Australia’s private debt market is entering the mainstream, both as a funding option for Australian businesses and as an asset class for income-conscious investors. Renewed interest in this form of lending is driven by the retreat of the banks from business lending and by record low interest rates that have enhanced the investment appeal of well-managed private debt funds.

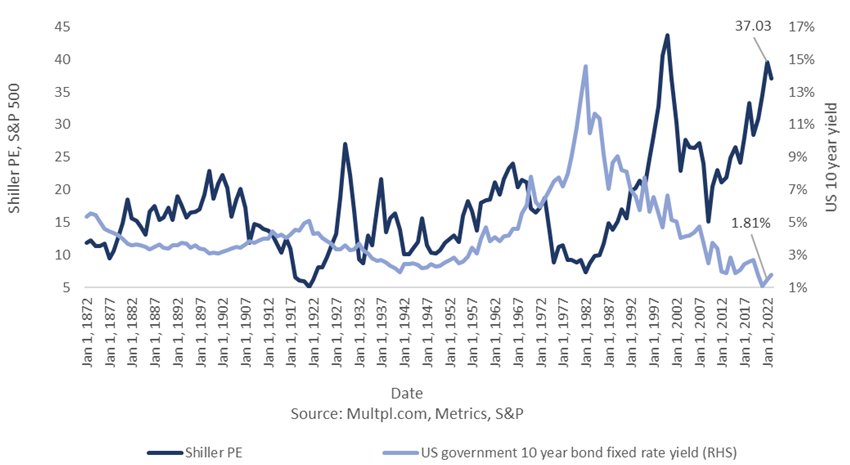

Exhibit 1: Shiller PE – S&P 500 and US 10 Year Bond Yield last 20 Years

Risks in both the fixed income and equity markets are rising because of sustained low official interest rates that have forced investors to chase higher prices and forced down yields. Equities prices have enjoyed a sustained run that has stretched valuations and reduced prospective capital and income returns.

The S&P ASX 200 Index is two-thirds above its historic average price earnings (P/E) ratio of 15 times, while the earnings yield is around one-third below its long-term average of 6.5%, according to the Australian Securities Exchange. With disruptions to supply chains creating inflation pressures since the middle of last year, investors risk exposure to rising official interest rates that may push equity prices down.

Public versus private markets

Public market investors rely on selling their assets to manage risk. In the current environment, it is a far from sustainable strategy because it relies on liquidity that may disappear when prices move lower.

In contrast, private debt transactions are designed to allow the lender and – through them - the investor to manage risk in both best and worst-case scenarios. The nature of private debt brings lender and borrower closer together. From the outset, lender and borrower develop a close relationship and use frequent reporting arrangements that allow timely responses to any change in circumstances.

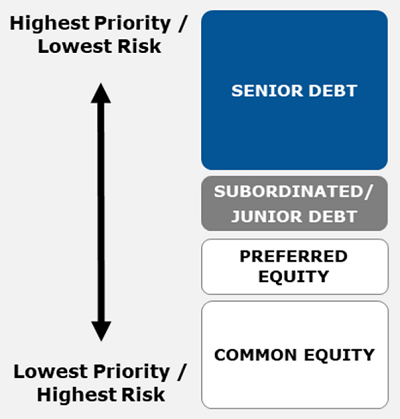

Exhibit 2: The Capital Structure

Another key attraction of private debt is its ability to offer superior protection of capital because of its position in the capital structure. Loans are typically secured against assets such as property and Australian insolvency laws ensure priority of debt repayment over other liabilities lower down in the capital structure. Equity takes the first loss or – put another way – is the last to be paid in the case of a borrower becoming insolvent.

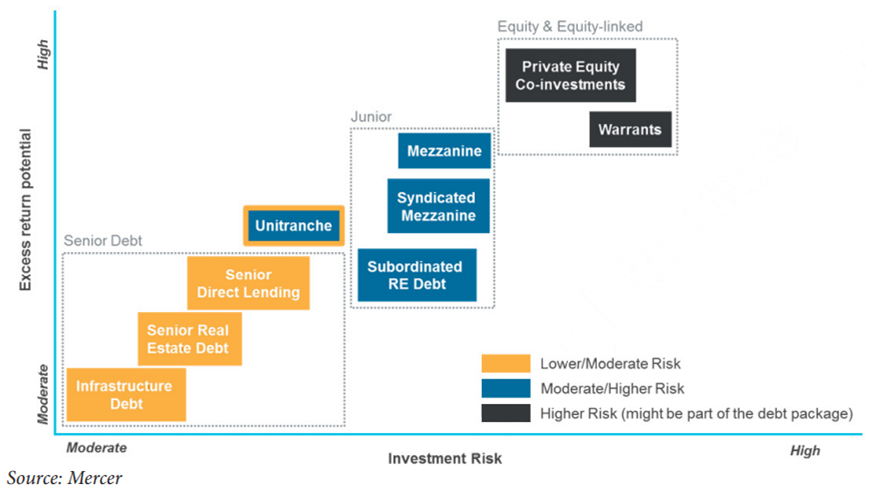

Returns across the spectrum

Loans from private debt providers typically span senior secured investment grade debt through to sub-investment grade with potential for equity-like enhancements such as warrants or options. Investors receive returns in the form of interest and fees on corporate loans paid as monthly distributions at an annual rate of about 4%, up to total returns of 10% or more after factoring in returns from equity-like enhancements.

