Increasing life expectancies are welcome, but they present challenges for retirees. Many people have told me, “I want to be able to spend all my money, so on the day I die I have got just one dollar in the bank,” but it’s a fact of life that date of death is not something that can normally be predicted with precision. One study has found there is little correlation between a person’s and their parents’ dates of death - to make it worse, the behaviour of retirement assets can be volatile and subject to sudden changes.

To this interesting mix, add Australia’s somewhat unusual post-retirement system. In many other countries retirees are used to an income for life. All the investment decisions are taken from them, but they are generally happier and feel far more financially secure. In Australia most of us retire with a lump sum and have to decide how to invest it. For us, the challenge is how to best use that lump sum.

This highlights one of the major problems facing retirees, and Australia. It is now accepted by all the major political parties that the majority of retirees live far too cautiously, and in doing so both deprive themselves of a better standard of living and deprive the country of much-needed economic activity. So, the problem has been identified — the big challenge is how to solve it.

Until recently there were two major forms of retirement income streams available to retirees. Account-based pensions offer retirees flexibility, control, and transparency. They are widely available and are suitable for most retirees. However, they have one problem - there is no efficient way to draw down your balance without fear of running out. As a result, the majority of retirees draw only the minimum, resulting in many people passing away with 90% of their super left unspent according to the government’s Retirement Income Review.

The traditional alternative is a lifetime annuity, which provides a guaranteed income for life but without the flexibility, control, and transparency.

Obviously, annuities get full marks for certainty, but lose marks for lack of flexibility.

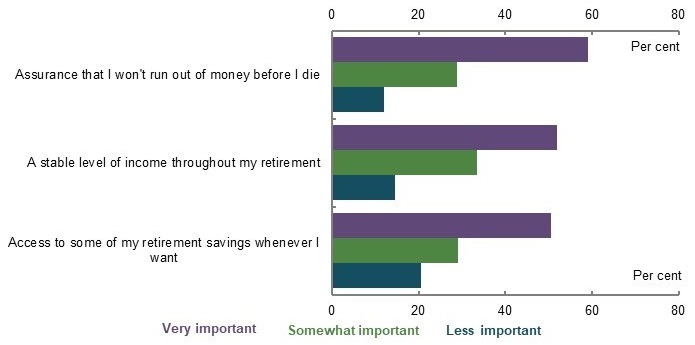

Importance of retirement income product features

Extracted from the Retirement Income Review Final Report, November 2020.

Note: More than 1,000 survey respondents aged 55 and over. Source: Mercer, 2019.

As part of the May 2018 Budget, the Morrison government announced its intention to introduce a retirement income covenant requiring trustees to develop a strategy that would help members achieve their retirement income objectives, which came into law on July 1 this year. The government wants the financial services industry to develop new retirement income stream products (a form of annuity) that manage the competing objectives of high income, longevity risk and flexibility. Longevity risk is possibly the greatest risk post-retirement — living so long you run out of money and ending your days living in a caravan in someone’s backyard, eating scraps.

Product innovation

The industry is starting to fill the gap with a range of enhanced account-based pensions and lifetime income streams or pensions. The account-based pension provides the flexibility — the lifetime income stream provides the certainty.

But could you combine an account-based pension with an annuity? AMP have asked this question and the result is MyNorth Lifetime, a new suite on AMP’s investment wrap platform North.

MyNorth Lifetime is the latest in a series of new retirement solutions. I’ve previously written about the QSuper Lifetime Pension which provides income for life based on the returns of a balanced portfolio, and which attracts a generous 40% discount on the assets test, leading to higher age pension eligibility for many retirees.

MyNorth Lifetime is much closer to an account-based pension than other lifetime income products, because it allows unrestricted investment choice, account transparency and income flexibility. The biggest differences to an account-based pension revolve around an annual cash bonus that is paid into the account.

This bonus is calculated by applying an age-based rate to your account balance. It operates as a form of reverse life insurance. Instead of paying premiums every year, you receive a payout every year, that increases substantially over time just like life insurance premiums. The only premium you pay is what’s left over in the account when you die (after the payment of an optional death benefit) – which is the opposite of a life insurance payout.

Effectively you are prepaying yourself – giving you the confidence to draw down at a higher rate knowing you’ll never run out of money. The income rates are quite a lot higher than the normal minimum drawdown rates.

For example, the income rate for a 70-year-old single is 8.18%, and the bonus rate is 0.56%. If this customer had $300,000 in their account, they’d be entitled to draw $24,551 in income and a bonus of $1,677 would be paid into their account at the end of the year. The following year the rates rise to 8.34% and 0.62%. These percentage rates rise every year, but your account balance is being drawn down, resulting in relatively stable amounts of income if you can earn around 6% net investment returns.

The upfront 40% assets test discount for lifetime income streams applies to this account. If the customer above had another $300,000 in an account-based pension and other assets, they’d be entitled to an age pension of $11,119 compared to only $1,734 without the new account. Like other lifetime income streams, I’d never recommend retirees allocate all of their super into these solutions – it’s important to keep readily accessible cash type investments as well.

The other unique thing about MyNorth Lifetime is that it can be opened pre-retirement where it can significantly increase the assets test discount. This is because Centrelink ignores the account balance and instead calculates the means test on your contributions, increased annually by the upper deeming rate (currently 2.25%). This means that as long as your super is earning more than the deeming rate, you are increasing the assets test discount, which could provide an even bigger age-pension payoff when you retire.

Case study

Jack is a pre-retiree. At age 50 he transfers $250,000 to the MyNorth super account. If the fund returns 6% per annum his balance should be almost $600,000 at age 65. However, for Centrelink purposes, his deemed balance would be close to $350,000 (the original balance increased annually by 2.25%), and therefore the assessment of his fund under the assets test would be only $210,000 after applying the 40% discount. This can make a very significant difference to the amount of age pension he would receive when he turns 67.

If this all seems a bit complicated, it’s because it is, so AMP are only making this available via financial advisers. It also has a unique feature in as much as the MyNorth product can be layered across the client’s existing portfolio, where it could be continued to be managed by the advisor without any changes to the underlying assets if that was deemed appropriate. I think AMP have broken ground with this one – it’s really up to anybody who feels it may be useful to them to discuss it in depth with their advisor.

Noel Whittaker is the author of 'Retirement Made Simple' and numerous other books on personal finance. See www.noelwhittaker.com.au or email [email protected]. This article is general information and does not consider the circumstances of any individual.