In the current low interest rate environment, the hunt for yield is a powerful force. Non-residential real estate via listed real estate investment trusts (A-REITs) and unlisted real estate funds (syndicates) have both benefitted from strong investment inflows. To date, investors have not been disappointed. According to the Property Council/IPD Unlisted Core Retail Property Fund Index* published by MSCI, unlisted syndicates generated a total return of 37.8% in the year to 31 March 2016, with an income return of 8.8%. For the same period, A-REITs generated a total return of 11.4%, with an income yield of 5.8%.

In this Part 1, we show the characteristics of unlisted real estate funds and how the Net Tangible Assets number is calculated, while in Part 2, we demonstrate how returns are affected by gearing, and the various exit strategies.

However, choosing to invest in any investment whether it be an A-REIT, a bank stock, or an unlisted real estate syndicate based on just the first year yield may lead to problems down the track when the market turns. Investing is about total returns – income and capital – over the life of the investment and a syndicate typically has a term of between five and seven years.

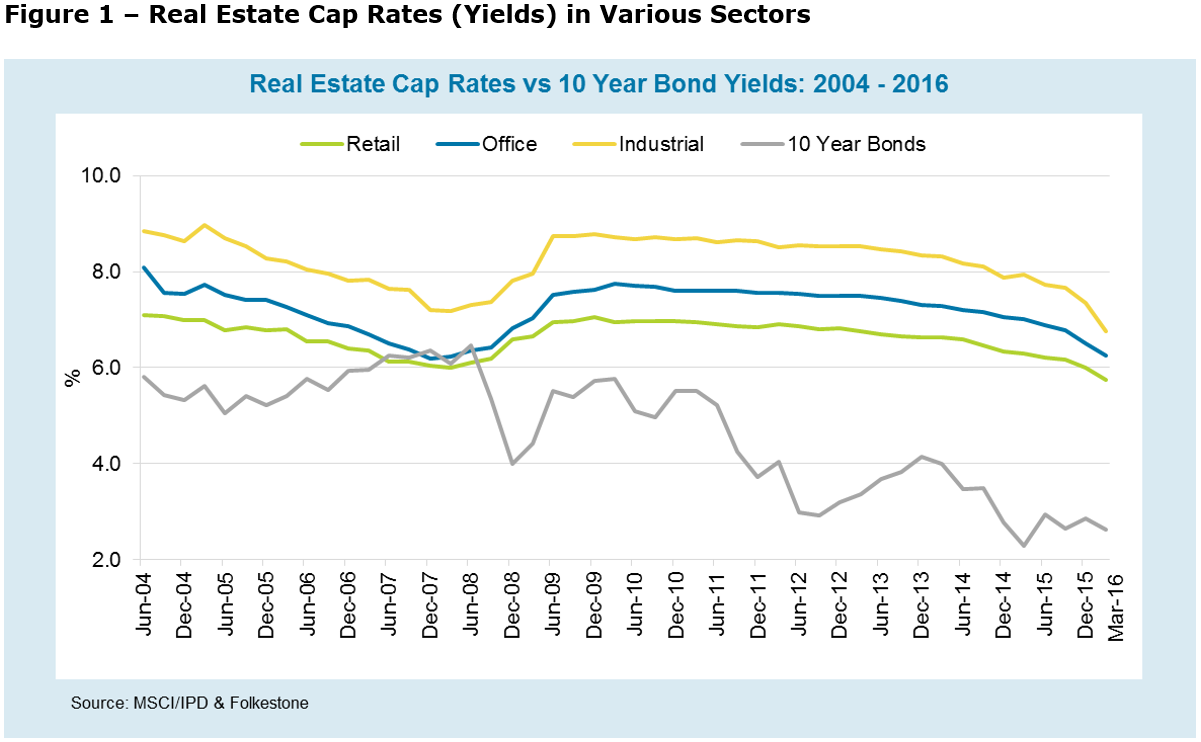

Most of the syndicates in the Index were established between 2010 and 2014 when real estate yields were higher, and hence the relative higher yield they are now generating. As prices of non-residential real estate assets have increased, yields have firmed (see Figure 1). Recent syndicate offers typically have starting yields of between 6.6% and 7.5%. When compared to the cash rate at 2.0% and 10 year bonds at 2.5%, the yields look attractive.

