Investors are in a difficult period, and it's vital to get the fundamentals right, particularly in the small cap part of the market. Companies need to generate strong cash flows after capital expenditures and stock-based compensation, and the cash flows must be sustainable. For investors, a resilient market position and growth in that market are worth paying for.

Small caps also need a valuation anchor, a reason to buy the company underpinned by a favourable estimate of value. We want to know what the company is worth through the cycle. We don’t want to rely on finding a ‘greater fool’, someone foolish willing to buy a company that lacks substance.

Bubbles regularly occur in small caps, where assets are completely overvalued. In small caps, relatively modest amounts of money can move around the market capitalisations of companies. Passive money from index buying and even retail money can also swing prices around.

Examples of past and future bubbles

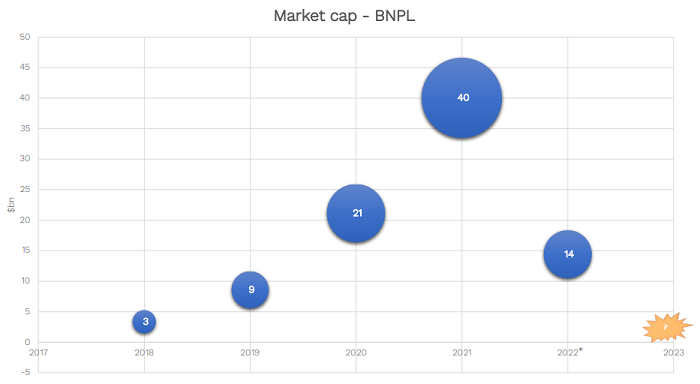

One example is BNPL, the Buy Now Pay Later sector. We did a lot of research on the sector and could not get comfortable with even low valuations. Afterpay came on the scene in 2018 but we could not see how the business model would make money. To date, it never has. At the time and in subsequent years, the market was looking for high growth and the narrative was good, they were penetrating markets and increasing revenues.

But then came a plethora of other stocks doing a similar thing – Sezzle, Zip, QuadPay - all IPO-ing and creating a huge bubble of enthusiasm. Any small cap fund manager not owning any of these stocks was hurt for a while and clients questioned their sanity. But eventually, when there was no business model and no cash flow coming through, they were found out. The tide went out and they were swimming naked, to paraphrase Warren Buffett.

Bubbles: When a bubble bursts…

Chart Source: Bloomberg. *2022 captures market cap from 1/1/2022 to 10/8/2022. Stocks include: APT/SQ1, ZIP, HUM, SZL, SPT

We believe interest rates going up is also like the tide going out. Economic gravity is reestablished and valuations and fundamentals are coming back to the fore.

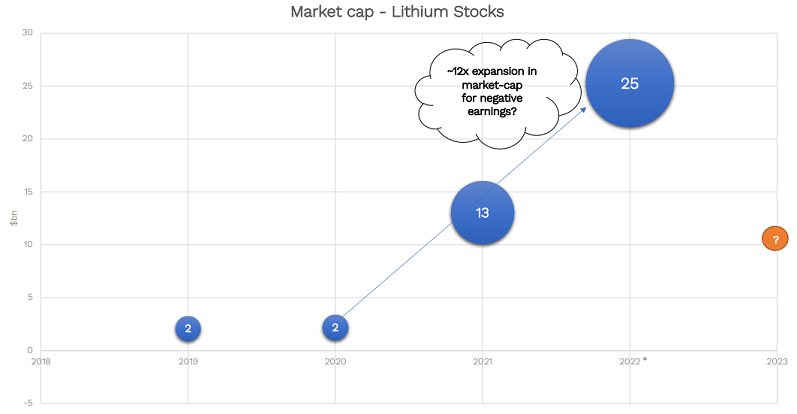

We believe another bubble is forming in small cap lithium stocks. The following chart shows the market capitalisation of lithium stocks over the last few years. While lithium is in high demand now and there is a focus on EVs for a cleaner future, many of these companies do not generate positive cash flows or earnings. Of the nine or so stocks that comprise this market capitalisation, only one makes money. The other eight are currently exploring, with in many cases, many billions of dollars of valuation ascribed to those assets. We don’t think that's sustainable long term.

