“Ageing is an extraordinary process where you become the person you always should have been.” David Bowie

A curious thing happened at the start of 2025. A social experiment was set in motion with barely a ripple of acknowledgement from the mainstream media.

With the arrival of the new year, the first members of ‘Generation X’ turned 60, marking the start of the MTV generation’s collective journey towards retirement, or their take on it at any rate.

As a member of Gen X, and someone with near-on three decades helping Baby Boomers plan, prepare for and move into retirement, it’s quite the mind-shift to realise that friends you grew up with are themselves starting to think about a life beyond work.

Time has a way of sneaking up on you. The years are long, but the decades are short.

The oldest of Gen X is now entering a new phase, one that could reshape Australia’s $4 trillion superannuation system as the remaining Xers follow them into the retirement zone over the next 15 years.

Staring at the prospect of a life beyond full-time work, is Gen X ready for retirement?

Gen X in numbers

While no official delineations exist, Generation X is broadly understood to include anyone born between the start of 1965 and the end of 1980.

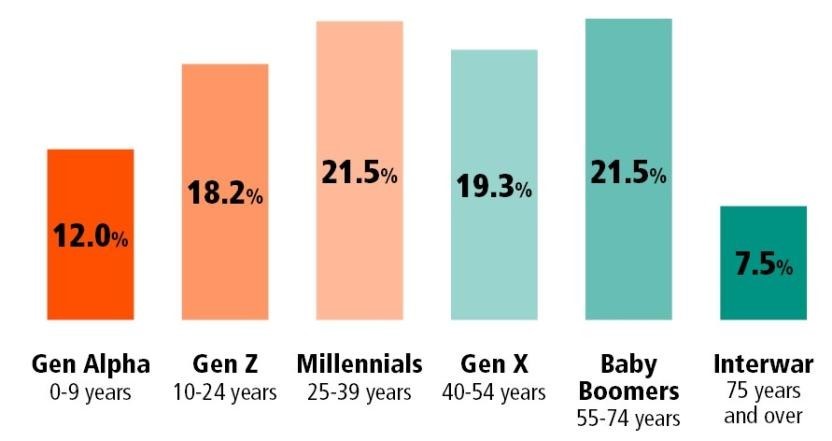

According to the Australian Bureau of Statistics (ABS), Gen X comprised just over 19% of the 25.4 million strong Australian population at the last Census, wedged between the numerically larger Baby Boomers (born between 1945 and 1964) who preceded them and the Millennials (born between 1981 and 1996) who followed.

Composition of Australian Population by Generation (Census 2021)

More recent data from the Australian Government’s Centre for Population projects the total population at some 27.7 million by mid-2025, of which Gen X will comprise roughly 5.2 million individuals.

What are the societal forces that have shaped their lives, and what are their concerns as they begin to contemplate a life beyond school drop-offs, pick-ups, surly teens morphing into young adults, and frenetic career workloads?

The influence of education

If there are two themes that define Gen X, it’s their embrace of higher education and the changing nature of housing they’ve experienced over the last 25 years.

Census data for those between 25 and 39 shows how critical higher education has been to shaping Gen X (and subsequent Millennial) life experience. At that age, only around 12% of Baby Boomers had a bachelor or higher degree, while 46% of males and 59% of females had no post-secondary qualifications.

By the 2006 Census, 22% of Gen X males had a bachelor or higher degree, as did 28% of females. Only 34% of males and 37% of females had no post-secondary qualifications.

Spin forward to the 2021 Census and 34% of male Millennials had a bachelor or higher degree, as did 47% of female Millennials. Only 23% of males and 18% of females had no post-secondary qualifications at that point.

In Gen X we see the start of a significant uplift in education and skills (what economists call 'human capital') which has had a profound influence on the Australian economy, especially in empowering women to engage more fully in the labour force.

Accelerating house prices and mortgage debt

The other major defining feature of Gen X adulthood has been the astronomical increase in house prices since 2000, when the oldest of this generation would have been breaking into homeownership.

Back then a median house was valued at $191,000 in Melbourne and $287,000 in Sydney.

By 2005 the median house price in Melbourne had risen to $320,000 while in Sydney it had rocketed to $494,000.

