The proposed changes to dividend imputation rules highlight one of the potential risks of a concentrated, home-biased, income-oriented portfolio.

It’s clear that investors who rely on dividend imputation credits for income will have an important decision ahead as to how to restructure their portfolio should this proposal come into effect.

Because we believe that an income-only strategy can create heightened risk in a portfolio and limit its potential for capital growth, we are strong proponents of the concept of total return investing – or investing for cash flow and capital appreciation.

Our research shows this to be a lower risk approach, in particular for those in the drawdown phase of their investment lifecycle.

Better not to focus only on income

Instead of constructing the portfolio to align income yield with spending requirements, a total return approach intends to align the portfolio’s asset allocation with the investors spending goals and risk tolerance.

This approach advocates keeping your portfolio broadly diversified at a low cost and focused on the overall, or total, return. Where the need for additional income occurs over and above the yield generated by this broadly diversified portfolio, the investor spends the amount made from the overall portfolio - or the total return - rather than switching around holdings to generate additional yield.

Changes to tax rules naturally provoke public debate because of the impact on the way investors have structured their portfolios but there are a couple of reasons why the total approach may be beneficial to the long-term health of your investment portfolio.

First, an income approach often spends the natural yield of the portfolio which may either exceed the spending requirements or it may fall short. This approach pays too little attention to the capital base, which can result in the portfolio being eroded by inflation and failing to last the duration, or retirees underspending from their portfolio and living an unnecessarily frugal retirement.

Second, an income-orientated portfolio may not align with the investors actual risk tolerance, which is particularly relevant in Australia, where portfolios are often concentrated in a small number of shares to generate the desired income yield. In particular, financial sector shares in Australia are commonly overweighted. Financial sector shares comprise around one-third of the Australian market, and around 36% of dividends paid.

In this way, being too focused on the income yield of the portfolio can mean you miss out on the importance of portfolio diversification across sectors and asset classes, replaced by a need to achieve a higher income yield.

Equally, overweighting higher yield bonds in the same pursuit of higher income can expose the investor to moderate or even significant credit risk, heightening volatility in the portfolio. Higher yield bonds display different characteristics to investment grade government and corporate bonds, which are a better diversifier in your portfolio to equity risk than high yield bonds.

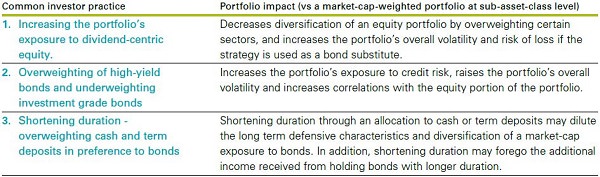

Summary of negative portfolio impacts resulting from common investor practices

Source: Vanguard. From Assets to Income: A goals-based approach to retirement spending

Controlling withdrawals of capital

In contrast, by focusing on the entire return earned by the portfolio, rather than its individual components, a total-return approach maintains a portfolio’s diversification and allows for better alignment with investment goals. Investors also have more control over the size and frequency of withdrawals. This is particularly useful when considering how to incorporate other financial resources, such as the age pension, into a retirement plan.

Some industry commentators have voiced concerns that investors may be prey to faddish income strategies should Labor’s proposal for franking credits come into play. But by taking a sensible, diversified approach and investing for both income and growth, investors can sidestep some of the pitfalls associated with the hunt for yield.

Aidan Geysen is Head of Investment Strategy at Vanguard Australia, a sponsor of Cuffelinks. This article is for general information purposes only and does not consider the circumstances of any individual.

For more articles and papers from Vanguard Investments Australia, please click here.