Bubbles: Will lithium be next?

Chart Source: Bloomberg. *2022 captures 1/1/2022 to 10/8/2022. Stocks include: PLS, AKE, LTR, CXO, LKE, VUL, PSC, ARG, SYA

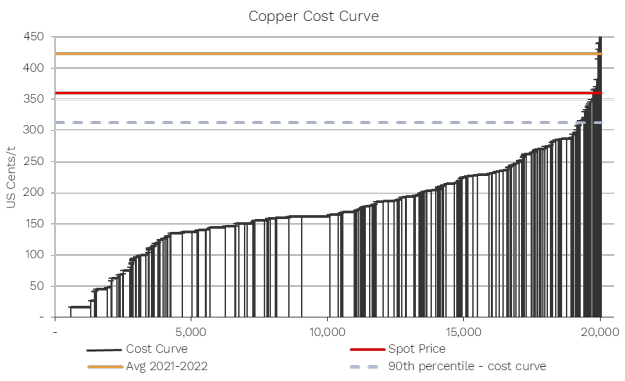

Consider the copper cost curve and what it reveals about Economics 101. The highest-cost marginal producers set the price in the long-term equilibrium, and the copper price shows where the high-cost players are.

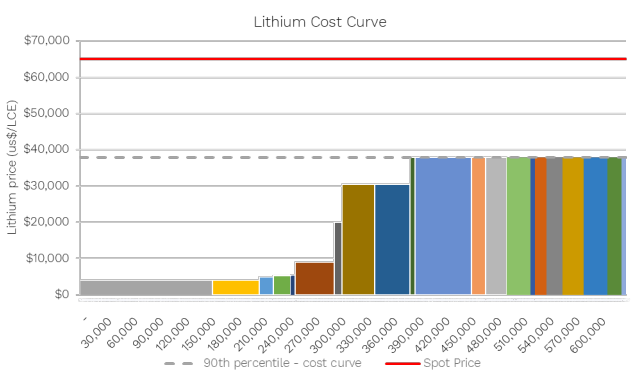

Copper and lithium cost curves and production costs

Source: Bloomberg, UBS and Canaccord (2022)

The lithium market is different. It's nascent on the supply side but with strong demand growth which is overriding and outweighing the lack of supply. But the supply response is coming with new mines opening and production coming online. It will catch up at some point. At the moment, the low-cost operators are the brine producers in Latin America. The high-cost end of the market includes Australian lithium hard rock miners, and their costs are hugely higher. As the market expands, these operators will set the price.

We believe the lithium price will probably fall to around US$40,000 per tonne in the long term, and the high-cost miners will be in a difficult equation. The money to be made is at the low end of the cost curve, and that's the brine producers. We think a bubble has formed here.

Prospects for two high-profile small caps

In addition to avoiding these bubbles, we also flag a couple of stocks that have been prevalent in micros and smalls for a long time that have limped on through multiple capital raisings.

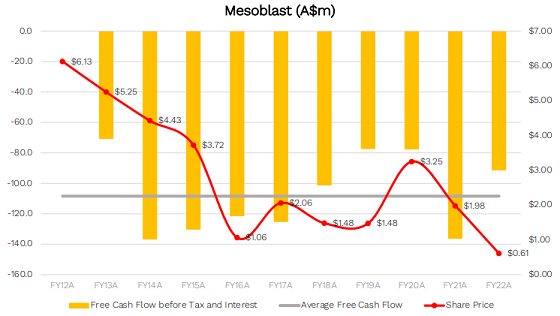

Mesoblast is really a gold stock masquerading as a biotechnology name, claiming everything from a cure for cancer to a cure for COVID using stem cells. While we like new ideas, we also look for proven commercial development of any technology.