Median full-time earnings stood at around $50,000 per annum then, for a median-house-price-to-median-income ratio of between 6.4 and 9.8 across the two major capitals.

By 2010, when the younger end of Gen X would have been entering the market, median house prices in those two cities were $495,000 and $603,000 respectively. By 2020 they had risen further to $733,750 and $965,000.

Median full-time earnings across both genders now is somewhere around $90,000 per annum. It’s not hard to see why today’s median-house-price-to-median-income ratio sits at between 9 and 13, depending on where you live.

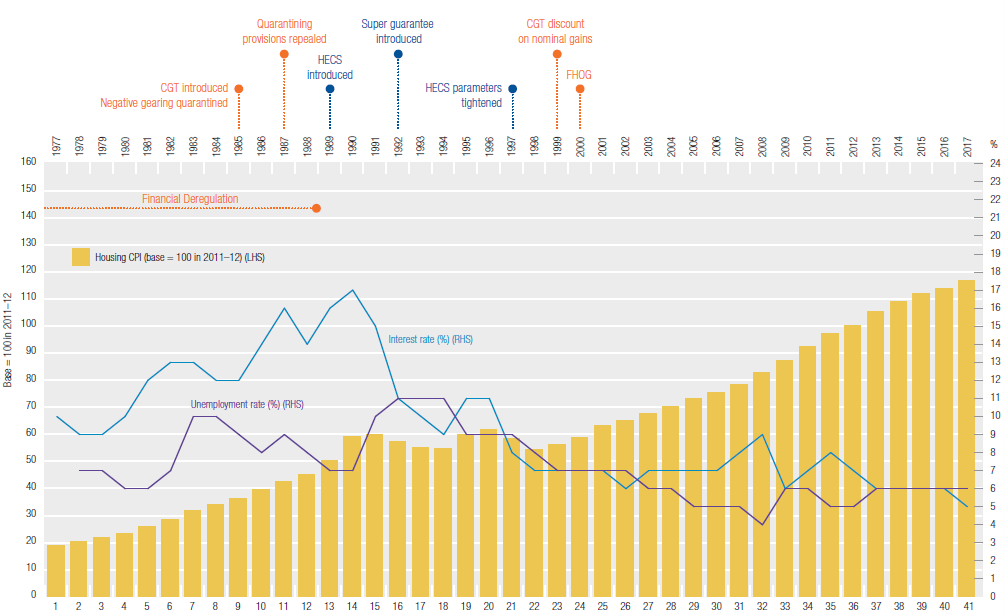

The chart below shows the housing and labour market conditions faced by a Gen X born in 1976 up to their early 40s in 2017. House prices, depicted by the yellow bars, broadly doubled in real (inflation adjusted) terms between 2000 and 2017.

Gen X Housing and Labour Market Conditions (source: CEDA)

In response, Gen X were the first to take on significantly higher levels of mortgage debt relative to their incomes, leaving them (and subsequent Millennials) far more exposed to interest rate rises, of the type that has driven the cost-of-living squeeze since early 2022.

While Baby Boomers might have faced mortgage rates north of 17% in the early 1990s, their debt levels were such that even at those astronomical rates homeowners were spending roughly 20% of their median incomes on mortgage repayments, according to the ABS.

By 2006 the much more indebted Gen X borrowers were spending closer to 30%, even as owner-occupied rates sat in the 7% - 8% range.

Mortgage indebtedness, historically most heavily borne by those between their mid-30s and early 50s, has only grown since 2017.

The average newly written owner-occupier loan then was just over $400,000. It is currently approaching $670,000, according to the latest ABS lending indicators data, with 30-plus year mortgages no longer uncommon.

All this translates into being in more mortgage debt for longer. In 1990, of homeowners aged between 45 and 54, only 36% had outstanding mortgages. By 2014 that had risen to 77%.

For the pre-retiree cohort of 55 to 64, more than one in two currently still have a home loan balance outstanding as retirement approaches.

What might retirement look like for Gen X?

Turning 60, as the oldest of Gen X are now doing, is a key marker in retirement circles, this now being the ‘preservation age’. Not that a 60-year-old Gen X might necessarily be looking to pull the plug on the world of work.

While that might have been common in the past when the preservation age was as low as 55, the average age at which people intend to retire has been steadily rising over time and is now 65.4 years.

