital Global Property Securities Fund (Managed Fund (ASX:RCAP) portfolio’s largest holding – U.S healthcare REIT Welltower (NYSE:WELL).

In 2023 WELL deployed US$4.8 billion into seniors housing properties at significant (30%+) discounts to replacement cost. The combination of higher interest rates, a pullback of traditional lenders, and real operational distress in seniors housing during Covid, has led to a broad opportunity set.

WELL has highlighted that ~US$16 billion of seniors housing faces refinancing in 2024-2025 likely providing further acquisition opportunities. For WELL, external growth activity has occurred at attractive yields, with the US$4.8 billion of acquisitions in 2023 yielding 7.2%, well ahead of the company’s 4.9% implied cap rate. The company has rightfully leaned on equity capital to fund its investment activity, sourcing ~US$6 billion of equity capital in 2023, which has the added benefit of further improving its balance sheet.

Affinity Living at Vancouver – A seniors housing asset in Vancouver, Washington State, recently acquired by Welltower.

During the quarter WELL reported a strong finish to 2023 with 12.5% like-for-like rent growth in the fourth quarter. The company guided to 10% earnings per share growth for 2024 excluding prospective investment activity. Welltower benefits from robust growth in seniors housing, with the REIT guiding to 18% same-store net rent growth for this segment that comprises nearly two-thirds of its income.

Time to reassess REITs?

The message surrounding the Global REIT sector right now is simple – REITs are in good shape and represent good value.

They trade at or below underlying asset replacement costs, and they have good balance sheets with moderate levels of debt and modest short to medium term debt maturities.

Importantly, REITs have continued to provide investors with liquidity day in and day out.

Publicly listed REITs do not and cannot hide behind the artificial gates of private funds. These dynamics are underappreciated.

Whilst many investment trends come and go, we believe great real estate in the right location is a sensible and compelling investment opportunity in the current market. It’s a sector that’s going to be relevant today, tomorrow, and long into the future.

Marco Colantonio is a Portfolio Manager at Resolution Capital, an affiliate manager of Pinnacle Investment Management. Pinnacle is a sponsor of Firstlinks. Resolution’s active GREIT Fund in Australia is ASX:RCAP.

This article is for general information purposes only and does not consider any person’s objectives, financial situation or needs, and because of that, reliance should not be placed on this information as the basis for making an investment, financial or other decision.

For more articles and papers from Pinnacle Investment Management and affiliate managers, click here.