Approximately ten years ago, I became involved in the small commercial property market as an investor. My research had shown this was an investment segment that provided steady income growth and capital gains when you take a longer-term investment approach (10 years+). I have since added more commercial properties to my portfolio and the experience to date has been favourable.

This article provides some insight into the investment opportunities and risks in the smaller end of the commercial market (valued at around $2 million or less) and why it is different from residential. These small commercial properties are sometimes purpose-built for tenants who are expanding or updating, and they can have a mixture of commercial and industrial uses.

Variable returns from prime properties

Commercial property has a similarity to fixed interest investing in that valuations are based on yield expectations. The most common proxy for valuations of smaller properties is the capitalisation method (‘cap rate’), where the net income is divided by the market value or purchase cost.

Cap rates for good quality, prime properties are around 7% – 8% currently, although each building is unique and returns vary significantly. Competition for the best locations can drive yields lower. Some examples of recently reported sales include:

- Commonwealth Bank Lilydale, sold for $2.88 million at 4.5% yield

- Bank of Queensland Varsity Lakes, sold for $620,000 at 7.5% yield

- Red Rooster Toowoomba, sold for $1.88 million at 7.2% yield

- VicRoads Regional Victoria, sold for $920,000 at 5.5% yield.

It is possible to obtain funding at around 5.25% – 5.5%. This means you can buy high quality-tenanted properties that are cash flow positive day one i.e. positive gearing.

Consider the following example:

- the property is valued at $1 million

- acquisition costs are 5%

- 100% of the purchase price is borrowed at 6.5%

- rental is $80,000 pa and increases are 3% pa

- capital growth (increase in value of property) is 3% pa

- the capitalisation rate is 7.62% ($80,000/$1.05 million).

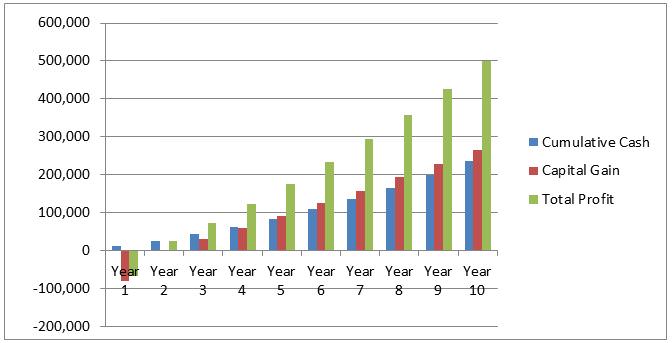

The graph shows that after 10 years the total ‘profit’, ignoring tax effects, is $500,000, made up of $235,000 surplus cash and $265,000 increase in property value. I don’t recommend 100% gearing unless you have other equity you can risk. There is, of course, nothing profound in these numbers, since the example assumes the property is positively geared and increases in value each year. But this has been my past experience and many investors who only consider the residential market are missing the potential of commercial property.

Important risks to understand

As with all investments, commercial property has risks and you need to build some contingencies into your budgeting for when this will happen. The main one in my view is ‘tenant risk’, where the property may be vacant for 6-12 months. It is common to obtain a bank guarantee for the first 3-6 months rent as part of an acquisition.

My experience is that valuers don’t tend to take into account to a significant extent the value of the tenant when determining the market value of a small commercial property. They will make reference to the tenant in their report but don’t qualify the value based on the tenant bonafides. I would rather take a marginally lower rent and wait an extra 3-4 months to get the right tenant, than take on a potential tenant who may encounter cash flow problems in the future. Again, you need to do your research. I have seen market reports on commercial properties which state that the average yield on national tenants is about 1% less than non-national tenants, but this has not been my experience.

Leases are typically in the 3-5 year range and the tenant pays for most of the maintenance costs. e.g. strata levies, rates and water. Get the right lawyer to draw up the lease and the tenant can even pay your land tax.

I prefer better quality properties with excellent tenants (e.g. national brand names and subsidiaries of public companies) on longer leases (5 years) in the 500-700 square metres range, in growing areas with excellent transport links.

To get the best interest rate when borrowing, banks don’t like the loan to valuation ratios (LVRs) to exceed 65% and will charge a higher interest rate for the higher risk. To be conservative I’d suggest a 50/50 gearing ratio as during the GFC, banks wound back their LVRs and clients that didn’t have spare cash ended up selling at fire-sale prices.

As in the share market, investors have been chasing yields in the last year, and this has increased commercial property prices, notwithstanding that real estate agent Knight Frank recently reported a high commercial property vacancy rate of 10.1%. The increased borrowing appetite of SMSFs is another competitive factor.

Furthermore, there are signs of weakening fundamentals such as loss of manufacturing jobs, small business stress, other staff reductions and falling rents which add a further need for caution. The specific supply and demand characteristics of the location are affected by the local economy, industry mix, transport patterns, planning permissions, capital expenditure and potential secondary use on sale.

It emphasises you need to do your research, which means reading, inspecting premises, speaking to agents and bankers. That way you will start to develop an understanding of the issues involved when you see the right commercial property, and you will have a better chance of making an informed decision.

Jack McCartney has worked in a variety of senior management roles in financial services and most recently ran Commonwealth Bank’s Business Bank Wealth division.