Editor’s introductory comment: A convertible bond gives the bond holder the right to convert the bond into a defined number of shares in a company at a predetermined price. As an example from the Australian market, the long-established Listed Investment Company, Australian Financial Investment Company (ASX:AFI) issued a convertible note in February 2012 for five years, maturing 28 February 2017. It paid a 6.25% coupon, with the right to convert the bond into shares in AFI at a price of $5.09. This was about a 25% premium to the share price at time of pricing the bond. In other words, for every $100 invested, the bond holder has the right to $100/$5.09 or 19.6 shares. The current price of AFI shares is $6.16, so not only has the investor earned 6.25% on the bond, but there is an attractive conversion to AFI shares pending. Hence the bond currently trades at about $117.5 having been issued at $100.

Convertible bonds have long been under the radar relative to other asset classes. Despite the attractiveness of convertibles they are unlikely to be the first point of call for a typical investor. Yet the relative lack of attention belies the qualities of an attractive asset class that benefits from a range of characteristics that can be of value to investors.

Over the long-term, convertible bonds have demonstrated their ability to deliver equity-like returns with significantly less volatility than equities, as shown in Figure 1. Investors can benefit from upside exposure to the equity underlying a convertible whilst retaining the intrinsic downside protection of a bond. Analysis of convertible bond returns over the long-term shows attractive risk-adjusted returns and absolute returns which have approximately matched those of global equity market indices as well as corporate bonds, with volatility almost at the mid between the two.

Figure 1: Comparison global convertibles v other assets, 1996 to 2014

Income and equity characteristics

Whilst convertibles do not, by their nature, fit neatly into a fixed income or equity bucket, they can provide both fixed income and equity investors with some attractive characteristics. In discussions with investors in Australia (and globally), we have come across many different ways investors can use convertibles in their portfolios. For instance, insurance companies globally, including Australian insurers, find them attractive due to their favourable capital usage treatment relative to equities.

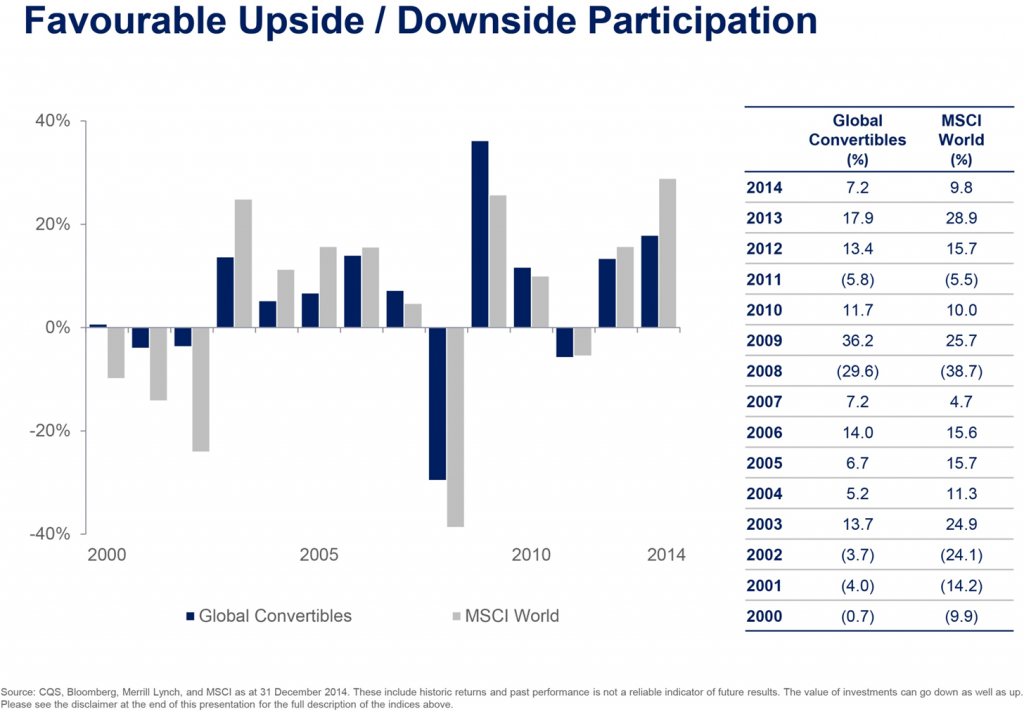

As Australian investors start paying more attention to the pension phase of their investment programme, they should increasingly see the appeal of the equity upside participation with downside protection offered by convertibles. Convertibles have characteristics that enable an investor to tailor a portfolio to meet their risk/reward requirements. For instance, for investors looking for an equity substitute, the portfolio can be tailored to have more upside participation (higher delta). For investors looking for a little upside for their bond portfolio, securities with more bond-like characteristics offering more downside protection (and less upside participation) can dominate the portfolio. Figure 2 shows how global convertibles can deliver less downside but with upside participation. A portfolio manager in a fund can also actively manage the average credit quality, regional allocations, industry exposures, types of convertibles and currency exposures (most convertible portfolios are fully currency hedged) to tailor the portfolio.

Figure 2. Global convertibles v MSCI annual returns, 2000 to 2014

The prospect of interest rate increases in the US is focusing attention on the tactical attractions of convertibles. In addition to their low correlation with government bonds, convertibles have shorter duration than traditional corporate credit and may therefore be more resilient during periods of rising interest rates.

The growth of the convertible universe is offering an increasing number of opportunities to investors. The global capitalisation of the convertible market is around $400 billion and is comprised of issuers across a diverse range of geographies, sectors and credit quality. The rate of convertible issuance has risen as companies increasingly identify the convertible bond market as an attractive source of capital for investment initiatives and for M&A activity. The technology and healthcare sectors in particular have been at the forefront of this trend.

Historical data shows that convertibles have demonstrated low correlation to government bonds and only moderate correlation to broader corporate credit markets, making convertibles an attractive diversification tool which can play a valuable role in portfolio optimisation.

Prospects for convertibles

The first quarter of 2015 witnessed solid year-on-year growth in global convertible issuance. We believe this trend will continue, as companies seek to secure a higher proportion of their funding from bond issuance and to reduce reliance on bank borrowing. Higher equity market valuations and the consensus expectation of rising US interest rates are also likely to have positive effects on new issuance, again providing an increased opportunity set for convertible investors.

Finally, investors can benefit from decreasing competition in the convertibles space. In recent years, bank proprietary trading desks have, by and large, closed and capital flows into convertible arbitrage hedge funds have been muted, creating valuation dispersion that may be exploited to achieve attractive returns. This is particularly topical as M&A activity has picked up in recent months. Many convertible bonds have attractive structural features that allow significant upside participation in the event of takeover.

Although not indicative of future performance, historical performance suggests that a strategic allocation to convertibles can reasonably be expected to increase a portfolio’s expected return for a given level of risk, given their low correlation to other fixed income assets, making the convertible market an attractive tool for investors. In addition, the present macro environment, with the potential for increased interest rates, possibly higher equity market volatility and increased M&A activity, should prove supportive for returns from the convertible bond market, proving it an asset class worthy of more attention from investors.

James Peattie is Senior Portfolio Manager at CQS Investment Management Limited, a London-based manager of alternative assets.

Editor’s note: Convertible notes issued on the ASX are listed in the Interest Rates Securities section at the back of The Australian Financial Review and the ASX has more information here. Many bond funds also make an allocation to convertibles bonds. Neither Cuffelinks nor CQS is recommending any of these investments and readers should take financial advice before making investment decisions.