Of the 130,000 people who retired in 2022, the average age of actual retirement for men was 66.9 and for women it was 63.2. This is unsurprising, as the age at which males and females can access the Age Pension has steadily risen from 65 for eligible males and 60 for eligible females to now be 67 for both genders.

All going to plan, the oldest of Gen X have somewhere between 5 and 7 years on average before they exit the labour force, at least in terms of full-time employment.

From that point onwards, they will face several risks in retirement, one of them being how long they’ll live. At birth, the life expectancy for an Australian male born between 1965 and 1967 was around 68 years. The respective life expectancy for females was then just over 74 years.

According to the recently updated Australian Life Tables, the median 60-year-old male is now expected to live to almost 85, while for 60-year-old females median life expectancy is now 87.

Given that half of all individuals who attain these ages will still be expected to be alive then, it is very possible that many Gen Xers (depending on actual age of final retirement) may experience 25-plus years of life after full-time work.

Are Gen X households retirement ready?

Having entered the workforce broadly from the late 1980s onwards, Gen X is the first generation to have had employer super paid on the vast majority, if not totality, of their lifetime earnings. The Super Guarantee, first introduced in 1992 at 3%, will mature to 12% in July this year, where it will remain unless the law changes.

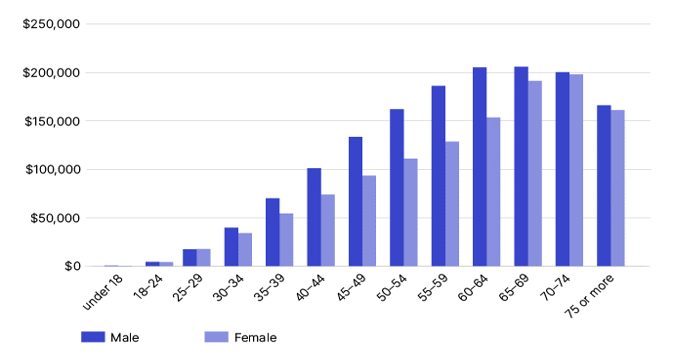

The most recent ATO data on median super balances below indicates that for males aged between 45 and 49, the median male super balance was $133,616, while for females it was $93,471.

For those between 50 and 54, the amounts were $162,146 and $111,063 respectively, while for those between 55 and 59 the amounts were $186,255 for males and $128,675 for females.

Median Super Balance by Age and Sex, 2021-22 (source: ATO)

The Gen X super balance gender disparity remains uncomfortably high at around 31%, and points to more work needing to be done on the long road to gender financial equality, to ensure that all Australians have a fair shot at creating decent retirement outcomes irrespective of their relationship status in their later years; single, heterosexual partnered or female same-sex partnered.

In terms of heterosexual couples however, it appears that the median older Gen X couple might collectively have some $350,000 in superannuation if already aged 60.

What it may end up being at the point of retirement will be dependent on factors such as remaining years of employment, individual incomes, employer super guarantee and other (voluntary) contributions along the way, as well as investment returns achieved.

Whether that final amount will be ‘sufficient’ will depend on their expectations, preferences and household balance sheet composition at the point of retirement.

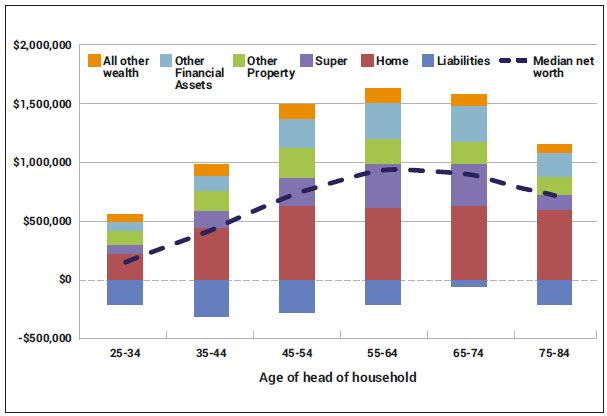

Data compiled by the Actuaries Institute shows that for home-owning Gen X, the family home dominates all other assets, and by a long way.

That is wholly consistent with the $11 trillion residential housing market at present, roughly 70% of which is held by owner-occupier households, each owning a dwelling with a current $815,000 median nation-wide valuation.

