“Make everything as simple as possible, but not simpler.” - Albert Einstein

When the Government decided people with high superannuation balances were receiving overly-generous tax concessions, it needed a method to identify the culprits. Intuitively, the obvious approach was to introduce a third tax tier: superannuation is already taxed at 15% in accumulation mode and 0% in pension mode. Here was a new tax rate on large amounts, so let's call it 30% on the balance in excess of $3 million. And so the announcement was made:

“From 2025-26, the concessional tax rate applied to future earnings for balances above $3 million will be 30%.”

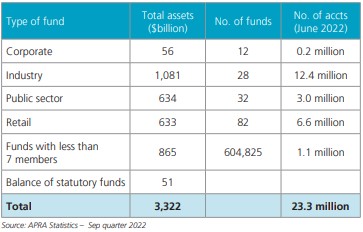

It was not until the following day that a Fact Sheet was produced, and the head scratching started. To everyone's surprise, it was a new 15% tax on a completely different base which included unrealised capital gains in the calculation. Treasury had realised it needed a solution to cover 23.3 million super accounts, of which only 1.1 million were in SMSFs.

Source: ASFA

Source: ASFA

A new tax definition of ‘Earnings’, not taxable income

Based on many of the hundreds of comments in Firstlinks, there is confusion around why Treasury and Treasurer Jim Chalmers chose the change in Total Superannuation Balances (TSB) for the tax. A tax invoice will be sent to large holders of super based on a new concept of ‘Earnings’:

Tax Liability = 15% x Earnings x Proportion of Earnings over $3 million

‘Earnings’ includes the change in TSB over a financial year. TSB is the total amount an individual holds in super, based on revalued assets.

Why did Treasury choose this tax method?

Channelling Albert Einstein (assuming the above quotation is accurately attributed to him), the Government wanted to make the calculation simple, but have they made it simpler than necessary and introduced flaws?

When Jim Chalmers instructed Treasury on his new revenue intentions, someone in the office knew there would be a problem in simply adding a third tier, which is why the announcement said:

“ … the Government’s implementation approach seeks to avoid imposing significant (and potentially costly) systems and reporting changes that could indirectly affect other members. The proposed approach is based on existing fund reporting requirements. Noting that funds do not currently report (or generally calculate) taxable earnings at an individual member level, the calculation uses an alternative method for identifying taxable earnings for members with balances over $3 million.”

Treasury needed to rely on the data held by the Australian Taxation Office (ATO) which knows the TSB, contributions and withdrawals across all super funds. It does not hold individual super tax information nor the taxable income of members of retail and industry funds.

In fact, nobody holds a consolidated view of taxable income.

Tax is not paid at the individual member level by large funds, in contrast to an SMSF where a member’s tax position could be identified. But any new tax needs to accommodate all forms of super, not only SMSFs.

In the spirit of keeping explanations simple, rather than going into the weeds and actuarial intricacies of large fund accounting, here’s how tax works.

The unit price for any fund is calculated by dividing the net asset value of its investments by the number of units on issue. The net asset value is the value of all assets, less fees, expenses and tax. Tax is paid in a large fund as an adjustment to the unit price.

Pension or accumulation funds are separate legal entities which hold units (investments) in a ‘wholesale’ fund, with the impact of revaluations and taxation calculated at a pooled level. The unit price in the accumulation fund is adjusted for taxation at 15% and pension fund at 0% based on income, realised capital gains, franking credits and withholding taxes. A fund member only sees the impact in the unit price which may be $1.50 instead of $1.60, but there is no way to isolate the individual tax impost based on current systems.

The large fund does not know which of its members should pay an additional tax because it does not know the member TSB. A member may hold super in a dozen different accounts. The only way to adjust the unit price is when all members pay the same tax rate of 15% for accumulation and 0% for pension.

Treasurer Jim Chalmers is stuck with a calculation method and now justifies taxing unrealised capital gains by saying it was Treasury who advised him to adopt this method.

