James Abela is Portfolio Manager for the Fidelity Future Leaders Fund, which has won the Morningstar Fund Manager of the Year Award for Domestic Equities Small Caps for 2018 and 2019.

GH: James, your fund invests in small cap stocks. How do you define your investment universe?

JA: It’s basically from a market cap on the ASX of about $200 million at the bottom end to $10 billion at the top end. I look at the All Ords, which is 500 stocks, minus the top 50. So that's 450 names and the fund owns around 50 of them.

GH: Many of those companies are not as well researched as the larger caps. How do you develop an understanding of the business and competitive advantage of a smaller company?

JA: I have three specific pillars: viability, sustainability and credibility. I call these the ‘three pillars of success’. If there is a high return on capital, stable or growing, and a market penetration curve the company can monetise and deliver a return on capital, that's the viability.

The sustainability or durability looks at debt, cash flows, good pricing power, closeness to customers, prominence in the marketplace … all that tells me about a strong position that can last a long time. And then the credibility comes down to management, good accounts and strong governance. They are the keys. If you have these pillars, the chance of success is high, and the company has the potential to be a future leader.

In my experience, disasters have all come from that last pillar, which is credibility. The companies that blow up usually have accounting or management questions, reputational issues or governance problems. They’re the red flags not to own those companies.

GH: A lot of CEOs are in the role because they have a big personality, and they're good at promotion and marketing, especially at smaller companies. How do you see through that?

JA: It comes down to the discipline of the viability, sustainability, credibility. Do they understand the accounting and finance disciplines, the markets they are in and the market power they have? Recognising the storytellers is where that last pillar is important. It’s one thing for a CEO to build a billion-dollar business, but to build a billion-dollar business that's sustainable is a whole new ball game. You see companies go bankrupt within three years of listing after reaching a market cap of a billion dollars at the peak, and they end up disappearing.

GH: Do you look for different skills, and perhaps even a change of personnel, in the sustainability stage versus the original building phase?

JA: Not really, no. It's more about the value system of the leadership. Personal integrity is important. Integrity in their business, governance, accounting and their markets. You look for the ways they speak and behave, the KPIs they focus on. Avoid those who are very short duration, flashy and with a heavy focus on company size. It's not a sustainable value system in terms of credibility of the business.

GH: We've seen a lot of examples of companies creating immense value within just a few years. Does the relative inexperience of the management throw up any problems for you?

JA: There's two aspects to it. One is the personal maturity of the leadership, and the other is the maturity of the business. And when I think of small caps, the journey from IPO or small cap to large cap is a 12-year journey.

GH: 12 years as a listed company?

JA: Yes. I think of a school teacher watching children. The kids start off at preschool and junior school, which is small cap, and then they go into high school kids, which is mid caps. And if they are successful in high school, they can become leaders in their industry. It's a 12-year journey. So when you see companies that have not been around more than six years, you're dealing with a junior school mentality. It's a young company in the world to be less than six years old. They can be very exciting and they can become multi-billion dollar companies in a short period of time. But the business maturity and perhaps the management maturity is not yet proven enough for them survive through to high school and get promoted into the ASX50.

I like founder businesses. Wisetech is quite different. This is a founder business that’s been going for 20 years. So that's like someone who’s already been to university with a master's degree. It's a different maturity profile that provides me with a lot of comfort, even if the company was unlisted for a long time. But a business that is just an idea and more of a concept that doesn't generate cash flows and earnings is where I'm more cautious.

GH: That's a good segue to the Toddler Index, which is something I hadn’t heard about until I read some of your material.