Folkestone does not believe the non-residential real estate sector will fall off a cliff in the next year or so with the exception of those assets in cities or towns reliant on the mining sector (e.g. Perth CBD office). As we recently pointed out in our 2016 Outlook paper,

“We are now seven years into the up-cycle, and we see less upside to many markets than we have in recent years … Easing capital market tailwinds and close to full valuations in some markets will mean that earnings growth rather than yield compression will be the key driver of value creation going forward.”

We still see opportunities to invest in unlisted real estate syndicates but it is becoming increasingly difficult to find quality assets at reasonable value. Now is not the time to stretch on price or overcommit to short-term strategies; maintaining investment discipline will be key.

Understand the asset and fund characteristics

Every real estate asset and fund are different, and investors should examine:

Asset level

- Characteristics of the asset – what is the age, quality and location of the asset?

- Tenant covenants - how good are the tenant covenants and what’s the risk of default?

- Lease expiry profile – what is the vacancy, when are the leases due to expire, are they staggered through the term of the fund or do they extend beyond the term of the fund?

- Rent structure - is the asset under- or over-rented compared to the rent level in the market, what incentives have been paid to tenants, when and how are rents reviewed during the lease term?

- Capital expenditure - will the asset require capital expenditure during the term of the syndicate and if so, how will the fund pay for it?

- Market dynamics - what is the prognosis for supply and demand in the surrounding market?

Fund level

- Longer-term yields - don’t just focus only on the first year yield published on the cover of the fund offer, remember it’s a five to seven-year investment at least.

- Distribution policy - is the fund paying distributions from its cash from operations (excluding borrowings) or capital, borrowings or other support facilities which may not always be commercially sustainable?

- Gearing - what’s the fund’s gearing level and how does that compare to the bank covenants, and how much buffer is there between the gearing level and the bank’s maximum loan to value ratio? How much, if any, of the debt is fixed versus variable? (We will show how changing the gearing can appear to enhance returns in Part 2 next week).

- Fees - what is the fee structure, are they transparent and aligned with investors?

- Manager track record - what is the performance track record of the manager?

- Poison pills - does the fund have a ‘poison pill’ which requires the manager to be paid by the fund if removed by investors for poor performance?

- Regulatory compliance – does the fund meet the six benchmarks and eight disclosure principles for unlisted property schemes described in ASIC’s Regulatory Guide 46 on Unlisted Property Schemes, and if not, why not?

- Treatment of acquisition costs – does the manager write off or capitalise costs?

- Exit strategy - what’s the manager’s likely exit strategy? More on this in Part 2.

Three points worth emphasising

1. Good real estate managers are asset enhancers

They create value by their ability to manage the asset through the cycle. They don’t rely on tricky capital management and financial engineering to deliver returns to investors. They also offer true to label simple and transparent funds with fee structures that are reasonable and aligned with investors. We advocate on-going management fees based on a percentage of net assets (not gross assets) of the fund as the manager is not incentivised to take on higher gearing. A management fee of 1.3% of net assets assuming 50% gearing is equivalent to 0.65% of gross assets. A performance fee is also appropriate so long as the benchmark rewards the manager for real outperformance not just turning up for work.

