Global equities feature three key ingredients at the moment: a concentrated market, wide valuation dispersions and different cyclical and structural opportunities. Investors have gone through a tough interest rate tightening cycle but monetary policy acts with a lag, and the delayed reaction is coming through in leading indicators. But at the same time, we have the US Treasury and politicians expanding the fiscal deficit, which is one reason why inflation is staying sticky.

Market valuations and policy variations

Factors are working against each other with a lot of policy volatility and variations in nominal GDP growth. What happens to market multiples in that environment? In the 1970s, the Price/Earnings ratio averaged around 11 times in US broad equities. That wasn't just because the discount rate was higher because we had inflation. It was because of this volatility and it derated equities (that is, lowered P/Es). Today, the P/E multiple is 30 times. The takeaway is that US equities are offering a narrow margin of error based on valuations today and the inflation and rate regime that we've shifted into.

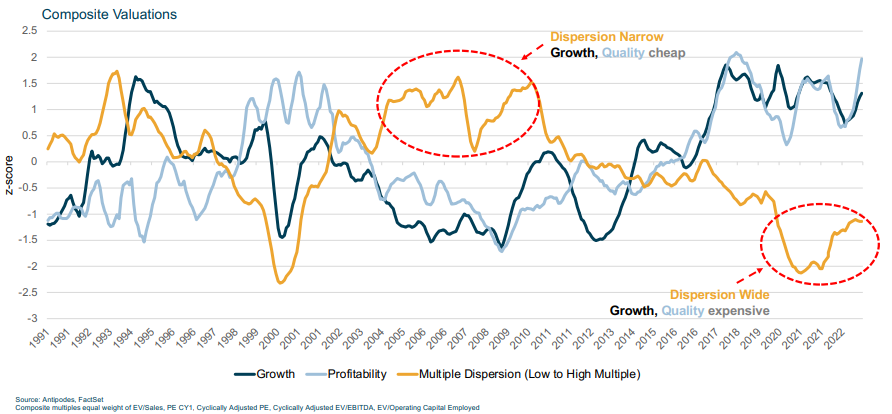

Let's talk factors. In the chart, the yellow line is what many investors think about as the value factor. We refer to it as valuation dispersion between value and growth. The yellow line is tracking the multiple paid for the lowest P/E stocks in the market by quintile versus the highest. It's been trending down for a dozen years, so there's a lot of valuation dispersion in the market today.

Owning quality or growth is more expensive than normal. While we know investors should pay a higher multiple for those characteristics, they are paying a very high multiple today. Is it durable growth and durable quality?

Multiple dispersion is wide and value stocks are cheap

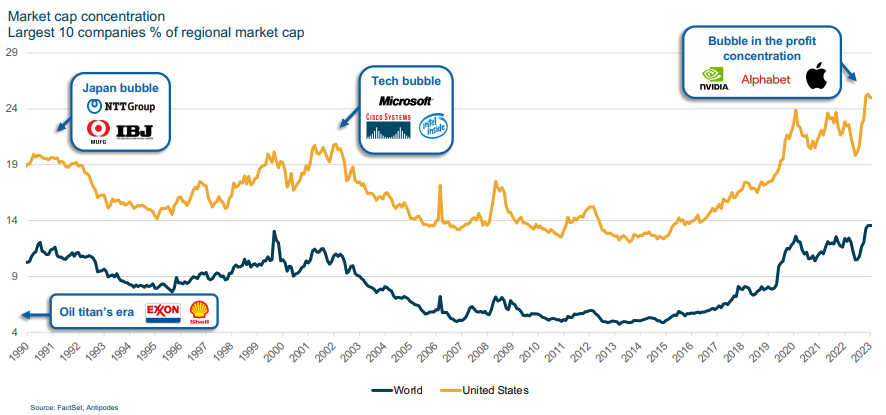

Market cap concentrations

Another observation is that market cap concentration is going through a crazy period that will not last. We’ve seen it before, from 1990 in Japanese equities, 2000 in US tech stocks and today, it's concentrated in the Magnificent Seven. The average is P/E multiple is about 36 times, with Tesla on a really high multiple and Meta and Alphabet on much lower multiples. But we're seeing a concentration of profit in the economy in a small number of companies.

Market capitalisation concentration also high

Everything else is on a lower multiple and the more we move away from the US, the lower that multiple goes. So, arguably, there are many sectors in many regions that are already pricing in a relatively hard landing.