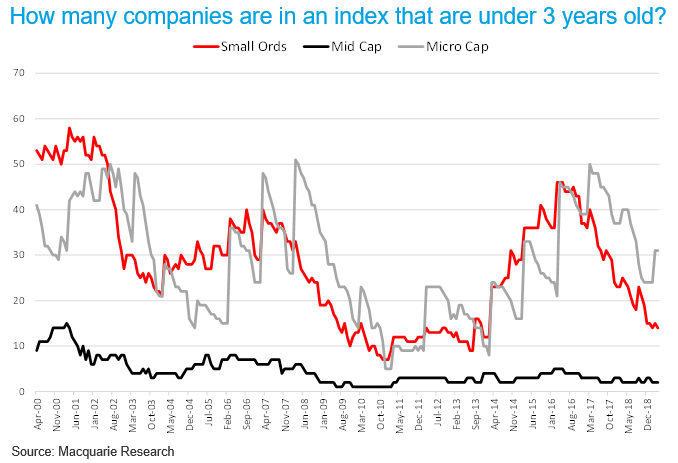

JA: Yes, it’s something I put together using data from Macquarie Research. Toddlers are companies in the index that are under three-years-old. When you have a large percentage of the index in companies which are very young, say toddlers are half the index, that's when the market is at its peak. In the year 2000, in 2007, and late 2016, either the micro cap index or the small cap index had the number of toddler companies as a percentage of the index greater than 50%.

And we all know what happened in 2001 and 2008 and then 2017. Reality bites on these companies, and the reality of competition and the return degradation strikes. Then IPO activity falls off a cliff, and the toddlers go to school and realise there are systems and behaviours that they need to abide by.

GH: So where are the percentages at the moment?

JA: They’ve gone down to 30 and less than 20. Since the end of 2016 to now, we've gone down from 50% due to a softer IPO market, but also a maturity and a seasoning of earlier IPOs. On average, 70% of them are more than three-years-old, which is actually much more normal.

(Ed. At this point, James showed me this chart on company age since listing).

GH: It’s an interesting idea. What else does it tell you?

JA: It signals times of high liquidity, an arbitrage between private markets and public markets, a high risk tolerance and optimism among investors, and generally a good economic cycle. Now that it's come down, it means that the risks of IPOs and the risks for young companies are probably closer to a floor than a peak.

GH: Many non-professional investors struggle with market timing. When the market is up with a good momentum, people want to get on board and they create a cycle of buy high sell low. And a lot of companies who may not be great quality are carried along on the tide. How do you separate that momentum of the market versus identifying a genuinely good company?

JA: Momentum is a specific thing for me. I think about it like a nightclub, and it’s about sentiment, confidence and liquidity.

GH: Like when Chuck Prince of Citigroup said in 2007, “As long as the music is playing, you’ve got to get up and dance.”

JA: Yes, the music's on and the momentum now is still strong. But for me, you need to be careful as you mature in life, you realise you need to leave the market, the party, when you're happy and you've had enough. You don't stay there until you're feeling ill or there are no taxis or there's excessive alcohol consumption. You need to leave at a sensible time.

GH: It's a good analogy.

JA: And for me, a sensible party time is the same as a sensible investment time. You take away the liquidity, remove the exuberance, and see what you have left. If you have cash flows, you have profits, you have sustainability. Momentum is very generous. You need to take away that spirit, that sentiment and courage and look at the hard reality of the business. Then when the market does fall, you’re faced with lower liquidity. And all those companies that have been feeding on the liquidity and momentum and strong sentiment but not much else will be facing bankruptcy, as we saw in 2008.

GH: So we’re in the nightclub and we're having a good time, and it feels late … what time is it now?

JA: It feels like about one o'clock right now. And by two o'clock, you definitely need to go. The bull market has been running too long, it’s been too generous with cheap money driving all these bubbles around the world. There’s a tech bubble, US markets are outperforming, junk bonds have 2% yields. It's the chase for yield which happened in 2008 which means a degradation of the price of risk.

GH: Are there particular sectors that you like or dislike now, something that you've identified that the market is not correctly pricing.

JA: A lot of things are fully priced right now and there's not a lot that's undiscovered. I'm more focused on what I think is sustainable. Selectively, I like parts of health care and technology, but some of the fintech sector is excessive in terms of valuations. There's a lot of exuberance and a lot of excitement, but valuations are in the danger zone.

Graham Hand is Managing Editor of Cuffelinks. This article is general information and does not consider the circumstances of any investor.

Fidelity International is a sponsor of Cuffelinks. For more articles and papers from Fidelity, please click here.