Cheques and bank service, or the lack of, were major topics when I addressed a seniors’ group recently. The word had got out that the government was phasing out cheques, and many of the members of the audience were feeling abandoned.

On cheques

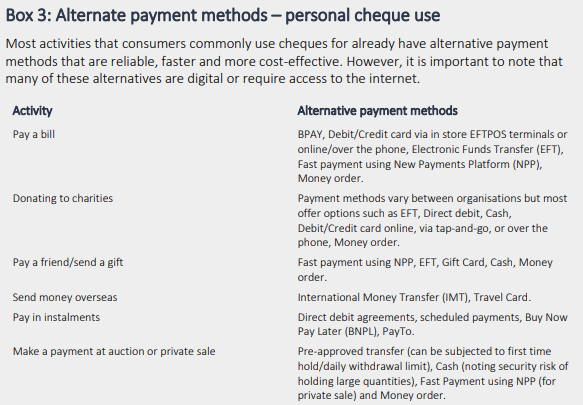

One person told me he was shocked to receive a letter from his bank telling him the Federal Government would be phasing out cheques. He said: “For years I have used cheques for donations to charities and sending family members a gift of money. Sending cash in the mail is not secure, and I have always found cheques to be a reliable and safe way to send money. How can I send a surprise gift of cash to family and friends once the cheque option is no longer available?”

I must confess it caught me by surprise. It’s been years since I’ve sent or received a cheque, and I have never given them much thought. They are one of the most inefficient methods of payment around. To send someone a cheque you have to write the check out in legible handwriting, find their address and write that on an envelope, also legibly, add a postage stamp and then take the letter to a post box. If you receive a cheque, you’ve got the hassle of finding a bank branch that’s still open, making out a deposit form, standing in line for the teller, and then waiting a week for the funds to be cleared.

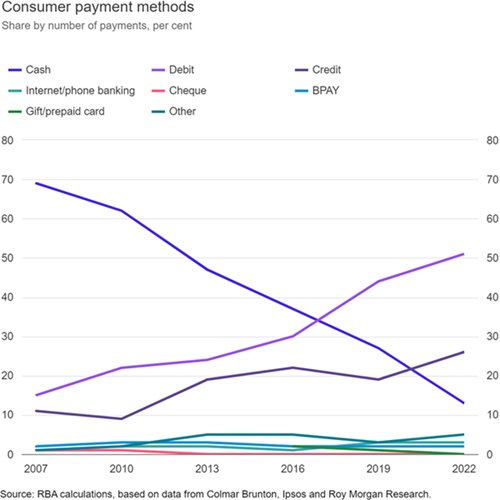

I spoke to the Reserve Bank, who told me that cheque use has declined drastically in recent decades. At its peak in the 1980s, cheque payments accounted for 85% of all non-cash payments. Today, cheques are used for just 0.01% of total payments. One of the main reasons is how easy the system is to defraud. The bank tells me that common cheque frauds include:

- counterfeit cheques (false copies of cheques previously issued),

- materially altered cheques (the payee or amount has been altered) and

- lost or stolen cheques (sometimes a whole chequebook has been stolen).

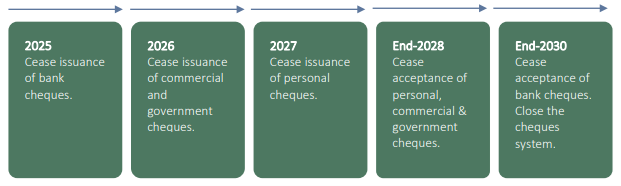

The government has a timetable for phasing out cheques. Next year will see the end of bank cheques, 2026 will be the end of commercial and government cheques, and by 2027 there will be no more personal cheques. By the end of 2030, the entire cheque system should be over and done with.

Figure 1: Potential staged transition plan for cheques system

Source: treasury.gov.au

The reality is that there are now much better methods payment available. For domestic transfers I love Osko ,which appears on many transfers I make through St George bank. Once you press the confirm button a message comes up that the payment has been successfully received by the payee. It’s instantaneous. And of course, you get an immediate receipt. Almost all my bills now come by email, and I just make an electronic payment through the bank account, print off a confirmation receipt, and staple that to the bill itself.

Not all the audience were convinced. One pointed out that there are elderly people who have never learnt to do internet banking, and plenty of people in the bush have no access to the internet if they knew how to use it. Very good points, and I had no solution for them.

Source: treasury.gov.au

Bye bye to cash

A more contentious issue is the phasing out of cash. The main functions of cash are as a means of exchange (to buy things), and as a store of value (you can safely tuck away a few $100 notes knowing that they will retain value into the future as legal tender).

The Reserve Bank’s sixth triennial Consumer Payments Survey found that most in-person payments are now made by tapping cards or mobile devices, even for small purchases. This means the share of in-person transactions made with cash halved — from 32% to 16% —over the three years to 2022. The demographic groups that traditionally used cash more frequently for payments, including the elderly, people on lower incomes, and regional residents, had the largest declines in cash use. Cash usage has generally been replaced with card payments. While Australians are aware of and use a range of other newer payment methods, such as digital wallets and buy now pay later services, they still make up a small share of payments.

When things get risky, like during the pandemic, people tuck $100 notes away as a risk management strategy. So, people now use cash less often as a means of exchange, but still value it highly as a store of value. And the numbers are big. It’s estimated there are now $60 billion worth of bank notes in circulation — that’s about $2600 a person. There must be somebody with plenty – there are none at my place.

The lack of bank service

The next issue was the refusal of banks to accept overseas cheques. One woman said her SMSF owns several properties in the USA and last year received two cheques for insurance claims on those properties. Both St George and Westpac refused to accept the cheques as, like almost every other Australian Bank, they no longer accept cheques in overseas currencies.

The Australian Bankers Association say the remedy is to ask the overseas institution to use the SWIFT (Society for Worldwide Interbank Financial Telecommunication) system which facilitates secure and swift international payments between financial institutions worldwide. It ensures efficient transfer of funds, enabling businesses and individuals to conduct cross-border transactions seamlessly. SWIFT is utilized by over 11,000 financial institutions across more than 200 countries and territories globally.

However, there is a glimmer of hope. Both HSBC bank and Heritage Bank tell me that they will accept cheques in US dollars on behalf of customers. Maybe it’s worthwhile opening an account with them.

Noel Whittaker is the author of 'Retirement Made Simple' and numerous other books on personal finance. This article is general information. See noelwhittaker.com.au.