With 730 responses, some surprising trends have emerged. The most informative feedback comes from the comments, which can be accessed in the full report, linked here. An analysis of results is presented below.

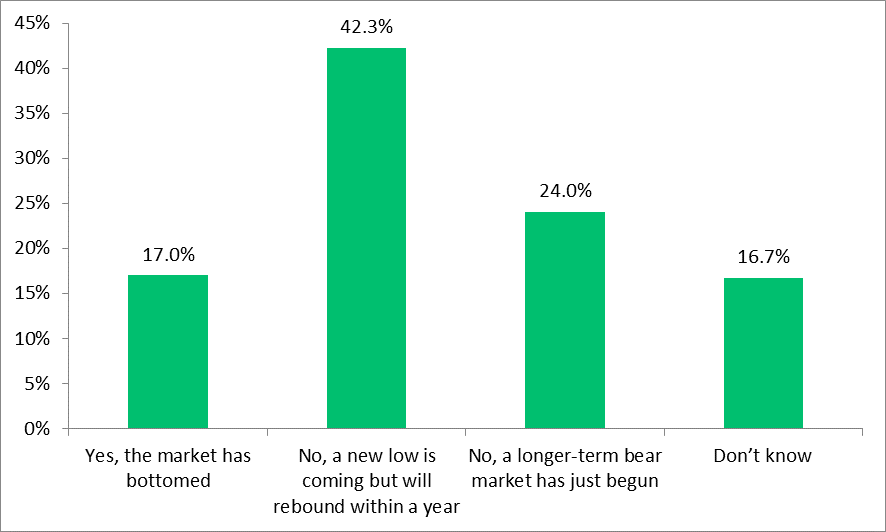

Q1. Has the low point since January already passed?

The S&P/ASX300 closed at a peak of 7,115 on 20 February 2020 (seems so long ago) before falling to 4,500 by 23 March, and now clawing back to 5,443 on 14 April, making it down 23% since the high. Despite the recovery, only 17% think the market has bottomed, a similar number to those who 'Don't know'. Two-thirds of responses think a new low is coming, including a high 24% who say we are in a longer-term bear market.

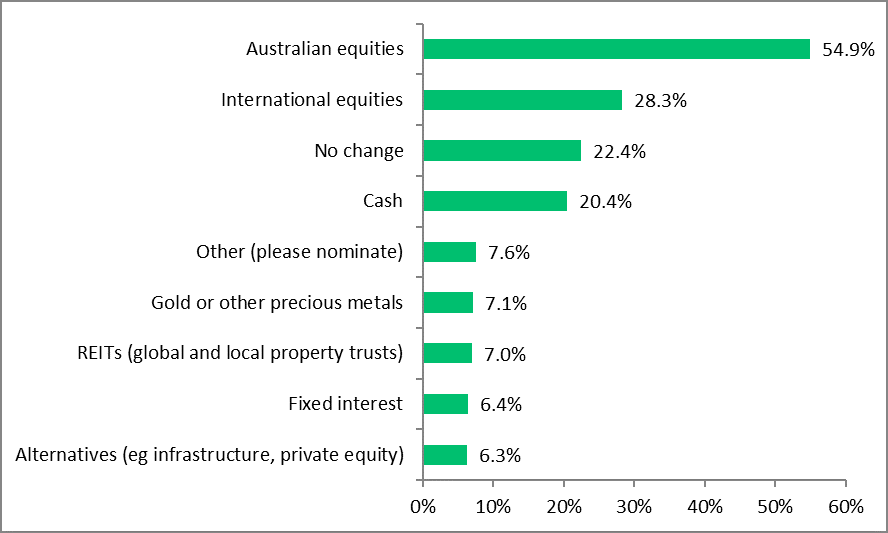

Q2. Into which asset class are you investing more after the sell off?

The 'please nominate' responses are included in the full report.

Q3. How much has your portfolio lost?

