Vivek Bommi is Senior Portfolio Manager and Managing Director at Neuberger Berman in London. His responsibilities include management of the Listed Investment Trust, NB Global Corporate Income Trust (ASX:NBI).

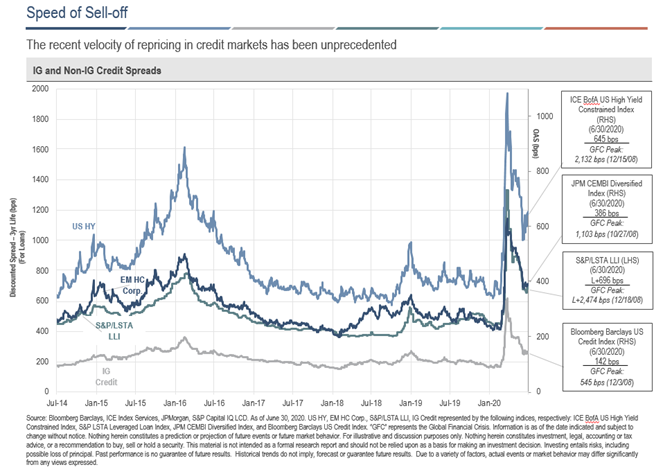

GH: A lot has happened in the corporate bond market since March. The Bloomberg High Yield Index on 23 March was 11.69% and now it’s about 6% which is an extraordinary recovery. How do you summarise the last six months?

VB: At the market low, the world was struggling to understand what lockdowns meant, and the virus was looking bad in China with potential to hit the world. Markets were shocked that people were suddenly working from home. People were worried about public health, and investors in risky assets were trying to sell because the unknown is the worst thing for risky assets.

At the same time, in late March in all fixed income markets not just high yield, there was a big liquidity mismatch. Lots of sellers and no real buyers as the natural buyers were either fully invested or assessing what was in their portfolio. We went through each name to see what the effect of a zero-revenue environment would be on each company and whether we needed to take action.

GH: What’s an example of a bond that was sold off but represented good value?

VB: Well, there was a one-year bond from Caterpillar, a US-based investment grade company, and because someone was trying to sell it, the bond sold for below 90. That’s a 10%-plus yield on an A-rated company. It was not a high yield problem, it was everything, even off-the-run Treasuries.

GH: Then what happened?

VB: First, the Fed stepped in and said it would buy investment grade issuers by expanding its balance sheet, and that calmed markets as people stopped worrying about investment grade names rolling over their debt. Second, and more subtly, the Fed backstopped fixed income ETFs. At that stage, fixed income ETFs were trading at a discount and big selling then feeds upon itself. And third, governments around the world stepped in with fiscal policies. Increasingly, markets looked well forward to understand the longer-term consequences.

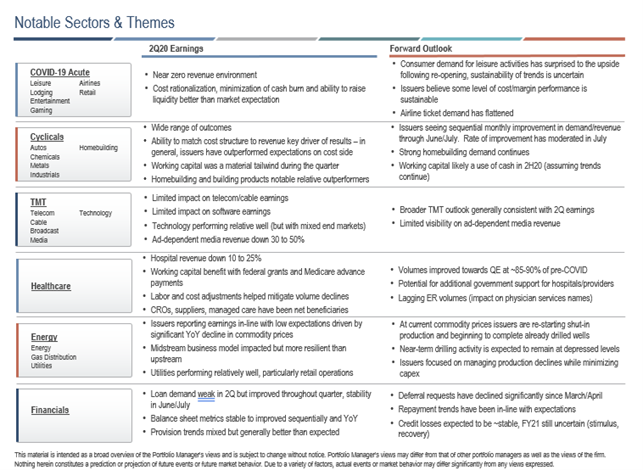

All these combined to give a better sense of the impact coronavirus would have on various companies and broadly speaking, it was not as bad as first feared. And so capital markets reopened quickly. Companies which needed cash could access equity markets or debt markets. Of course, certain industries were more impacted, such as theme parks and travel for example. But even they were able to raise capital to withstand multiple years instead of multiple months of zero revenue. It changed the dynamics and the picture on the number of defaults.

GH: Was the Fed activity in ETFs and direct bonds confined to investment grade?

VB: No, they also bought high yield ETFs as well. In bonds, they specifically picked names that were downgraded from investment grade to high yield. But in fact, they did not do that much, but just having that backstop gave people a lot more comfort.

Now, at this point, when you look at fixed income, high yield credit is one of the few games in town. It’s a large, diverse market of US$2.5 trillion, including regular companies everyone knows, which makes them easier to analyse. Not much else offers yield anymore, neither governments nor investment grade unless you're willing to go out very long in the curve. Some money is going into emerging market sovereigns, but many people are less comfortable with that.

In the last few months, there’s been US$30 billion of retail flows into high yield funds and another US$30 billion of institutional money so the market has a good tailwind.

GH: Are you concerned about the ‘zombie’ companies which could not refinance their debts if not for this injection of liquidity? Is the can kicked down the road?

VB: Realistically, few companies pay off all their debt anyway and it’s an efficient use of a balance sheet to run with some debt. If a person takes a 30-year mortgage, over what time frame do they expect to pay it off? Almost every company can pay off all their debt in 30 years because corporates are long-term entities. Individuals want to pay off 100% of their debt because they stop working, so it makes sense.

