In the last two weeks, the 'active versus passive' investment management arguments rose to prominence again with heavyweights Warren Buffett, Jack Bogle (Vanguard Founder), Raphael Arndt (CIO of the Future Fund) and Manny Roman (PIMCO CEO) weighing in. It's far from a settled debate despite index investing winning the money flows. Morningstar estimates that in the US in 2016, US$340 billion poured out of active funds while index funds rose $505 billion.

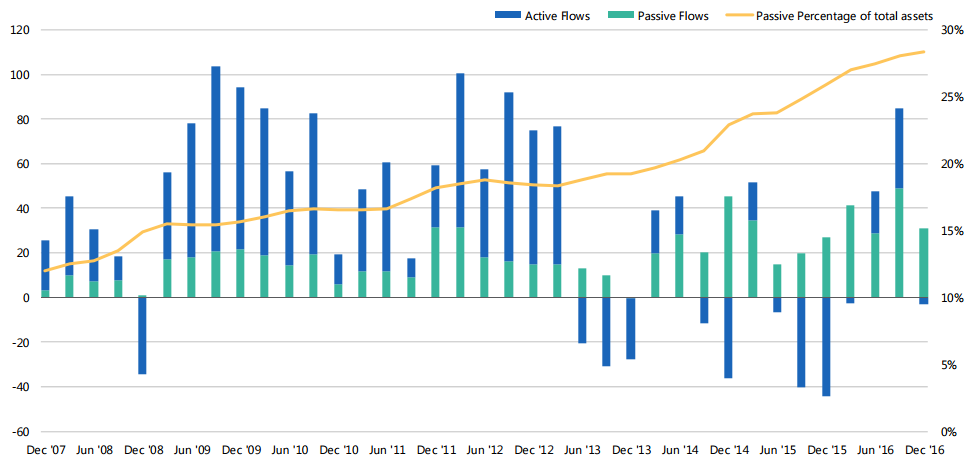

Even in bond funds, where active managers have a much stronger track record of outperforming their indices than equity funds (more on this later), low fees are attracting the flows despite the performance. Passive’s share of bond fund assets has risen from about 12% to around 28% over the last decade. In fact, despite rising rates, passive funds have not had a single quarter of net outflows, while most active funds are losing balances, as shown below.

Active v passive quarterly flows into taxable US bond funds, 2007 to 2016

Source: Morningstar Direct, as at 31 December 2016, data for US flows.

Let’s check what these big four names said on indexing recently.

Warren Buffett, Chairman, Berkshire Hathaway

At the Berkshire Hathaway AGM last weekend, Warren Buffett again advocated index investing for most people, arguing it has saved them 'hundreds of billions' in fees. He even called out Jack Bogle for a standing ovation. His annual letter to shareholders is linked here, although sections of it are starting to sound repetitive. It’s somewhat ironic that Buffett himself supports indexing for the masses while outperforming with a 19% pa return since 1965 versus the S&P500 (including dividends) at 9.7%. Obviously, he’s a special case.

On indexing from his newsletter:

“Over the years, I’ve often been asked for investment advice, and in the process of answering I’ve learned a good deal about human behaviour. My regular recommendation has been a low-cost S&P 500 index fund. To their credit, my friends who possess only modest means have usually followed my suggestion.

I believe, however, that none of the mega-rich individuals, institutions or pension funds has followed that same advice when I’ve given it to them. Instead, these investors politely thank me for my thoughts and depart to listen to the siren song of a high-fee manager …

That professional, however, faces a problem. Can you imagine an investment consultant telling clients, year after year, to keep adding to an index fund replicating the S&P 500? That would be career suicide. Large fees flow to these hyper-helpers, however, if they recommend small managerial shifts every year or so. That advice is often delivered in esoteric gibberish that explains why fashionable investment “styles” or current economic trends make the shift appropriate...

In many aspects of life, indeed, wealth does command top-grade products or services. For that reason, the financial “elites” – wealthy individuals, pension funds, college endowments and the like – have great trouble meekly signing up for a financial product or service that is available as well to people investing only a few thousand dollars ...