This chart shows the cash flow consumption over the last decade. It's been almost $100 million a year of R&D effort. And to date, there's no commercial cash-earning business after burning through around $1 billion. The only thing compounding are the shares on issue. A buyer 10 years ago has lost about 90%. Obviously, there are periods of enthusiasm where it trades well, followed by a large rights issue. Investors should look through the fundamentals for actual cash flows and strong businesses.

Example of a cash burner company

Source: Morningstar, IRESS, Spheria

In contrast, a stock we do own has a good history of cash flow generation. NZME, New Zealand Media and Entertainment, is the Number One masthead in New Zealand. It owns the leading set of newspapers in New Zealand, the number one radio business, and operates the digital license for iHeartRadio.

The big kicker is the digital side of the business, called OneRoof, which is similar to Domain in Australia. It's the number two player in the market behind TradeMe, similar to how REA in Australia is ahead of Domain. We see upside in the property digital market because New Zealand has lagged Australia in developing the potential. The market is going from print to digital with a lot of money to be made and a valuable position going forward. This is in addition to its main masthead where digital subscriptions are outweighing deliveries of the print edition. While the company is going from old world to new world, it’s trading at about four times earnings, and we think it will rerate at significantly higher levels.

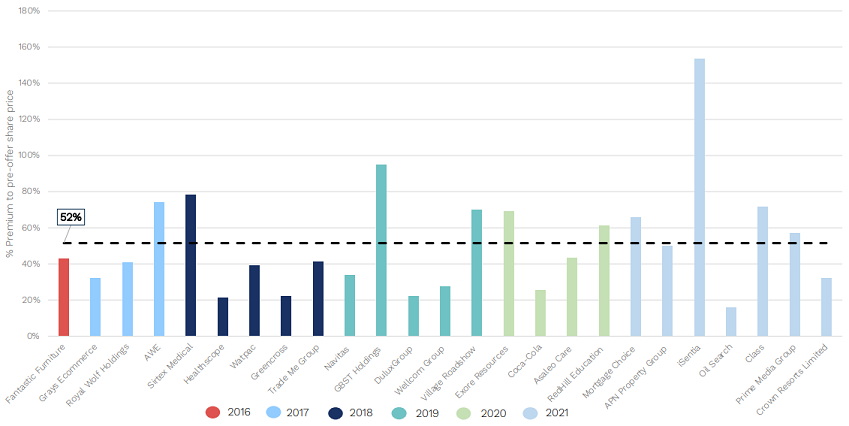

Takeover potential in the small cap market

What happens in the small cap sector if the price re-rating does not occur? For quality companies, it’s always worth looking at the takeover potential. We have seen 25 takeovers in six years at the small end of the market. The last big one was Class, a leading player in the SMSF software market. It was a subscription business with a great cash flow, a strong balance sheet and the valuation was attractive.

Small cap takeovers over time, % premium

Source: IRESS

Investing in small caps

Over a long period of time, by avoiding the bubbles and not trying to time the market, identifying enduring businesses with good economics will eventually be recognised by the market mechanism either through takeovers or through dividends or buybacks or just share price appreciation. Our approach is to sort through a big universe of stocks using good technology and our team of analysts, and discard a lot of areas that don't generate cash and earnings. Avoid the hype and focus on conservatively-geared businesses that make good cash flows.

Marcus Burns and Matthew Booker are Portfolio Managers at Spheria Asset Management, an affiliate manager of Pinnacle Investment Management. Pinnacle is a sponsor of Firstlinks. This article is for general information purposes only and does not consider any person’s objectives, financial situation or needs, and because of that, reliance should not be placed on this information as the basis for making an investment, financial or other decision.

For more articles and papers from Pinnacle Investment Management and affiliate managers, click here.