Australia has a proud history at the Summer Olympics. We have won at least one medal in every Summer games all the way back to 1896.

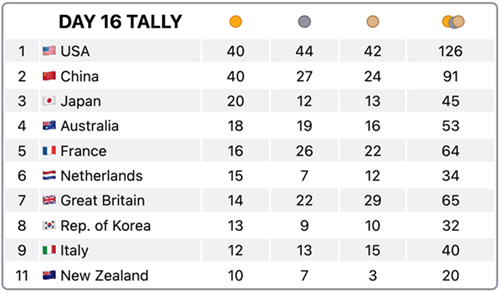

We have secured top-ten finishes on the medals table every Olympics since 1992. The fact there are more than 50 countries with larger populations makes these results ever more impressive.

The 2024 Olympics were no different.

Most gold medals

There are different ways to measure Olympic success, however the International Olympic Committee (IOC) medal tally ranks countries by the number of gold medals won.

By this measure, Paris 2024 was Australia’s most successful Olympics.

Our 18 golds breaks the previous record of 17 set in Athens (2004) and Tokyo (2021).

So how did this happen?

The golden haul was led by our swimmers, particularly the women.

Swimming is Australia’s most successful Olympic sport. We have a strong swimming culture and very demanding national qualifying times.

Importantly, there are a lot of swimming events at the Olympics – in Paris there were 35 golds available in the pool. In comparison, sports such as hockey and handball only had two gold medals on offer.

Australia won 18 swimming medals including seven gold.

Traditionally, when the swimming events finish, Australia starts to slide down the medal tally as other countries with strengths in other sports surge.

This slide did not happen as fast in Paris. Day 12, with four golds and two bronze (none from swimming) was our most successful day in Olympic history.

We also won gold medals in events for the first time. One of those went to Arisa Trew, 14, who became our youngest gold medallist and first gold medallist in women’s park skateboarding.

Other first-time golds included the women’s time trial (Grace Brown), men’s 50-metre freestyle (Cameron McEvoy), women’s BMX (Saya Sakakibara), women’s pole vault (Nina Kennedy), women’s canoe slalom (Jess Fox) and women’s kayak cross (Noemie Fox).

One-third of Australia’s gold medals came in less traditional Olympic sports such as canoe slalom, skateboarding and BMX.

In fact, if the Fox sisters, Jess and Noemie, were a country, their combined three gold medals would have ranked them 29th, ahead of countries such as Denmark and Austria.

Comparing to previous results

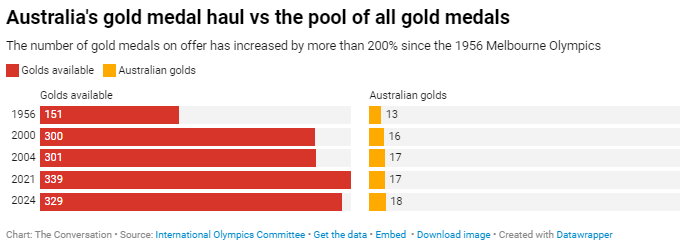

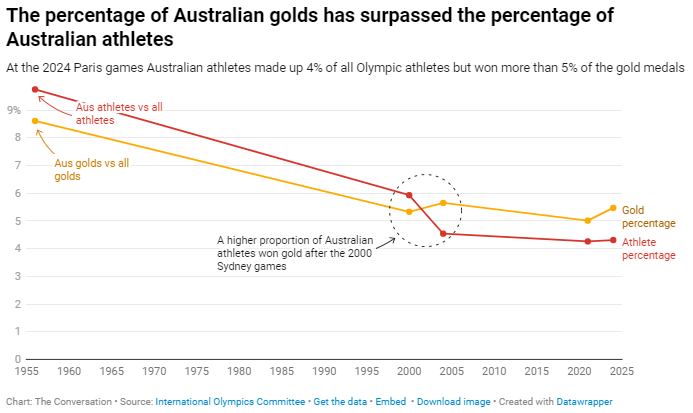

Comparing medal tallies historically is difficult, as many things have changed.

New sports have been added in recent Olympics, resulting in more medals being available. But the world population has nearly tripled since 1956, which means more competition for medals.