The likely result from this parade of promises is predicted in an adage: “When a person with money meets a person with experience, the one with experience ends up with the money and the one with money leaves with experience.”

Jack Bogle, Founder, Vanguard

Jack Bogle, credited with starting the index fund movement with the launch of what became the Vanguard 500 Index Fund in 1975, released an essay called The Road Less Travelled on how the index fund industry developed, linked here. It’s the first time he has recorded the history of his idea and his 66 years in the industry. Vanguard’s numbers are extraordinary - $4 trillion in assets, 23% market share of assets, $304 billion in 2016 cash flows (171% of industry cash flows).

Here are some extracts:

“For surely fate would have eventually awakened the investment world to this fundamental truth: before intermediation costs are deducted, the returns earned by equity investors as a group precisely equal the returns of the stock market itself. After those costs, therefore, investors earn lower-than-market returns. Fact: The only way to maximize the share of the financial market returns earned by the 100 million families whom the fund industry serves is by minimizing the costs borne by fund shareholders ...

Recent data from Standard & Poor’s reaffirms the tough job facing active managers. For the first time, S&P SPIVA (“Index Versus Active”) produced comparative data for the past 15 years on a broad matrix of funds. On average, the indexes outperformed an astonishing 90% of all actively-managed mutual funds. Over the 15-year period, the passive indexes outperformed the average actively-managed funds by 1.5% annually, a cumulative enhancement of almost 25% for capital accumulation, simply by the use of passive market indexes.

In 1980, equity fund assets were $44 billion. By 2016 these assets had soared to more than $8 trillion. Expense ratios of actively-managed funds had declined to 84 basis points, still 53% above the 1960 level. With the growth of lower-cost bond funds, the industry-wide asset-weighted expense ratio for long-term funds is now at 68 basis points, almost 25% above the 1960 level. With total fund assets averaging $17 trillion in 2016, fund advisory fees and operating expenses come to a total of $110 billion per year — 5,600 times the 1951 level of $20 million in an industry whose assets grew by 5,400 fold. Economies of scale for fund investors — zero.”

Dr Raphael Arndt, Chief Investment Officer, Future Fund

Dr Raphael Arndt recently explained how the Future Fund’s thinking about active investment has evolved over the last decade, in a paper linked here.

“Listed equity managers in general aren’t particularly good at making macro calls. Likewise, when we analyse positions in our portfolio, we are increasingly discovering managers are knowingly, or unknowingly, taking significant factor positions …

Today, relative to a decade ago, we have technology available that means we can better analyse positions in our portfolio – to better understand underlying factor exposures, macro calls, style tilts or offsetting positions.

In short, the advances in technology enabling better understanding of underlying exposures, combined with lower forward looking returns means the world has fundamentally changed, requiring a new approach to active equities investing ...

I have talked a lot about the benefits of passive and low cost strategies and how they are playing an increasing part in our Listed Equities program.

However we continue to believe there is a role for active management and that it will continue to play an important part in our Listed Equities strategy. We call this our Global Alpha program.

Through this program we are seeking out managers who can add value through genuine stock picking skill that is uncorrelated to market returns, or beta.

We have reshaped our Alpha program – with the intention that we have a small number of managers delivering attractive risk-adjusted returns.

We are looking for true stock picking skill executed in a way where we are not paying for beta or for style or factor bets.

We also don’t want active positions across different managers that offset each other at our portfolio level.

We envisage that pure stock-picking skill has the best opportunity to thrive when given the broadest canvas possible.

In our view, this is most likely to be found in relatively small capacity managers looking at global stocks with long-short market neutral mandates. In this type of strategy we are paying for pure stock picking alpha and the results are highly transparent.

Importantly we won’t pay active management fees for the delivery of market beta or factor exposures, which we can purchase for a few basis points.

We are in an environment where sophisticated investors are no longer willing to pay active management fees for beta returns, or even for sensible positions from the managers’ point of view but which cancel other positions at the portfolio level. Nor will investors pay for stock picking skill but receive only style factors or managers taking macro bets.

What does all of this mean for a long only active equities manager?

It means fund managers need to consider their value proposition.

They need to take a good, hard look at themselves and their client’s needs and understand how they are creating value and how much of that they are seeking to retain though fees.

