Australia’s superannuation system ranks among the world’s best but running out of money is still a major concern for most Australians in or approaching retirement.

There is good reason to be concerned. Most super funds still lag in offering suitable retirement products to ensure this is not the reality.

What can you do about your concerns?

If your superannuation is with a large institution, the reality is that your fund might not yet offer a modern retirement income product so your balance is likely to move into an Account Based Pension (ABP) when you retire.

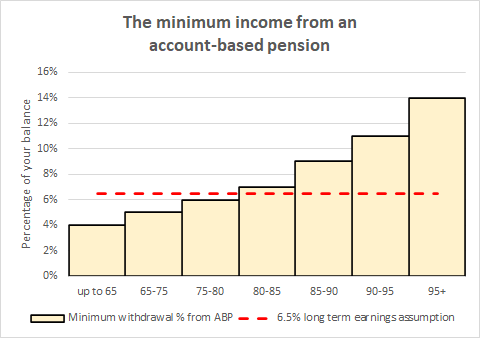

ABPs require you to withdraw a minimum percentage of your balance each year as your ‘income’ in retirement. The following percentages apply to your ABP balance at the start of each year and are the minimum you must withdraw (although these levels have been temporarily reduced by 50% in FY20, FY21 and FY22 in response to the pandemic).

|

Account Based Minimum Annual Pension Payments:

|

|

Age in years at start financial year?

|

% account balance to be paid as a minimum

|

|

Under 65

|

4

|

|

65-74

|

5

|

|

75-79

|

6

|

|

80-84

|

7

|

|

85-89

|

9

|

|

90-94

|

11

|

|

95+

|

14

|

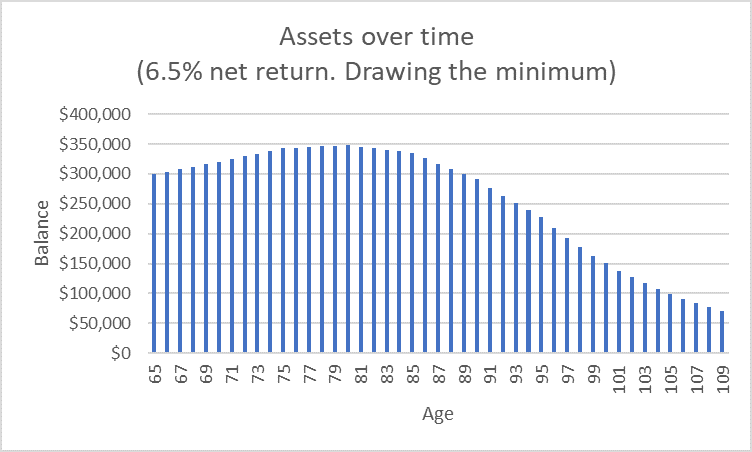

For this purpose, let us assume that a member can earn 6.5% p.a. each year in retirement and inflation is a fixed 3% p.a. Notice how the minimum percentages are initially less than the assumed investment return and from age 80 are greater than the assumed investment return.

When the investment return is higher than the minimum withdrawal, your account balance (assets) increases in dollar terms. Later, when the investment return is less than the minimum withdrawal, your account will correspondingly decline in dollar terms.

Remembering we have assumed the same investment return every year (6.5%), when in reality we know it will change regularly and the real-life experience could show greater variability than assumed here for ease of understanding.

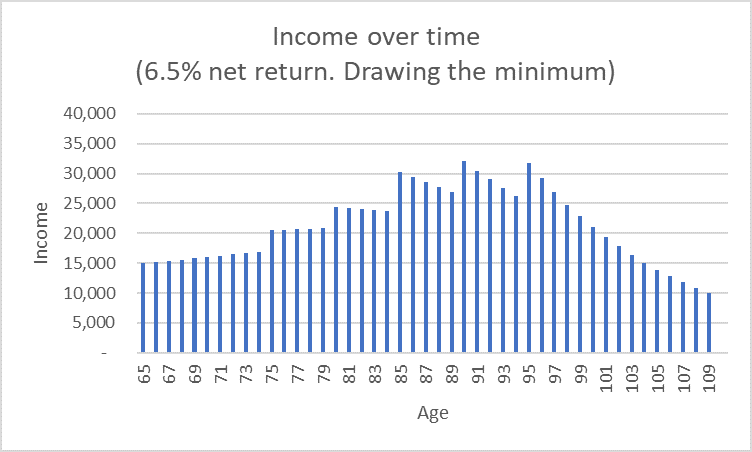

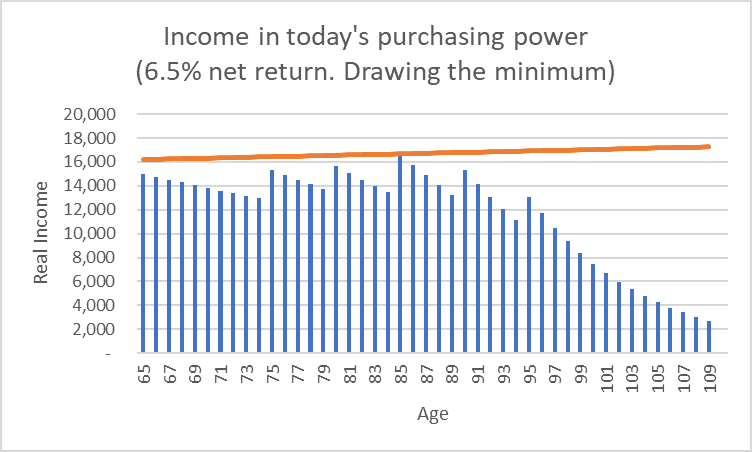

So how is this reflected in your actual annual pension income each year of retirement? An income projected to the end of the Australian Life Tables would look like this:

But will that be enough income when you need it most?