“That's the advice of Treasury, working with other relevant agencies, that that is the most efficient, simplest and best way to go about it, and so that's what we intend to do.”

How accurate are the asset valuations?

It is not only the taxing of unrealised gains which is driving the call to reconsider the policy. It brings into sharper focus the issue of how unlisted assets are revalued. Previously, this valuation debate centred on the impact on unit prices for performance purposes, such as whether favourable valuations allowed large super funds to produce good results in the Your Future Your Super test.

Performance tables frequently include funds which hold large portfolios of unlisted assets which have not been revalued down in the face of rising interest rates in the same way listed funds are forced to recognise a market value. A prime example is in the listed property space, where property trusts are trading on listed markets at large discounts to their NTA values, while the assets have retained their value in the unlisted space.

This is a complicated and emotive subject for another place, but the added complication with this new tax is that members will now pay tax on the values of thier super assets, intensifying the focus on how assets are valued.

Problems will also arise in the listed space, such as on illiquid securities. Small and mid cap stocks notoriously trade in small volumes and prices can vary widely depending on whether a bid or offer is hit at the last trade.

Will large super holders consider other options?

SMSFs are set up for many reasons, such as control over a wider range of investments than offered by large funds. However, the imposition of a new tax will encourage trustees to consider alternatives. At least two come into play: other tax structures and holding assets in personal names.

1. As another article by Ashley Owen demonstrates, based on assumptions on how much unrealised capital gains are likely to be taxed, an investor with a personal marginal tax rate of 47% (but excluding unrealised capital gains) may pay less tax than an investor in superannuation with the additional 15% (but with tax levied on unrealised gains).

2. Other tax-related strategies will receive a boost, such as:

- Where a Condition of Release has occurred, cash out the amount in excess of $3 million.

- Move the money into a Discretionary Family Trust (DFT) which includes a company as a beneficiary.

- Pay the income from the DFT to the company beneficiary which pays tax at 30% (or to any family member with a marginal tax rate rare below 30%)

The impact of this change is that tax is still paid at 30% but only on realised gains. It also removes the risk of paying the 17% tax on death when super is not paid to a dependant. Treasury should expect a big increase in the use of DFTs and less tax on unrealised gains and death benefits, and these should be factored into the so-called $2 billion a year in tax savings.

Already legislated but not certain are the Stage 3 tax cuts, offering a flat marginal tax rate of 30% between $45,001 and $200,000. This change will push even more people out of superannuation.

How would a deeming rate work?

Treasury was effectively given two choices: create a simple method to calculate a new tax, as adopted, or invent a new process, such as a deemed return on large balances.

A deeming rate is used in social security to assume an earning rate on assets for pension eligibility, and there is a General Interest Charge (GIC) on unpaid tax liabilities. In super, a rate could be applied to large balances and taxed accordingly.

There is an obvious flaw in this alternative which probably discouraged its adoption. In the market falls and the TSB reduces and unrealised capital losses result, a large super holder would still receive a tax bill, unlike in the proposed scheme.

Is a systems change really so difficult?

Treasury and the Treasurer went for a simple method to impose a new tax, based on ATO records. If implemented, it will create large tax bills in years when stockmarkets, property or other asset revaluations deliver strong returns.

The large super funds have strongly resisted a major change to their systems to identify individuals with over $3 million, and funds do not want the added burden of further tax collection. On the surface, it does not seem an insurmountable systems problem to identify the pre-tax income of each person in a super fund and advise the ATO, which can combine the data with the super balances and impose a new tax on those above $3 million.

For the moment, due to the lack of consolidated taxable income data for super, Treasury has created a new tax with far-reaching consequences it did not expect.

To share your views on the merit of the new super tax, please see our current Reader Survey.

Graham Hand is Editor-at-Large for Firstlinks. This article is general information based on an understanding of the current new super tax proposal which has not yet been legislated.