The S&P/ASX300 is down 20% since the end of January 2020, and 40% of respondents estimate their portfolio is down at least that percentage. This suggests significant allocations to growth assets. Only 17% say they are up overall or down less than 10%, so relatively few have escaped with only a scratch.

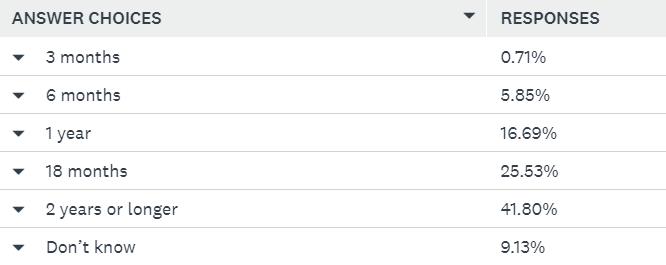

Q4. How long until the economy recovers?

There's mixed feedback on the LUV recovery:

- The 'L-shaped' recovery, where GDP falls and stays down for a long time. This is supported by 42% who believe recovery will take two years or longer.

- The 'U-shaped' recovery, where output falls then drags along the bottom for a while, and spikes up as the economy improves. This shorter time period of one year to 18 months gained 42% of the vote.

- The 'V-shaped' recovery, with a sharp fall in GDP and a rapid recovery, but only 7% believe we can recover in three to six months.

A solid 9% are undecided on any type of LUV.

Perhaps there's a fourth variation, the 'W-shaped' recovery. NSW Chief Health Officer Kerry Chant says we should prepare for 'zig and zag' where coronavirus restrictions are eased and some liberties are restored, but they could be re-imposed if infections spike. There is potential to reopen parts of the economy if businesses demonstrate strong enforcement of social distancing rules.

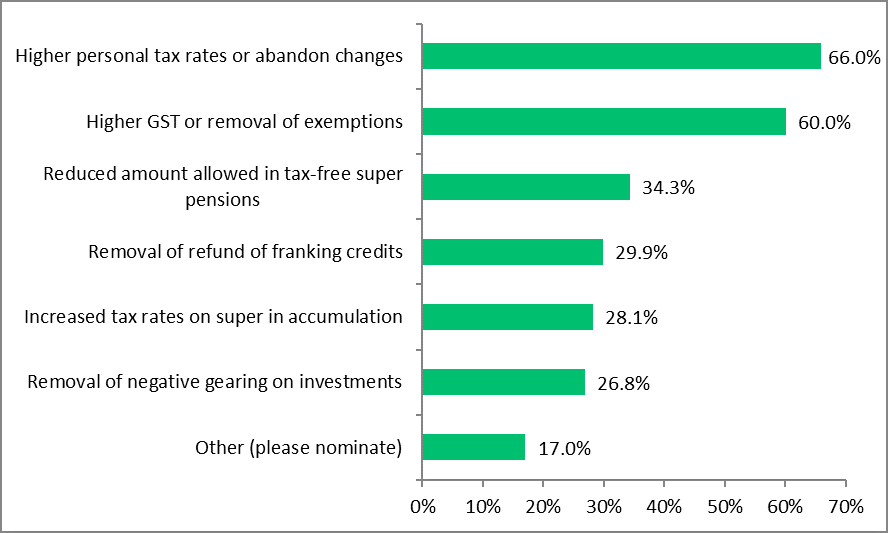

Q5. When the crisis is over, what new Federal Budget policies do you expect?

The 'please nominate' responses are in the full report.

