Australian listed property trusts, often called A-REITs, are well positioned for an environment of elevated inflation and low growth. Commercial leases in office, industrial and logistics typically have inflation-linked annual increases in rents written into multi-year contracts, providing inflation protection on income. A-REITs have deleveraged since the GFC and offer exposure to subsectors with inelastic demand for their services in an environment where the global economic activity is subdued.

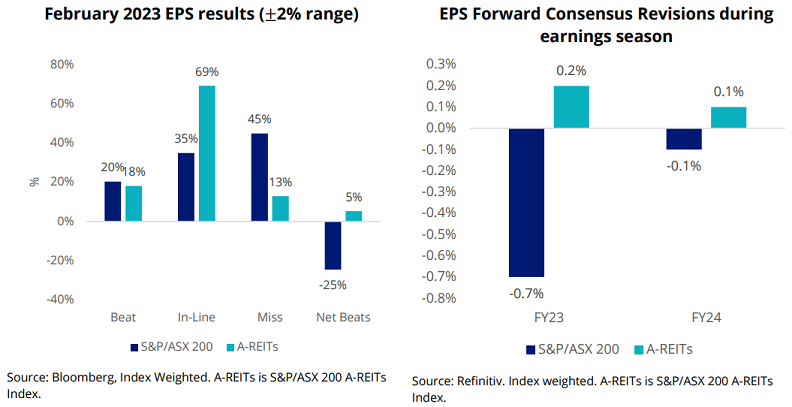

In the recent Reporting Season, A-REIT earnings results were ahead of the S&P/ASX 200 with earnings per share (EPS) beats higher than misses by 5%. On forward consensus, A-REIT FY23 and FY24 Earnings Per Share (EPS) revisions were upgraded whereas S&P/ASX 200 revisions were downgraded.

Despite rising rates, A-REITs reported a smaller than expected expansion in cap rates (required yield on a property) and drop in net tangible assets ending December 2023. Disappointing results from resource mega caps BHP and Rio Tinto dragged on the equity benchmark index.

As we near the second half of 2023, we favour industrial and retail REITs in Australia and globally as both subsectors have shown improvements in occupancy rates. We prefer exposure to Australian REITs as the economy is better positioned than most countries to manage economic challenges in 2023 and fundamentals are also more attractive at an asset class and subsector level.

Three sector potential with stock examples

Let's consider three sectors - industrial, office and retail - with stock examples in each.

1. Industrial REITs

We are overweight Australian industrial REITs. Occupancy rates are lower and market is more concentrated with Goodman Group holding majority market share, restricting barriers of entry.

Industrial REIT cap rates and net operating income in Australia and globally are likely to remain sticky as tenants look to manage excess inventory levels and expand e-commerce channels amid low vacancy rates. Retailers will continue to invest in optimising delivery chains as they address demand for both in-store and online consumer spending. E-commerce and industrial demand are firmly anchored in the economy and remain resilient in the face of slower growth.

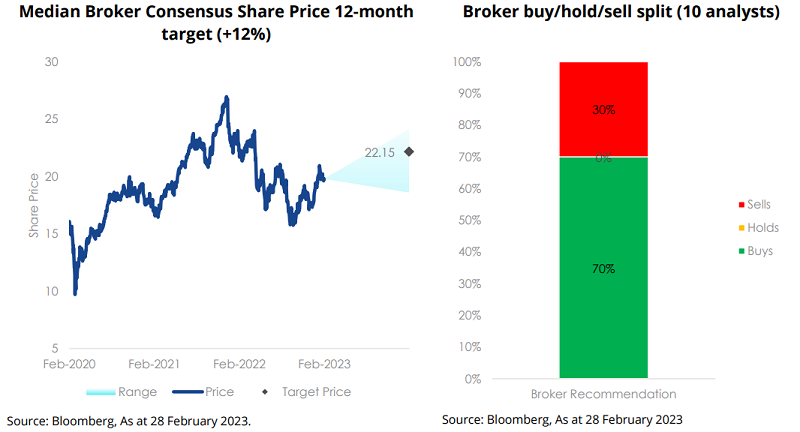

Goodman Group (ASX:GMG)

Goodman Group was one of the worst performing REITs over the past 12 months following the recalibration in valuations as markets priced in higher interest rates. Strong sales and earnings growth resulted in Goodman Group becoming one of the most expensive ASX-listed REITs which quickly unraveled during the 2022 asset deflation bear market.

During the February 2023 earnings season, Goodman Group HY23 EPS came in line with expectations and forward guidance was upgraded to 13.5% (from 11%). VanEck see this as achievable given Goodman has major market share across industrials with rental growth expected to remain elevated, local vacancy rates and new market pipeline low.

2. Office REITs

Office REITs were the worst performing subsector in Australia and globally over 12 months. The rising interest rate environment and adoption of hybrid working environment contributed to less demand for office space, a double headwind for performance.

