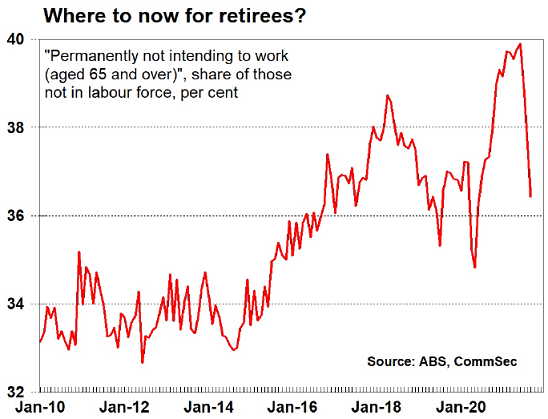

Before Covid-19, a major reason that Aussies weren’t employed or looking for jobs was because they had retired. That is, they were out of the job market. In fact, in April 2018, 38.7% of people said that they were “Permanently not intending to work (aged 65 and over)”, up from 33% just four years prior (September 2014). Then there was a reassessment. The proportion of those not in the workforce because they were retired fell from 38.7% to a 3-year low of 35.3% in July 2019.

Record numbers, but are they accurate?

And in the period since, due to Covid, it is not possible to determine firmly whether the trend has changed because more people exited the job market over the lockdown period. They weren’t employed as such – they didn’t work for one hour or more in the past week - but neither were they looking for work because they were likely to return to their employer after the lockdown.

The lockdowns have effectively scrambled the data. The proportion of those not in the workforce because they were retired hit a record 39.9% of the total in June 2021 and this has since fallen to a low of 36.4% per cent in September 2021.

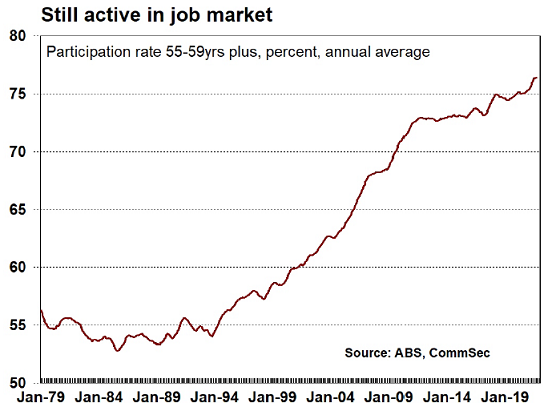

So let's check two other data points at different ages.

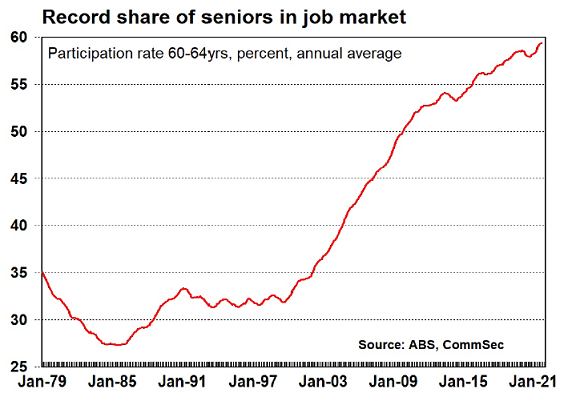

First, a record proportion of people aged 60 to 64 years are in work.

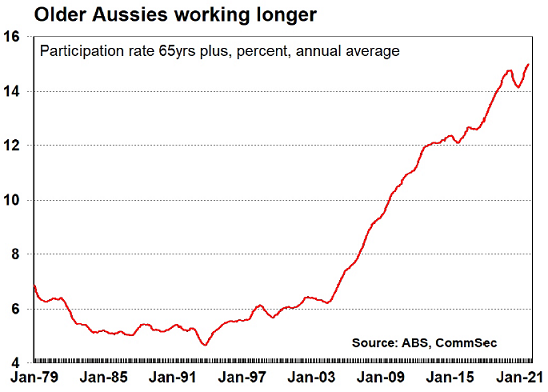

Second, the 65 years plus age group participation rate shows more Aussies are working longer.

Impact on overall job market

Working out why people are not in the job market will be important in coming months. If more people are electing to retire then there are fewer potential workers to fill positions. That may mean the job market tightens more than generally expected, putting upward pressure on wages and prices. And that is especially the case if foreign borders stay closed.

In other words, The Great Retirement could lead to a tighter job market. Older Aussies may see greater health risks in being in the job market in the Covid era. And still others may elect to live large given the experience of the past 18 months.

At this stage data still shows that older Aussies are active in the job market with record participation levels. However peak levels may not be far away.

In other countries, notably the US, there are similar concerns about the future state of job markets with more businesses saying they can’t find the workers to fill positions.

The great reopening has led to supply-chain breakdowns and higher prices for goods. The great reopening may lead to similar worker-job breakdowns, with labour shortages driving up wages. With thousands of Aussies reaching retirement age every week, their decisions about work could have broader, long-term inflationary implications.

Craig James is Chief Economist at Commonwealth Securities Limited (CommSec). This article provides general market-related commentary only and has been prepared without taking into account your objectives, financial situation or needs.