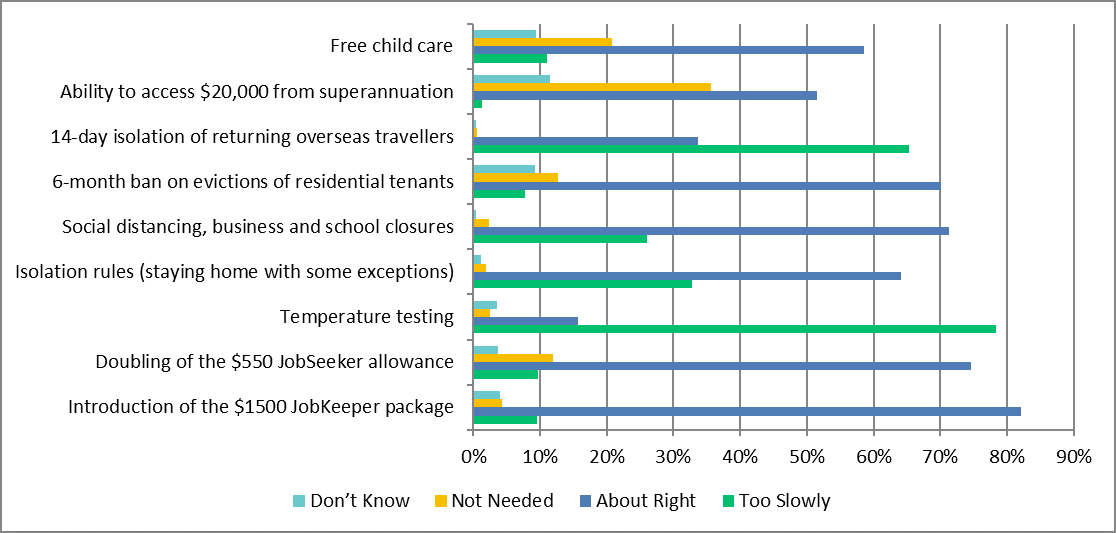

Q6. How well has the Government responded?

Amid strong support for the Government's actions on JobSeeker and JobKeeper, access to super, social distancing and stopping residential tenancy evictions, a large majority believe temperature checking and quarantining of people returning from overseas has been poorly handled.

I can verify personally how shoddy we were with returning overseas travellers. We disembarked the passenger ship Greg Mortimer on 4 March after a wonderful trip to Antarctica, and flew back to Chile. The ship then did one more expedition in Antarctica before sailing to Argentina on 15 March to pick up passengers for a 21-day cruise called 'In Shackleton's Footsteps'. They barely made it back to the first stop in the South Shetlands before they realised they had a problem.

This is the ship on which Australian passengers were stranded for a month, mainly off the coast of Montevideo in Uruguay. A charter plane finally rescued the Australians and Kiwis last weekend, with the majority of them catching coronavirus.

We went on from Chile to Buenos Aires for a week, returning to Santiago on 11 March. At the airport in Chile, our temperature was taken twice, we had to fill in a detailed report on where we had been in the previous 30 days and then we were subject to an interview. It was well-organised and polite, but a thorough examination of all travellers.

We dodged a bullet, as Chile closed its borders a few days after we left.

After the flight back to Sydney, on 12 March, we walked through customs in Sydney. No temperature checks, no forms to fill in, no interview. And now, two-thirds of all coronavirus cases in Australia are related to returning passengers. Obviously, Ruby Princess was a debacle but the mistakes were much broader. After countries around the world had introduced border checks, Australia was still waving people through.

The blue bars in the chart below show our readers believe the Government acted 'About Right' in most instances, with strong support overall except the high green lines ('Too Slowly') in temperature testing and isolation of returning travellers. There's also decent opposition to the $20,000 release from superannuation.