Now, there are certain industries that have increased their debt load and are burning cash, and they probably have more debt sheet than is preferred. They need to pare it down, the obvious examples are hotel companies, leisure cruise lines and the like. Some of these have moved from investment grade companies to high yield. Over time, as their earnings and stock prices improve and they start repaying the debt, they'll probably move back up but it'll take a while.

GH: Do some companies borrow even if they don’t need the money immediately?

VB: Frankly, some take out debt as an insurance policy. Those companies have other debt maturing within 12 to 24 months out and they're sitting on cash and will probably repay their debt. Ford is a perfect example. Pre 2005, it was an investment grade company, it took out a lot of debt for its restructuring and then earnings had a problem. It was downgraded to high yield in 2005 but by 2011 it was back to investment grade. I characterise a zombie as a truly insolvent company, meaning its debt load is in excess of its enterprise value. Those don't last long because markets are pretty efficient. Banks and bond markets won’t lend to them.

GH: What about governments? Australia now has over a trillion dollars of debt, are we passing problems to future generations or don’t we need to worry because the debt doesn't need to be repaid? It can just be rolled over forever when it’s a government.

VB: Yes, but as you increase your debt, whether a corporate or a government or an individual, you are creating less flexibility in the future. There’s a natural limit to how high you can go. At least corporates have levers to pull in cutting costs or raising equity to generate cash flow. Some corporates prefer to raise equity than debt to maintain financial flexibility in the long term.

GH: Your highest-profile fund in Australia is the listed trust, NBI, and it's been part of this high yield journey in 2020. What has Neuberger Berman done in the last six months to address the falling share price and the discount to Net Tangible Assets (NTA)? It's seen a strong recovery and now the discount is narrow.

VB: The market has obviously improved from the lows, but we have been engaging with our clients as much as possible, explaining the story. The goal is to pay out a Target Distribution on a monthly basis which we have been doing. We have full transparency in the portfolio, which shows large companies rated by the three major rating agencies. Some of our peers say their portfolios are investment grade and in the fine print, the rating is done in-house, not by independent agencies.

GH: In Australia, the big flows into ETFs have been in global equities but also very strong into fixed interest in various forms. And yet, investment grade returns are very low in a fragile economy. How are investors justifying such large fixed interest flows with returns that barely cover inflation?

VB: First is protecting their portfolios from another equity drop, especially after the market rally. Second, if you take a look at the main corporate bond index (the ICE BofA US Corporate Constrained Index with a market value of US$8.3 trillion), the year-to-date return is 6.7%, which sounds good, but the current yield is only 2% because it includes US Treasuries. Investors don’t look forward, they say, “Wow, investment grade paid nearly 7%, I should put money into that.” But US Treasuries returned 11%, meaning the rest lost 4%. With a yield of 2%, if you're just a little wrong on rates, that wipes out your total return.

GH: So the gain is all in the duration and not the credit. The last time I saw the duration of the index, it was out to about seven years, so a 1% rise in rates means a 7% loss of capital.

VB: It’s now out to 8.2 years. It’s the largest investment grade index. Yield of 2%, duration over 8 years. If rates go up only 0.25%, you've pretty much zapped all of your yield right there.

In Australia, many retail investors have their money in bank hybrids as their fixed income proxy, which has worked. Yet they have a much higher aversion to non-investment grade debt than almost anywhere else in the world. They think if a company is rated ‘junk’ it's a terrible company because junk means bad. But the median EBITDA of companies in our portfolio is about US$1 billion. The median EBITDA of the ASX100 excluding banks is less than A$200 million. These high yielders are not small companies.

GH: What is NB doing in the investment grade space that is available to Australian investors?

VB: We offer a flexible multi-sector global bond solution, the Neuberger Berman Strategic Income Fund, which has an investment grade average rating. It's also has a monthly distribution which we think appeals to those looking for a good durable income steam.

GH: Let’s finish up with your market outlook.

VB: If the US election has any impact, it will impact more on broader markets and you may see some of that translate into mark to market within high yield. But we don’t see a major impact on the credits in our portfolio. Biden will probably increase scrutiny on big tech but that affects little in the mainstream economy.

There is a possibility that the Democrats may spend more which might put some upward pressure on rates.

On the virus side, I live in London and there is no real lockdown. It’s not like March and April where you couldn’t go to work and only grocery stores were open and you couldn't travel outside of London in your car. That was a real lockdown. I'm usually asleep by 10 o'clock so the new curfew on bars and restaurants has no impact on me.

The capital markets have been functioning well, supported by the US Fed and central governments, the future volatility in fixed income should be significantly lower even if we go a second lockdown.

Both the virus and the election are highly consequential for the long term. We are keeping risk levels in check given their volatile nature and the range of potential outcomes.

GH: The high yield market has improved a lot since March. Is there still value there?

VB: I think there's still good value. In today's global index, the yield is about 6% with 3.8 years of duration. So if rates move, say, 1% up, there's enough yield to compensate for that. But rates will only move up if there is growth in the economy, which is good for credit. We now know far more about the likely impacts of the virus on most companies.

Vivek Bommi is a Senior Portfolio Manager at Neuberger Berman, a sponsor of Firstlinks. This material is provided for information purposes only and nothing herein constitutes investment, legal, accounting or tax advice, or a recommendation to buy, sell or hold a security. It does not consider the circumstances of any investor.

For more articles and papers by Neuberger Berman, please click here.