2. Understand how the manager calculates the NTA of the fund

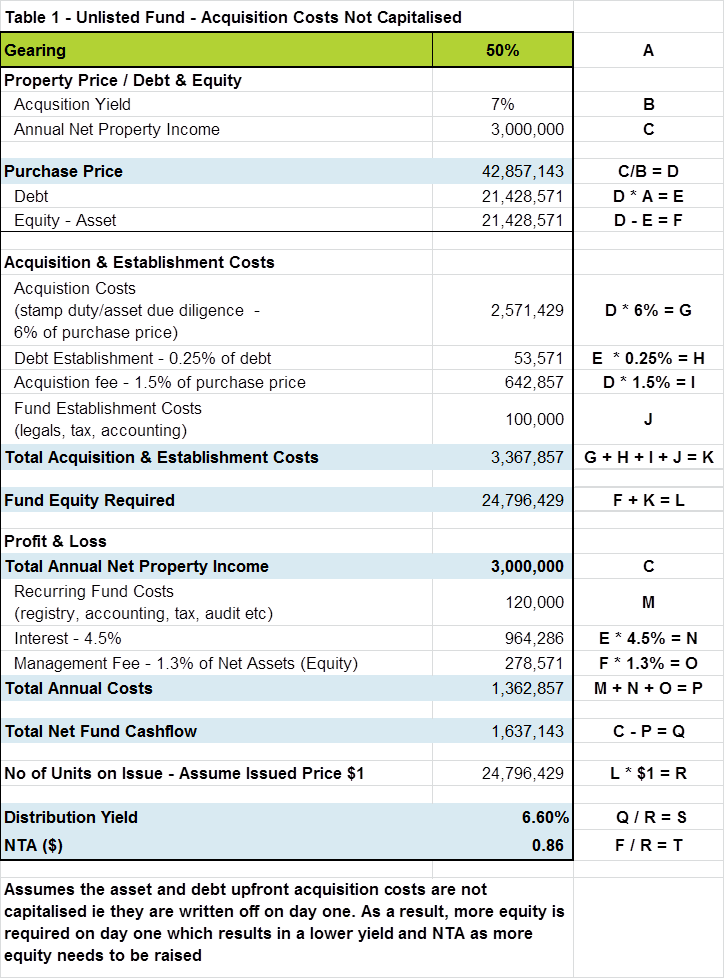

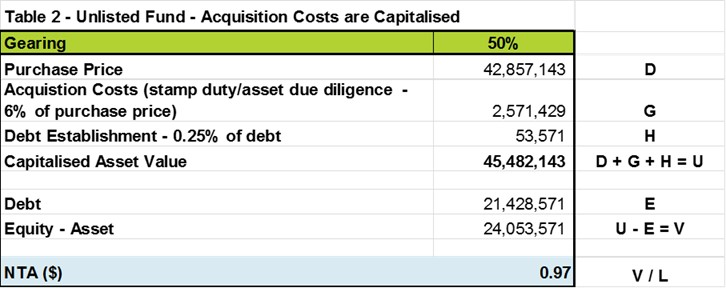

Some managers capitalise part of the acquisition costs rather than write them off on day one, which means the initial Net Tangible Assets (NTA) is higher. Table 1 shows the initial NTA when acquisition costs are not capitalised and Table 2 shows the impact when costs are capitalised. Instinctively when presented with the two options, an investor may think they are better off investing in the fund adopting option 2, where the NTA looks significantly higher. We (and most of the leading managers) advocate taking the conservative path and writing these costs off on day one which unfortunately results in a lower initial NTA. Managers capitalising costs run the risk that if the value of the asset has not risen by at least the amount of the capitalised costs at the next financial review date, then they will have to be written off at that time, impacting the NTA.

3. Chasing short-term yield may not deliver the best outcome

Thirdly, unlisted real estate funds or syndicates offer a legitimate investment option for investors where liquidity is not a high priority. But like any investment, investors need to understand the risk and return. The first-year headline yield should not be a priority. Real estate is a long-term investment and chasing short-term yield may not deliver the best long-term investment outcomes.

*Note: The Index tracks the performance of 28 funds with a gross asset value of $3.3bn. These funds own either office, retail, or industrial assets and must have greater than 90 per cent direct property exposure, less than 50% per cent gearing, must not capitalise interest and be an ASIC registered managed investment scheme.

In Part 2 next week, we examine gearing and how an unlisted real estate syndicate generates returns, and the different types of exit strategies.

Adrian Harrington is Head of Funds Management at Folkestone (ASX:FLK). This article is general information and does not address the specific investment needs of any individual.