Why have the Magnificent Seven re-rated? Will Alphabet or Meta sell more digital ads in a recession than they do today? Will Tesla sell more cars in a recession? Investors must be very certain that the high multiple is justified and we argue conditions will be tougher. Now, we also have companies in that group that are arguably more defensive, such as Microsoft. It's got a great business and AI is giving it more pricing power.

Past winners often fall behind

So is it rational to play defense in some of these companies that are maturing, that are becoming more economically sensitive? Let's do a history lesson. In 1980, the number 1 company in the world was IBM, effectively the inventor of the PC. But IBM was famously dependent on two other companies, Intel for chips and Microsoft for the operating system. It saw those two companies as suppliers.

Now let's go to 1990. The biggest company in the world was NTT, a very boring company. It's the Japanese equivalent of Telstra. Then by 2000, IBM has been disrupted by its two suppliers. Microsoft and Intel which have taken all of that profit pool in personal computing. Then coming out of the GFC, China delivered a massive stimulus and companies exposed to China became the largest companies in the world. Today, Apple has brought desktop computing power to our fingertips on a mobile device.

Investors should expect a reshuffling of winners

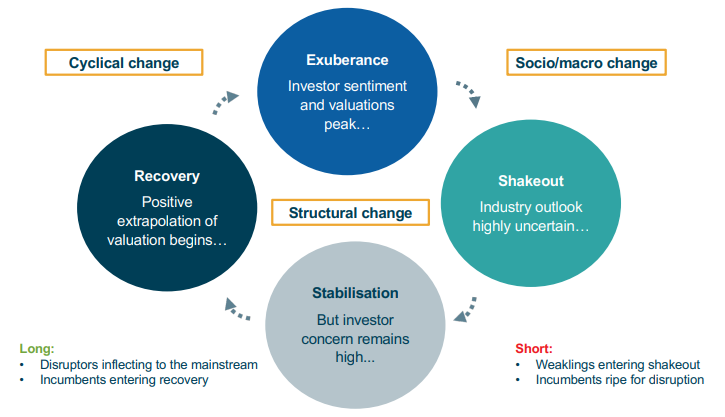

The point of this history lesson is the top 10 companies are constantly turning over because of the competitive dynamic in the market. Investors need to navigate structural and cyclical change, avoid the cyclicals that become value traps and miss the growth stocks that become growth traps as they mature, with an eye on socio and macroeconomic change.

In our portfolios there are four pillars:

- Lower-growth companies have a role at multiples where they're attractive investments.

- Companies that are transitioning into strong structural growth.

- Defensive or secular growth companies that are benefiting from structural growth but are still mispriced relative to that growth.

- In our long-short fund, single stock shorts and tail risk hedges that are mispriced.

Here are some examples.

It is hard to find anyone who has a positive case for China, but valuations are at record lows and there are opportunities in really high-quality companies. For example, Alibaba today and its equivalents like Baidu, which are Chinese versions of the Magnificent Seven, are trading at 10 to 12 times earnings. They are very strong businesses, they're hard to break, they are run for shareholders, and they are priced for an extraordinarily high level of geopolitical risk and a very bad economic outcome. There's a significant margin of safety and we think there are opportunities in these companies.

In our second example, a structural transition story is Total, an oil company, but it is an oil company that has been biasing its investments towards natural gas as a transition fuel, as well as renewables. More than half of its investment is going into those areas. There has not been the supply response to higher oil prices that we've had in the past. At a 15% free cash flow yield, there is a lot of value in Total.

And then, a third area of structural change, and AI adoption is a very long-term trend. The companies that we think are in the best position to benefit from AI adoption are those ones who can monetise it with their business customers. We think it will be hard to make money out of selling AI services to consumers, but we think there is a big productivity gain for companies like Microsoft. We don't think it is priced in for Oracle, Microsoft, SAP.

The bottom line

There is a massive amount of concentration in the market, valuation dispersion is high and value as a factor is cheap. These will lead to opportunities.

Investors should avoid paying yesterday's prices to solve for tomorrow's uncertainty. Crowding into some of the Magnificent Seven is not a defensive move, and investors should be wary of the potential for economic sensitivity in some of those names.

Jacob Mitchell is Founder and Chief Investment Officer of Antipodes Partners, managing over $10 billion and an affiliate manager of Pinnacle Investment Management. Pinnacle is a sponsor of Firstlinks. Jacob spent 14 years at Platinum Asset Management before starting Antipodes in 2015.

This article is for general information purposes only and does not consider any person’s objectives, financial situation or needs, and because of that, reliance should not be placed on this information as the basis for making an investment, financial or other decision.

For more articles and papers from Pinnacle Investment Management and affiliate managers, click here.