Andrew Bloore, Chief Executive of SuperIQ, summarises the three key changes SMSF trustees and advisers must be aware of from 1 July 2014.

1. Increases to super thresholds for 2014/15

- the general concessional contribution cap increases from $25,000 to $30,000.

- the temporary concessional contribution cap (applying to those aged 49 years or over as at 30 June 2014) is $35,000.

- the annual non-concessional cap increases from $150,000 to $180,000.

- the non-concessional cap under the bring forward rule increases from $450,000 to $540,000. However, if the bring forward provisions have already been triggered (in the 2013/14 financial year or earlier) the cap remains at $450,000 and is not indexed to the higher limit.

- the Superannuation Guarantee rate increases from 9.25% to 9.5%.

2. Changes to insurance definitions for superannuation funds from 1 July 2014

SMSFs will only be able to provide an insured benefit to a member that aligns with a condition of release, allowing the following policies to be provided:

- death

- terminal illness

- permanent incapacity

- temporary incapacity

However, polices such as trauma insurance, which do not have a condition of release, are now prohibited.

Also many policies have ancillary benefits imbedded in them that also do not strictly align with a condition of release (for example, often an Income Protection policy will pay a lump sum for a specified injury, such as a broken limb), but because this does not align with any condition of release from superannuation, the same policy inside an SMSF will not be able to provide this ancillary benefit.

3. New ATO administrative penalty powers effective 1 July 2014

These measures provide the Australian Tax Office with powers to levy penalties for breaches of superannuation law, including rectification and education directions for SMSF trustees and a financial administrative penalty regime.

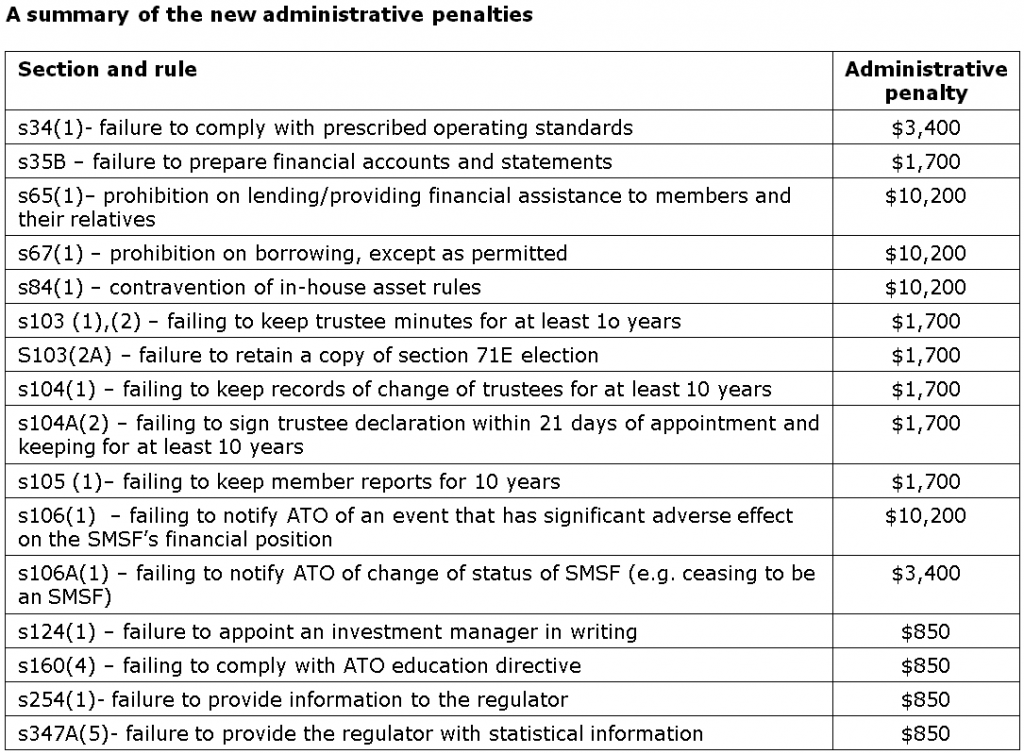

The administrative penalty will fine trustees for breaches that in previous years have escaped punishment. Where a penalty is imposed it must be paid by the trustee personally (i.e. not from the assets of the SMSF). The fines are based on penalty units, which is currently $170 per unit. Fines range from $850 for failing to comply with an ATO education directive (5 penalty units), all the way through to a $10,200 fine for a fund that, say, lends to a member or relative of a member (60 penalty units).

Monica Rule provides more detail on the ATO’s new administrative penalties.

From 1 July 2014, the ATO has new penalties to impose on SMSF trustees who contravene the superannuation law. The new penalties apply to contraventions that occur from 1 July 2014 as well as contraventions that were made prior and remain unrectified.

The old penalty regime only allowed the ATO to take the following limited, and in my opinion, quite harsh options on trustees for contravening the superannuation law:

- issue a notice of non-compliance to the SMSF (i.e. remove the tax concessions)

- disqualify the trustee

- accept an enforceable undertaking from the trustee to rectify the contravention

- take civil or criminal action on the trustee.

The old penalty powers did not allow the ATO to take appropriate action based on the severity of the contravention. The new penalty powers allow the ATO to tailor the penalty to fit the contravention, including:

- rectification directions

- education directions

- administrative penalties

With rectification directions, the ATO can direct an SMSF trustee to rectify the contravention within a certain timeframe and upon completion provide the ATO with evidence.

Education directions allow the ATO to direct an SMSF trustee to undertake specific education to improve their superannuation knowledge within a certain timeframe. Within 21 days of completing the course, the trustee must provide the ATO with evidence that they have completed the course and sign a trustee declaration form confirming their understanding of the trustee’s duties. Any costs incurred for the education cannot be paid or reimbursed from the SMSF.

Administrative penalties will be imposed for specific contraventions. The amount of the penalty will vary depending on the seriousness of the contravention and applied at the full rate. The trustees or directors of corporate trustees will be personally liable for the penalty ranging from $850 to $10,200. The penalty must come from the corporate trustee or the personal resources of the company’s directors or individual trustees. If an SMSF has individual trustees, then each individual trustee will be liable for the penalty (e.g. $10,200 penalty x 4 individual trustees, totalling $40,800). If an SMSF has a corporate trustee, then each director will be jointly liable for the one penalty (e.g. $10,200 penalty divided by 4 directors). The ATO does have power to remit the penalty and will consider remission based on a trustee’s past compliance history, whether trustees have been reckless or incompetent in the operation of their SMSF; and the likelihood of complying in the future.

The new penalties can be imposed by the ATO in addition to the other enforcement actions.

Although trustees may rely on their accountant, financial adviser, lawyer or auditor to help manage their SMSF, the ultimate responsibility and accountability lies with the trustee of the SMSF. If you are planning to take more interest in the superannuation and SMSF laws, it is much better to do it on your own terms than be directed to do so by the ATO.

Monica Rule worked for the Australian Taxation Office for 28 years and is the author of ‘The Self Managed Super Handbook – Superannuation Law for Self Managed Superannuation Funds in plain English’. Monica is currently presenting a series of SMSF seminars around Australia.