The remaining 30%, comprising residential investment property, is held by around 15% of the adult population, nearly one in every six taxpayers.

Super is the second largest household financial asset, at around $4 trillion in aggregate.

Other financial assets, including shares, managed funds and interest rate securities, round out proceedings at around $3 trillion, according to the latest ABS Finance and Wealth data.

Composition of Household Balance Sheet by Age Cohort (source: Actuaries Institute)

Against these household assets, mortgage debt is the key liability. The latest ABS data shows combined long-term household debt (mostly mortgage related) sits at some $3 trillion, split roughly 55% to owner-occupied and 45% to investment property.

And therein lies the key difference between retirement planning for Gen X and the Baby Boomers who preceded them.

Generation X will be the first generation to approach retirement with sizable mortgage debt outstanding for the median home-owning household, with the effect of periodic property upgrades, renovations, relationship breakdowns and the increasing use of equity withdrawal having all had an impact on Gen X.

With around one in four of those over 65 now renting, it is also likely that more Gen Xers will retire as renters compared to Baby Boomers, either never having attained homeownership or failing to regain it after having ceased being a homeowner through force of circumstance.

Neither state is ideal when approaching retirement.

Hard decisions may have to be made by indebted homeowners; keep servicing a mortgage in retirement or find a source of capital to extinguish it.

For private market renters the options are even more constrained, with a recent Grattan Institute report revealing that housing costs can consume almost 30% of household disposable income for those aged 65 to 74, compared with just 7% for similar-aged homeowners.

This leads to a significant disparity in retirement outcomes for homeowners versus renters, with the analysis revealing that the rate of income poverty for renter retiree couples is around 45%, compared to 11% for mortgage-free homeowning couples.

Among single female retiree renters, the income poverty rate is shockingly high at 78%.

Challenges for the Retirement Income System

Already into their early 60s, it won’t be long before the last of the Baby Boomers starts to shift into life after full-time work, aided by our maturing superannuation system.

For the most part superannuation, in conjunction with full or part Age Pension for the majority of the newly retired, has done an admirable job in helping them maintain a dignified existence into their retirement years, with one big proviso: that they enter retirement as homeowners, ideally unencumbered by a mortgage.

So ubiquitous is the narrative of unencumbered homeownership in retirement that much of today’s retirement income system is built on the presumption of it. You see it in everything from suggested retirement budgets, to default assumptions in retirement calculators, to the payment rates for the Age Pension.

Applied to Baby Boomers, that was a perfectly sensible rationale under which to operate. Applied to Gen X, not so much, with the Grattan Institute analysis showing that mortgaged retiree households have a rate of income poverty more than double that of mortgage-free retiree households.

Gen X pre-retirees, holding much larger debt levels compared to previous generations, will force a re-think of the assumptions upon which the retirement income system is built.

Changing the retirement narrative

Famed British economist John Maynard Keynes was once reputed to have asked of a colleague: “When the facts change, I change my mind. What do you do, sir?”

The facts of housing security in retirement are changing, and Gen X will ask of the superannuation system Keynes’ rhetorical question. Of that I have little doubt.

I am, however, optimistic that the majority of Gen X can attain a dignified retirement of their choosing, even if facing the aforementioned mortgage debt burden and with more retirement stressors than previous generations, including potential health and financial impacts from a changing climate.

Because the ‘X’ in Gen X stands for eXtraordinary adaptability. For a life lived at the crossroads; at the intersection of the old and the new, between the analogue 20th Century and the digital 21st Century. From the Apple IIe to the latest Apple iPhone 16 Pro, from the Commodore 64 to ChatGPT, and from the Atari ST to Agentic AI, Gen X adapts, incorporates and gets on with it.

We may have morphed from smelling like teen spirit to reading with glasses, but retirement will be just another such crossroad to negotiate.

Gen Xers wouldn’t have it any other way.

Now it’s up to the superannuation sector to step up to the challenges and opportunities their Gen X members bring to the table.

This is an abridged and lightly edited version of a piece recently published by the author on LinkedIn.

Harry Chemay consults across superannuation and wealth management, having made substantial contributions to the design of retirement income products, the application of digital advice to traditional super/wealth management frameworks, and product enhancements for direct-to-consumer offerings.