In short – they have to confront the new reality.”

Emmanuel Roman, CEO, PIMCO

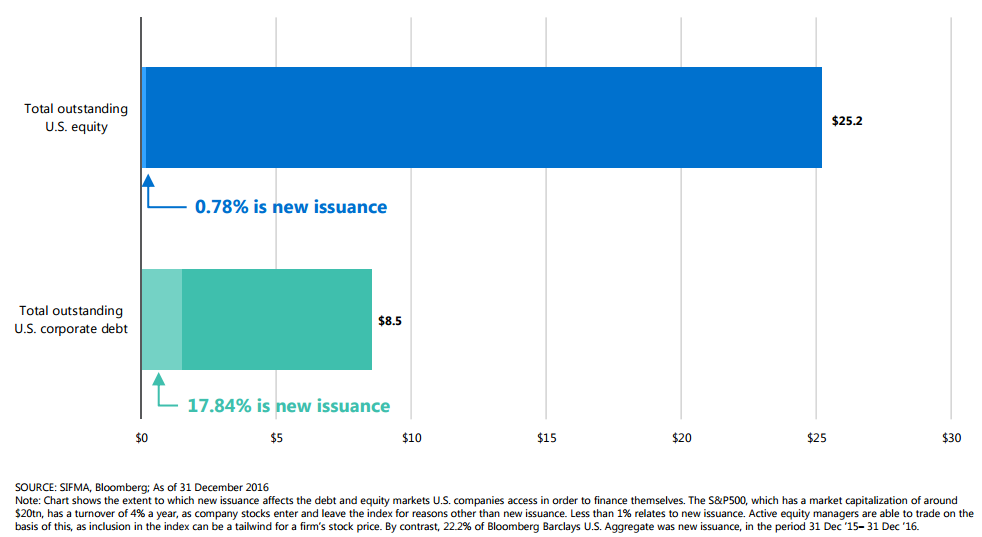

At a Research Affiliates Conference I attended in Los Angeles last week, PIMCO Chief Executive, Manny Roman, explained why active bond managers have special advantages over indexers. He titled his paper, Bonds are Different. Among his evidence was this convincing chart.

New issuance in US corporate bond market versus US stock market ($ trillions in 2016)

Roman argued that due to bond maturities and rollovers and early calls with reissuance, annual new issues are a large 18% of the total outstanding debt in the US corporate bond market. To convince large bond fund managers to participate in new transactions, issuers usually leave some margin on the table for the buyer. In addition, new issues often require a cornerstone investor who is given a special rate to ensure the issue’s success, or a borrower wants to raise money quickly and is willing to pay above market rates. He cited an example of a recent Deutsche Bank issue picked up by PIMCO at a margin of 350bp when the market level was about 150bp. This mirrors the experience in Australia when, for example, Unisuper agreed to buy $300 million of CBA PERLS 8 to give the borrower confidence to go to the public market.

In contrast, the graph shows annual new issuance represents less than 1% of outstanding US shares. While equity managers can achieve some improvement in prices by participating in a placement or attractive rights issue, it is a fraction of their investment activity.

Roman argues other factors such as bond investors with ‘non-economic’ incentives, including pension funds matching long-term liabilities rather than maximising returns, and issuers with bonds in different countries at varying margins due to local regulations, give large global managers a competitive advantage. He claims active bond management should deliver at least 1.5% over index after fees.

BetaShares Australian ETF Report April 2017

Finally, as a sign of the rising popularity in Australia, BetaShares’ latest ETF Report, attached here, shows balances reached a record $28.3 billion at the end of April 2017, with new money flows of about $400 million for the month.

My conclusion on active versus passive

Investors can choose the best of both worlds. Identify a group of talented managers who are genuinely smart and do not follow indexes. Complement them with direct holdings and index funds (either unlisted or ETFs) to reduce costs and gain the appropriate asset allocation for your portfolio. Avoid concentrated cap-weighted funds such as those based on the S&P/ASX200, since 40% of the exposure is to banks and miners, especially where they significantly replicate your direct portfolio.

Graham Hand is Managing Editor of Cuffelinks.