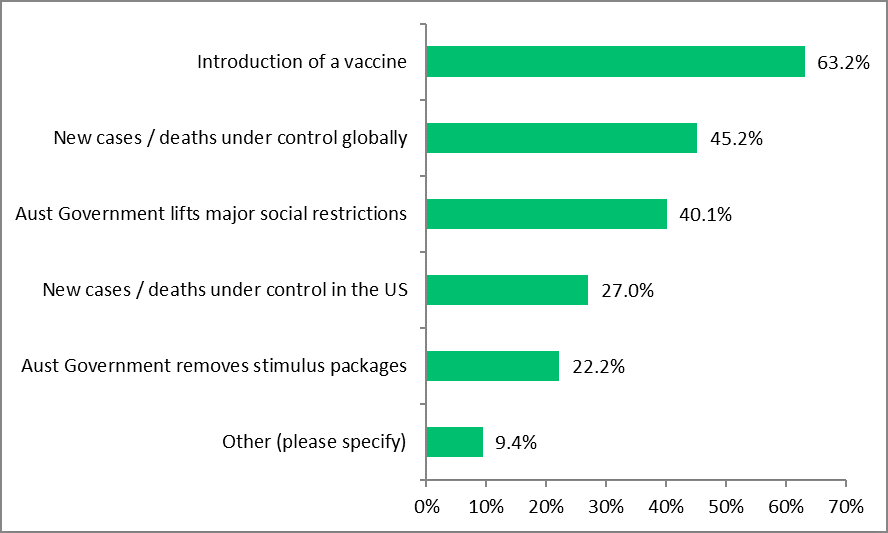

Q7. What will be the trigger for you to believe we are over the worst?

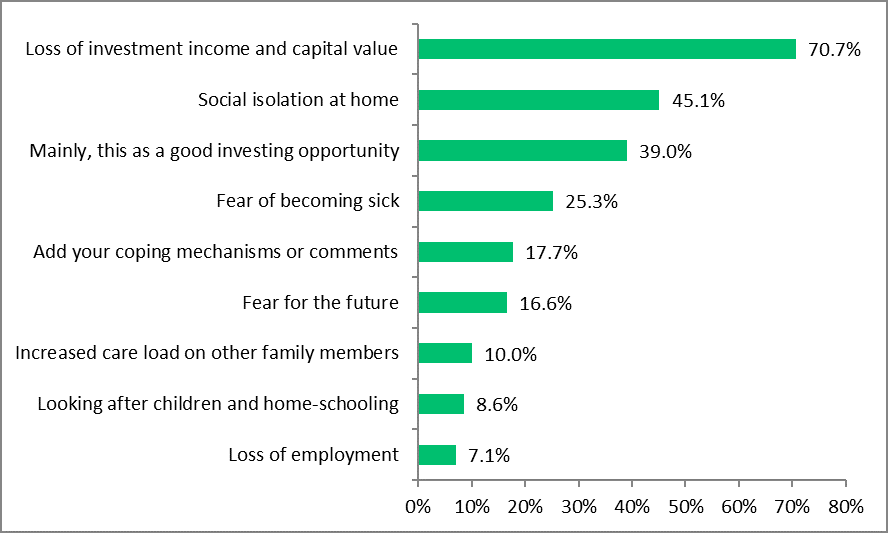

Q8. How has the pandemic affected you adversely?

Nobody has experienced a global pandemic before, and the implications are widespread. Everyone is feeling it in some way, although a surprisingly optimistic 39% responded, "Mainly, I see this as a good investing opportunity."

Q9. What will be some sustained consequences of COVID-19 when the crisis is over? Or any other general comments.

Over 450 comments were received for this question, covering a range of consequences including taxation, debt levels, holidays and travel, government policy, global trade, education, employment and spending. They are included in the full report.

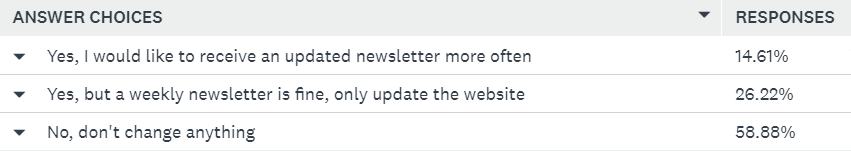

Q10. Would you like Firstlinks to publish more regularly during the crisis?

Most readers want Firstlinks’ coverage of the crisis to continue as it is. New articles are now posted to the website during the week.