For many years, we have produced an analytical, market-wide view of the Australian reporting season’s results. This framework has allowed us to logically judge the pulse of the market and assess the themes that would be ‘hard to see’ when looking at each company result in isolation.

While our framework has always looked deep into the revenue, earnings and dividend environment (which has highlighted the difficulties for company gross profit margins and earnings growth), this season we have also introduced an ‘Income Scorecard’ to look more closely at income outcomes for the stocks in the S&P/ASX 200.

Introducing the Income Scorecard

We have looked at reporting season winners and losers from a pure income perspective, rather than stock price performance, as this reflects how we think about portfolio construction for our retirement income-focused portfolios.

Retirees require a reliable income stream. By investing in stocks where stable franked dividends are a larger component of total return, we seek to provide more certainty in income generated by our income portfolios, no matter what the capital gains or losses may be for a stock.

August 2023 income results

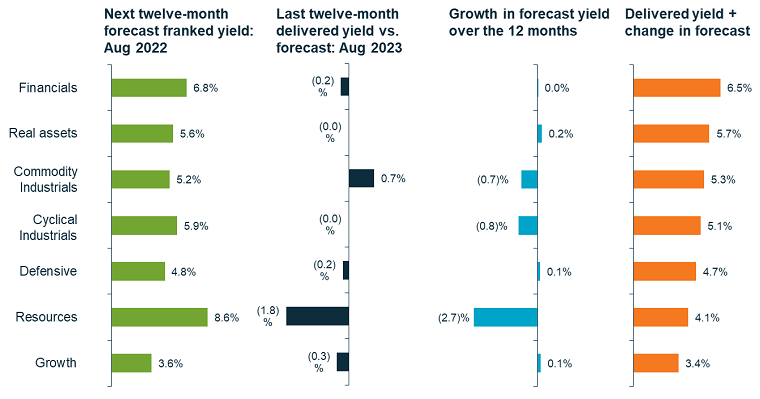

We have tracked how companies have delivered on the market’s forecast dividend expectations over the last 12 months, and how their dividend growth expectations have changed to review if they are providing any inflation protection. We then ranked them on the sum of their delivered yield and forecast yield growth and aggregated the results by super sector average.

Note that we have stripped out the impact of stock price movement on forecast yield changes over the last 12 months by assuming a static stock price based on the start of the period. We have also limited the income universe to stocks with at least a 3% franked yield, and our proprietary assessment of sufficient quality and liquidity for an income investor. This leaves us with around 115 stocks out of the S&P/ASX 200.

Financials

Financials came out on top, broadly delivering on the 6.8% franked yield expectation set in August 2022, with no reductions in forecast yield. Within the sector, Bendigo and Adelaide Bank was a standout as stable player with delivered yield and growth expectations benefiting from higher rates and Net Interest Margins (NIMs).

We would note that given much-publicised concerns over the capacity of borrowers to navigate the transition from low fixed-rate mortgages, bank sector earnings growth risks are skewed to the downside. Saying this, our proprietary estimates of the resilience of dividends for the big four banks does remain attractive. We are comfortable with retaining bank exposures for their income generating ability, however our focus on downside income risk means that this is at a significant underweight relative to a yield-weighted view of the index.

Real assets

In Real Assets, we also saw strong delivery against August 2022 expectations. We saw the strongest income winners in the electricity generators Origin Energy and AGL Energy, with higher dividend growth expected from higher electricity prices.

Within REITs, being discriminatory was important, and Scentre Group was a standout, delivering CPI+ rental increases. This varies with many other REITs who have fixed rate increases despite rising costs. Debt tenure was also important as those with shorter debt books are now paying higher interest costs. Higher interest rates (and cap rates) are leading to pressure on leverage and an inability or unwillingness to invest in development growth. It is evident that many companies have not hedged their interest rate positions adequately.

While Aurizon was a poor performer due to the impact of weather conditions on dividends versus expectations, its regulated rail network earnings and group dividends are well-placed to benefit from this year’s regulatory reset and inflation-linked contract prices.

Commodity industrials

Within Commodity Industrials companies, petrol retailers such as Ampol and Viva Energy Group helped the sector to deliver higher dividends than expected 12 months ago through improved margins in refining, but growth is expected to be muted going forward.

Cyclical industrials

Within the more Cyclical Industrials, discretionary retailers such as Super Retail Group and JB Hi-Fi stood out due to super profits translating into strong dividends and strong balance sheet positions. The next 12 months will be harder, but as dividends have been conservative, there is still a good buffer.

For cyclical companies, the boom period for gross profit margins really is over. Selling prices are no longer rising to offset falling volumes as consumers (in particular younger people and families) hold back as interest rates continue to normalise. At the same time, the cost of doing business is rising, and rising faster into FY24 than FY23. Companies are starting to suffer from wage rises, accelerating rent rises, and other things like higher insurance, electricity costs and tech spend.

Defensives

Income for the Defensives as a whole did not do as well as expected in a downturn, as revenue has not grown with inflation. However, stocks such as Lottery Corporation delivered both a good dividend and growth expectations in a tough environment as they raised prices and continue to move ticket sales online away from newsagents. Telstra also had good inflation protection in its revenues through its mobile plan price rises.

Resources

Resources companies, while seen as strong dividend payers on an absolute basis 12 months ago, have failed to deliver versus expectations.

They have suffered, stemming from the weak outlook for China property policy and the impact of lower forward commodity price expectations and higher costs for capex programs for mine replacement and net zero initiatives feeding into weaker earnings expectations. Forward dividend growth has been severely reduced, with fundamentals for iron ore looking the worst among the commodities. From an income perspective, BHP is in our view better placed to deliver than others in the sector.

Growth

The Growth bucket is small for income stocks given poor dividend yields, but within the qualifying names, Carsales.com did better than most.

What this all means

At the aggregate market-weighted level, we are expecting to see another year of poor dividend growth, dominated by the ongoing decline in expected profit margins for the Resources names. In our view, pockets of potential growth reside in the Real Assets, Industrials, and the Insurers (but not the Banks) within Financials.

Positioning our income portfolios

For some time, our portfolios have been positioned for a possible earnings or GDP recession. We have focused on companies that can support fundamentally higher franked dividends in the higher rate environment and not be exposed to valuation risk. Our retiree-focused Martin Currie Equity Income strategy is designed to limit the portfolio to no more than 6% in any one stock and 22% in any one economic sector. This leads to a structural underweight towards large caps.

Our highly diversified portfolio includes high-quality names such as Medibank Private, ANZ Banking Group, Telstra Group, Suncorp Group, and Aurizon Holdings.

*As of 30 September 2023, on a forward-looking basis, the strategy is expected to provide a franked dividend yield of 6.7% over the next 12 months, which compares to the 5.4% expected franked dividend yield for the S&P/ASX 200.

Reece Birtles is Chief Investment Officer at Martin Currie Australia, a Franklin Templeton specialist investment manager. Reece is also the lead portfolio manager for MCA’s Value Equity, Equity Income and Diversified Income & Growth strategies. Franklin Templeton is a sponsor of Firstlinks. This article is general information and does not consider the circumstances of any individual. The information provided should not be considered a recommendation to purchase or sell any particular security. It should not be assumed that any of the security transactions discussed here were, or will prove to be, profitable.

For more articles and papers from Franklin Templeton and specialist investment managers, please click here.