Planning cash flow in retirement is extremely difficult because of so many uncertainties around – expenses, health, investment returns and of course - how long we are going to live.

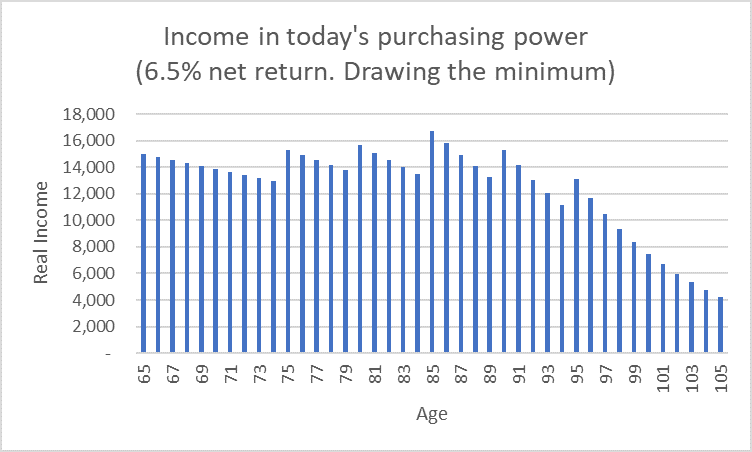

To maintain your standard of living, you will need your income to increase in dollar terms, and maintain its value in real terms i.e., in purchasing power. To view the income from the above ABP in real terms (today’s purchasing power) we remove the effects of future inflation and ignore any income from other sources such as the age pension.

So, let’s take a closer look.

The ABP income in real terms maintains its value (broadly) until just after average life expectancy. So, the maximum offset provided by an ABP against having to claim an age pension occurs before life expectation.

Many existing ABP pensioners have not yet reached this age as ABPs (and their predecessor, the allocation pension) have not been available for long enough to see many pensioners experiencing this decline in income in real terms (unless their actual rate of investment return is less than the assumed rate of investment return).

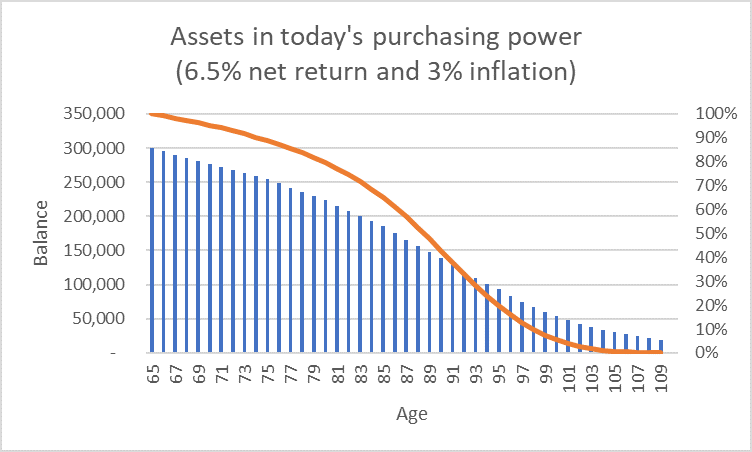

We can also look at an ABPs projected balance in real terms as shown in the chart below. Only if the investment return earned is greater than the minimum percentage plus the rate of inflation, would the account balance increase in real terms. Between ages 65 and 75 this requires an investment return of at least 8%.

The orange line on this graph shows the percentages of 65-year-old males who are projected to still be alive at each future age.

Females and couples have a higher percentage projected to still be alive at each future age as their life expectancies are longer, and as a result they will spend more time where income and assets are declining in real terms and need to plan accordingly!

Since the mid-1980s the mortality rate for a 65-year-old male has fallen by more than 50% and this trend is expected to continue. This means, the orange line is expected to shift to the right and you will live longer than you think and spend more time when your real income might decline.

How can I make my money last the distance?

The good news is that more modern retirement income products are starting to be offered by superannuation funds to provide an increasing (in dollar terms) pension that lasts for the life of a single person or a couple, and ought to provide income that on average does not decline in real terms.

An example of the income that an investment-linked lifetime annuity might provide is indicated by the orange line in the chart below and provides a direct contrast to the previous declining income projection.

This is assumed to be supported by the same investment choice as the ABP, but with a deduction of 0.5% p.a. from the net return to allow for the costs of providing longevity insurance.

There is an urgent need to deal with the high levels of worry about retirement income for all Australians. For greater peace of mind, security, and a better retirement outcome from one of the world’s best retirement systems, in one of the world’s best countries to retire in, longevity needs to be addressed.

David Orford is the Founder and Managing Director of Optimum Pensions. Optimum Pensions was launched in late 2017 with the objective of providing innovative sustainable retirement income solutions. This article is general information and does not consider the circumstances of any investor.

This is the first of five articles which will examine alternative solutions to reduce the potential to run out of money for retirees.