Two fixed income specialists have opposite views on NAB National Income Securities (ASX:NABHA). Differences of opinion make a market as each side determines whether NAB is likely to call the bond. The debate is heightened by the recent decision by Macquarie Bank to call Macquarie Income Securities (ASX:MBLHB).

MBLHB call at par bodes well for NABHA

Justin McCarthy, BGC Securities

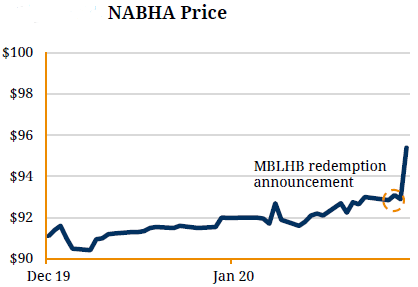

After the market close on 30 January 2020, Macquarie Bank announced that it will call/redeem the legacy Tier 1 Macquarie Income Securities (MBLHB) for $100 (par) plus accrued interest on 15 April 2020.

The MBLHBs traded at $93.00 prior to the announcement but promptly moved to ~$100.00 the next day, where they have remained.

The MBLHBs join a long list of legacy securities that have been called in recent years as the capital treatment towards regulatory ratios falls in line with the Basel III transitional rules. All legacy/non-Basel III compliant Tier 1 and Tier 2 securities will become completely ineligible for regulatory capital from 1 January 2022.

Macquarie Bank noted in its call announcement that only $94 million or 23.5% of the MBLHBs were counting towards Additional Tier 1 (AT1) ratios at present which would have been a strong reason in favour of the early call.

The MBLHBs were issued in 1999, as were the similar NABHAs, which were both classified as ‘Income Securities’.

The call at par of the MBLHB follows last year’s call by ASB Bank (a subsidiary of CBA) of two NZD legacy Income Securities which were trading at ~NZD82.50 and ~NZD85.00 prior to the announcement.

Our opinion and base case is that NAB will likely call (or possibly roll over into a new capital security) the NABHAs in early 2021. Whilst MBLHB is only counting 23.5% towards Macquarie Bank’s AT1 ratios, NABHA is considerably higher at ~62% in 2020, suggesting they still have a meaningful contribution to NAB’s AT1 ratios. From 1 January 2021, the contribution falls to just ~31% and then 0% from 1 January 2022.

The call announcement of the MBLHB strengthens our already high confidence that the NABHAs will be called before 2022. Following the Macquarie Bank announcement, the NABHAs jumped $2.55 or ~2.7% to a high of $95.45 (at the time of editing on Tuesday, they are $95.35).

The following table details the yield to February 2021 call and November 2021 for various purchase prices (dirty price).

|

Purchase Price

|

Yield to Feb-2021 Call

|

Yield to Nov-2021 Call

|

|

$93.50

|

9.13%

|

6.06%

|

|

$94.50

|

8.06%

|

5.44%

|

|

$95.50

|

7.00%

|

4.83%

|

|

$96.50

|

5.96%

|

4.22%

|

|

$97.50

|

4.92%

|

3.62%

|

|

$98.50

|

3.90%

|

3.03%

|

Given our base case is for a call in early 2021, we believe the NABHAs still exhibit good value. A call in 2020 (and hence higher returns than in the table above) can’t be ruled out either with hybrid refinance conditions currently favourable and new issue margins near post GFC lows.

NAB has also been proactively buying back their legacy Tier 2 USD ‘Discos’ issued in the US market despite the very cheap credit margin of just 15bps (0.15%).

This recent announcement from Macquarie Bank also continues to support our strategy of investing in well-priced hybrids and securities from best-of-breed companies but down the capital structure. Many of our best-performing recommendations have been from the maligned hybrid sector, including SVWPA, MXUPA and MBLHB which have now all been called at par despite trading in the $70s just a few years ago.

NABHA perhaps not on road to redemption

Simon Fletcher and Charlie Callan, BondAdviser Hybrid Research

NABHA was issued in 1999 and was originally due to be called on the 29 June 2004 but, at its discretion, NAB decided to leave it outstanding. Unlike the NAB Convertible Preference Shares or the more recent Capital Notes, this security has no conversion features or triggers embedded in the documentation and therefore we are much more comfortable with the security from a structural perspective. However, as was evident during the GFC, the capital value of this security is still subject to significant volatility during a period of stress.

As a perpetual security (meaning it has no defined call date or maturity date), it is difficult to put a true valuation on it. Due to the effect of changes in what now qualifies as regulatory capital, we do expect it will be redeemed or exchanged within a reasonable time horizon (before or during 2022). The reason we have identified this timeframe is that although the contribution to regulatory capital value is still high (2019/2020), it will rapidly decrease and will reach zero at the start of 2022.

We have revised our recommendation on NABHA to Sell, as the Notes rallied strongly in response to Macquarie Bank announcing that MBLHB will be repaid.

Following the introduction of the Basel III regulatory scheme, APRA bundled several NAB securities issued under Basel II together, permitting NAB to use $6.05 billion of its Basel II capital as Tier I under Basel III. Under the scheme, the Bank is required to reduce the Basel III contribution by 10% per year, with the allowance reaching 0% in 2022.

However, with a number of the securities in the initial pool having since been redeemed or refinanced, the share of NABHA that counts as AT1 capital has not progressively reduced. Rather, in 2019 ~90% counted toward AT1, up from ~80% in 2018, a result of the redemption of securities in the initial pool of Basel II Notes. This will reduce to ~60% in 2020, ~30% in 2021 and finally to 0% in 2022.

From a NAB Treasury perspective, NABHA appears to be cheap relative to any refinancing alternatives, and as such we estimate that NAB will have incentive to leave the Notes to run for longer than current market-consensus.

Furthermore, with the Bank facing significant refinancing hurdles in the near-term, opting to redeem an additional $2 billion through repaying NABHA would be relatively surprising in 2020. Given the above, as NAB leaves the Notes running, and assuming market consensus consequentially becomes more aligned to ours, we would expect the Notes to sell off in the shorter-term but we are reasonably confident that NAB will eventually redeem the securities.

If the security is called, the capital upside to investors is significant and the biggest driver of the Bank executing this call option is a lower marginal cost of funding. We continue to believe the cost will remain low enough over the coming years to warrant replacement but following strong price returns and margin compression since 2017 (which we captured with variable Buy recommendations), we believe the wider market is under-estimating the chance NAB may choose not to redeem NABHAs in the next few years.

We note NAB has two large, new-style hybrids to refinance in 2020 - $1.3 billion (NABPC) in March and $1.7 billion (NABPB) in December. In July 2022, NAB also has $1.5 billion to refinance (NABPD). It most recently raised $1.9 billion (March 2019) for NABPF.

We would likely revise our recommendation at a capital price lower than $90.

Investors should be aware the margin for this security has been volatile in the past, primarily due to the movement in the broader listed bank capital market (i.e. Tier 1 hybrids) rather than anything specifically related to this security or the Issuer.

Source: Bloomberg, BondAdviser

This article is general information and does not consider the circumstances of any investor.