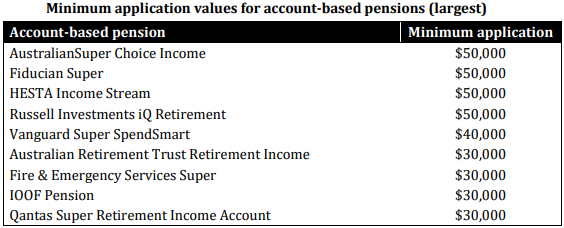

Why an estimated one million Australians aged 65 or above still have an accumulation account is not completely resolved. We noticed while researching this topic that minimum application amounts may be precluding some low-balance retirees from accessing account-based pensions (ABPs). We estimate that 50,000 Australians who are retiring over the next year may not be able to access an ABP because they do not meet minimum application requirements of their superannuation fund. The table below lists funds with the largest minimum ABP application amounts extracted from product disclosure statements (full list in Appendix of original paper). We briefly detail our concerns, acknowledge nuances, and suggest some steps forward for funds and policymakers.

Our concerns

We have a range of concerns over limiting ABP access for low balance members:

- A retirement account provides access to a tax-free environment – Low balance members may miss out on a tax benefits could easily provide a 0.5% return uplift annually (relative to the comparable investment strategy applied in accumulation). This can have a meaningful impact on income and balance over longer periods. While somewhat coincidental, 0.5% is the threshold level used in the Your Future, Your Super performance test.

- Exclusion from pension bonus – Members not meeting the entry requirements for their fund’s ABP will also be excluded from participating in any retirement bonus (where offered).

- Effective member engagement – It is unclear what options are being presented to members with less than the minimum ABP balance requirements, and whether their super fund is engaging with them in a proactive manner including suggesting realistic next-steps. A generic message that there is a good retirement product while confronting members with minimum balance requirements that they may not meet seems like a poor communication practice, and may reduce member confidence.

- System design not being made available to all – The design features of Australia’s retirement income system include an accumulation phase that taxes contributions and income and a retirement phase that is tax-free. Precluding low balance members from the tax benefits during retirement seems inconsistent with a fair and equitable system.

Nuances

We acknowledge that the problem is nuanced:

- Many low-balance members withdraw their accumulation balances – Many low-balance members may not make use of an ABP even if available due to an intent to withdraw their balance – although it is challenging to identify the degree to which ABP take-up to date has been inhibited by account access or intentional choice. The extent to which lower ABP take-up is intentional reduces any business case challenges (next dot point), and would reduce the cost of reducing minimum ABP balance requirements.

- Super funds face a business cost challenge – Operating a product with operational complexities and small balances is likely to be cost-ineffective, although this challenge is likely to shrink over time as the system matures and balances grow. However, small ABP balances is only one of many areas where super funds face member cross-subsidisation challenges. Other examples include operating and investment fees, insurance design, engagement programs, and retirement income strategy development costs. Whether avoiding cross-subsidisation across ABP members is appropriate is debatable.

- Consideration of capital reserve or contingency accounts – The linkage between small ABP balances and the minimum drawdown rules warrants consideration. Many low balance retirees are currently required to draw a very modest income, but may be better off using their modest assets in super as savings they can access as and when required. This leads us to reflect on the merits of what we call a ‘contingency account’ in this Retirement Explainer, and Treasury called a ‘capital reserve’ in the appendix of their Superannuation in Retirement consultation paper. Such an account offers scope to allow low balance retirees to access a flexible source of funds while capturing tax benefits.

Our take

Some funds might do more to provide their low balance members with access to an ABP. The benefits would not only be financial, but also include more effective member engagement, and ultimately a fairer system. Given that we estimate 50,000 low-balance members will join the retiree cohort next year, we advocate for steps to be taken as priority. We call on super funds to consider their minimum ABP balances, and Treasury to continue exploring their capital reserve idea as a more appropriate match to the needs of low balance retirees. While the size of the affected cohort will likely shrink as the system continues to mature, this cohort will not entirely disappear, and a sizable number of Australian retirees appear to be impacted now. We think more should be done to assist these members.

David Bell is the Executive Director of The Conexus Institute. Geoff Warren is a Research Fellow with the Conexus Institute, and an Honorary Associate Professor at the Australian National University.