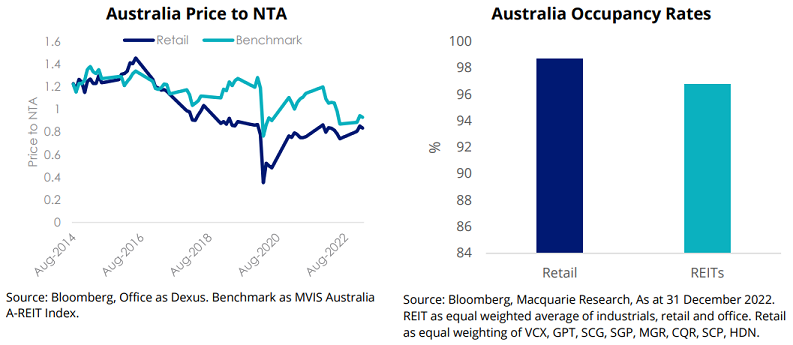

Despite office REITs trading at a discount to NTA and ratio lower than the benchmark, we favour an underweight position given the secular headwinds emerging particularly globally. The US economy is likely to contract at the end of the year with the unemployment rate expected to rise, reducing demand for office space. This environment will give businesses more buying power when negotiating office leases. Office REITs will also need to expand capex to further attract tenants, putting downward pressure on margins. Senior executives mandating employees back to the office will be muted given the economic slowdown anticipated.

Quality office REITs with sought after space in good locations and amenities will remain attractive. We expect that top-tier office towers to provide uplift in rental growth, while older office buildings will likely be less favourable.

We prefer Australian office REITs exposure relative to global. The US great resignation that played out following COVID-19 saw employees move outside of the bigger cities negating the need for office space. A return to office in the major US cities would require a multi-year transition, keeping occupancy rates low. The great resignation in Australia was smaller hence why we see occupancy rates remaining elevated relative to the US. The Australian economy is also better placed considering the anticipated influx of skilled migrants in 2023 creating further demand for office space.

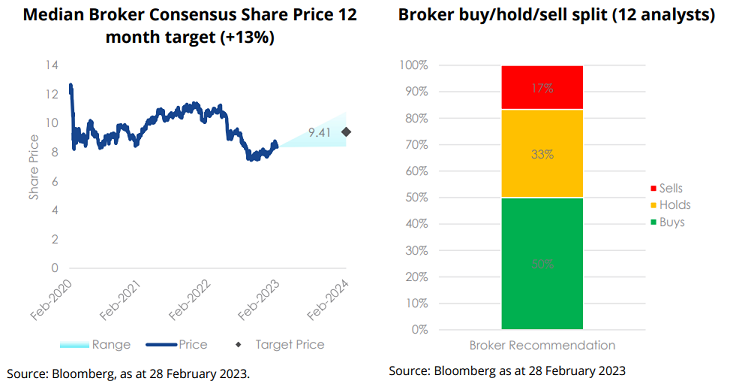

Dexus (ASX:DXS)

Office REIT Dexus was one of the worst performing stocks over the past 12 months in the A-REITs sector, following the valuation re-rating in a high interest rate environment. During the February 2023 earnings season, Dexus reported high occupancy levels above 95% and relatively prudent balance sheet with 25.6% interest rate hedging, reinforcing the resilience of the portfolio compared to the broader market.

Dexus collects approximately 70% of its income from office rent, of which 50-55% is from Sydney CBD. Given the economic uncertainties surrounding the Australian economic and implications on office REITs leads to our cautious view on the company’s outlook in 2023.

3. Retail REITs

Retail REITs led the asset class over 12 months in Australia and globally. This strong performance was primarily driven by a reversion to pre-COVID retail conditions from increased customer foot traffic, surge in retail spending and occupancy rates. Retail sales growth ahead of pre-covid trends, multi-decade low unemployment and high wage growth globally highlights broad labour market resilience and scope for customers to maintain healthy discretionary spending.

Looking forward, we are optimistic on the subsector's near term outlook but favour exposure to global REITs relative to Australia. The subsector is well-equipped to benefit through inflation-protected rents despite softer anticipated customer spending following rate hiking cycles. However, Australian consumers will see a more immediate impact from rate rates. Price to NTA is favourable, trading at similar levels to the benchmark globally and at a discount in Australia.

Scentre group (ASX:SCG)

Retail REIT Scentre Group finished middle of the pack over 12 months. February 2023 earnings results were operationally strong, reporting FFO of 20.06 cps (above guidance) and an occupancy rate of 98.9% (up from 20bps on the pcp). The group benefited from increased consumer visitations and visitation time. Looking ahead, high interest costs remain a headwind and are cautious given the likely slow-down in spending following the RBA hiking cycle. However, Scentre Group is well equipped to manage an inflationary environment with specialty leases priced at CPI + 2%, providing scope for rental growth.

VanEck sees the emerging macro-economic environment, characterised by elevated inflation and low growth as the central scenario over the medium term. This environment is beneficial for real estate assets which offer inflation-linked revenue streams including exposure to subsectors that offer inelastic demand in an environment where the global economic activity is subdued.

Cameron McCormack is a Portfolio Manager at VanEck Investments Limited, a sponsor of Firstlinks. This is general information only and does not take into account any person’s financial objectives, situation or needs. Any views expressed are opinions of the author at the time of writing and is not a recommendation to act.

For more articles and papers from VanEck, click here.