In 1956, Australia won 8.61% (13 out of 151) of the gold medals available and were ranked third on the medal tally.

This is our highest percentage of golds and our highest rank.

So, was this actually our best Olympic performance?

Maybe, but it is important to acknowledge we had a lot less competition.

Australia’s remoteness and international conflicts resulted in many countries not attending the games. China did not compete. Neither did most of Africa.

Only 72 countries competed and nearly 10% (323 out of 3314) of competing athletes were Australian.

In 2000, Australia won its most medals (58, including 16 gold), but were likely advantaged by a vocal home crowd and featuring our biggest team ever (632 athletes).

Athens 2004 probably ranks slightly ahead of Tokyo 2021 as our team won their 17 golds from 301 events, whereas there were 339 events in Tokyo.

But there were slightly more total competitors in Tokyo.

In Paris, 10,714 athletes from 206 countries competed; 462 (4.31%) were Australian.

The 2024 team may have been advantaged by the non-attendance of most Russian athletes. However, Russia’s most successful Olympic sports are wrestling, gymnastics and athletics, not swimming, skateboarding and canoe slalom.

Also, Australia only won four gold medals last time Russia did not attend the games, in 1984. So we don’t know what difference it would have made to our medal tally.

One thing we can all agree on is that Australia has had a very successful Olympics.

What was the secret to Australia’s success in Paris?

A search of the Olympics subreddit provides some plausible (“strong sporting culture”) as well as humorous (“all the slow Aussies got eaten by wildlife”) answers to this question.

But what other reasons are there?

Funding boosts

The Australian Sports Commission directly invested a record $398.3 million in high performance funding for Paris.

This money funded projects such as developing a replica Paris BMX Freestyle track and launching a new canoe slalom kayaking program.

This preparation helped contribute to Olympic success for Australia.

Direct athlete support

Since the Tokyo games, $47 million in direct athlete support grants have been awarded.

The AOC also invested in Indigenous Athletes Support Grants and financial incentives for medal winners.

Mining magnate Gina Rinehart also personally supported our swimming, rowing, volleyball and synchronised swimming teams.

This support allows athletes to train more and work less.

Female role models and inspiration

Some of Australia’s finest recent Olympic performances have been from women. This has included Cathy Freeman’s iconic 400m win and the more recent performances of swimmer Ariarne Titmus.

More media exposure, equal representation, federal funding and presence for female sports has made it easier to inspire and support new generations of elite female athletes.

These developments may have contributed to the success of our female athletes, who won 13 of Australia’s gold medals in Paris.

Science and innovation

Australia has always been at the forefront of sports science.

For example, Australia was the first country in the world to use underwater cameras to extract data from the pool.

They are planning to increase their use of AI in the lead-up to the 2028 Olympics.

Australia also used environmental measurement units in the Olympic village to help athletes avoid the negative effects of hot summer temperatures and humidity during the games.

Australian athletes continue to benefit from state-of-the-art facilities at the Australian Institute of Sport.

The (AIS) European Training Centre in Italy tripled its accommodation in the lead-up to Paris.

It now provides a “home away from home” and competitive advantage for more Australian athletes training or competing in Europe.

Enhanced wellbeing focuses

All major Australian sporting bodies have been committed to the “Win Well 2032 Pledge”.

The pledge focuses on ensuring national sporting organisations are committed to supporting mental, emotional, cultural and physical wellbeing to foster the best chance for athletes to succeed.

Historical precedent

Australian athletes have consistently performed better in the Olympics than other developed countries with bigger populations, like Canada and Spain.

Australians have always had a strong interest in sports, with many of us believing sport contributes to our national identity.

In 1962, Sports Illustrated identified Australia as the best sporting nation in the world per population level.

These foundations set a precedent for modern and future generations, creating an expectation to maintain Australia’s global sporting status.

Vaughan Cruickshank, Senior Lecturer in Health and Physical Education, University of Tasmania;

Brendon Hyndman, Associate Professor of Health & Physical Education (Adj.), Charles Sturt University, and

Tom Hartley, Lecturer in Health and Physical Education, University of Tasmania

This article is republished from The Conversation under a Creative Commons license. Read the original article.