These enhancements are usually taken as a sweetener to a particular loan and as a sign that the borrower is working to the mutual advantage of both parties. But private debt providers still assess them with the same rigorous process used to evaluate a loan.

Sub-investment grade loans do not automatically mean sub-par borrowers. A sub-investment grade loan that delivers a higher yield will usually be secured and the lender takes other measures to protect its capital such as more restrictive terms, conditions and covenants. Often a company will decide that the benefits of operating with a sub-investment grade credit profile – such as higher leverage - outweigh the costs, such as the higher price of borrowing. Lenders and investors to such companies are focused on ensuring the borrower strikes the right balance and can generate sufficient cashflows to service and repay the debt owing.

Exhibit 3: Private Debt Risk/Return Levels by Category

A lender might require the borrower to maintain certain ratios, such as net debt to earnings before interest, tax, depreciation and amortisation, or debt servicing costs to operating income that, if breached, trigger repayment or security terms. It can impose limits on equity 'cures', or injections of capital by the shareholders that, if too frequent, may indicate the borrower is having difficulty servicing the loan.

Loan agreements can also restrict dividend payments until interest and principal repayments are secured. The original focus on terms, conditions and covenants, combined with the close relationship and frequent reporting requirements allow the lender to act to protect its capital if circumstances change.

Macro conditions remain supportive

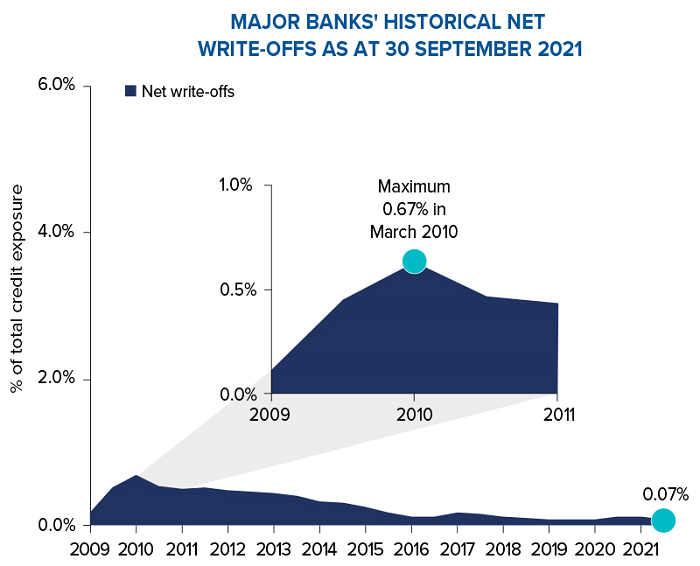

The value of this approach is highlighted in data for corporate loan exposures. As the chart shows, losses peaked at just 0.67% of total Australian business loans in March 2010 – towards the end of the GFC. Since then, they have steadily declined and were just 0.07% in September 2021, according to Bloomberg data.

The Reserve Bank of Australia Financial Stability Review in October 2021 noted that business insolvencies have declined and stayed much lower since the onset of the pandemic in early 2020.

Exhibit 4: Historical Australian Corporate Loan Loss Rates

Source: Major Bank APS 330 reporting. Past performance is not a reliable indicator of future performance.

If conditions deteriorate, such as the economy suffering a recession and increasing the risk of loan defaults, there are protections built into private debt transactions, including security arrangements, that may act to protect investors capital. If emerging inflation pressures are sustained and trigger a rise in official interest rates, private debt investors’ capital and purchasing power is protected because it is priced at a floating rate above the benchmark Bank Bill Swap Rate (BBSW).

Rising inflation that may trigger central bank interest rate increases is a growing risk to investments. Inflation readings in developed economies are at multi-decade highs, spurred by supply chain disruptions and rising energy costs, and officials at the US Federal Reserve have indicated that rate rises are coming soon. The Reserve Bank of Australia, meanwhile, has reaffirmed its intention to avoid rate moves until at least 2023 when it expects to see sustained wages growth and inflation.

The macro environment remains supportive for business, with governments and institutions focused on nurturing economic recovery and jobs growth to help the country re-emerge from the pandemic. Ahead of a Federal election this year promised personal tax cuts are due to be delivered. Re-opening the economy to international travel would also help to restore population growth, in turn spurring demand for housing and supporting the construction and property industries that are among the users of private debt.

How to access private debt

Private debt (or corporate loans) is not an asset class that investors can easily access directly, and therefore need to be accessed via a manager with scale and expertise in this market.

Investors have the option of investing in private debt via credit-focused Listed Investment Trusts (LITs) and unlisted funds. Listed Trusts provide daily liquidity, similar to shares, so investor can sell their fund units on the ASX, whereas well-diversified unlisted funds can also offer liquidity on a regular basis.

For both types of investments, there are options to suit an investors risk appetite, from predominantly senior secured loan portfolios yielding ~4% income p.a. through to equity-linked loan portfolios that provide a higher yield of ~7% with potential for upside gains through equity participation.

Andrew Lockhart is Managing Partner and Co-Founder of Metrics Credit Partners, an Australian debt-specialist fund manager, and sponsor of Firstlinks. This article is general information and does not consider the circumstances of any investor. Its listed vehicles operate under the tickers MXT and MOT.

For more articles and papers from Metrics Credit Partners, click here.