During the late 1980’s, a German pop band named Milli Vanilli became an overnight sensation. Their success was driven by the release of the album Girl You Know It’s True, which included several top-five hits and resulted in them winning the 1990 Grammy Award for Best New Artist. One of the top songs was called Blame It On The Rain. The lyrics for the chorus are:

“Blame it on the rain that was falling, falling

Blame it on the stars that shine at night

Whatever you do

Don't put the blame on you

Blame it on the rain, yeah-yeah

You can blame it on the rain.”

Source: https://genius.com/Milli-vanilli-blame-it-on-the-rain-lyrics

Around the time they received the Grammy, a scandal broke out that Milli Vanilli had been lip-syncing in their performances and it was not their voices on the recorded album. They ended up having to hand back the Grammy award. The band lost all credibility and thereafter, we have found it hard to believe people who blame things on the weather.

Never thank the weather gods

Each year during April, several companies provide quarterly trading updates to the market. They are often provided in conjunction with the annual Macquarie Conference which occurs in late April/early May and provides an opportunity for investors to meet with management teams. One trend we noticed this year was the number of companies which downgraded their earnings due to the impacts of weather.

We understand that significant weather events can have an impact on the operations of a business, however, we are sceptical when management call out the weather as a core driver for operational underperformance.

Some companies which have downgraded due to unfavourable weather include Boral (ASX:BLD), JB Hi-Fi (ASX:JBH), Village Roadshow Limited (ASX:VRL), Experience Co Ltd (ASX:EXP), and Myer (ASX:MYR). Exogenous, uncontrollable shocks can directly affect the short-term earnings of some companies and hence there is a justification for this highlighting. However, we believe there is an asymmetry whereby companies will always call out uncontrollable headwinds but almost never call out when there are tailwinds to earnings outside of their control.

One such example was JB Hi-Fi. In a presentation to the Macquarie Conference, JB Hi-Fi downgraded its full year Group Net Profit After Tax (NPAT) guidance from $235-240 million to circa $230 million. The company commented that:

“The Good Guys performance has been impacted by challenging conditions in the Home Appliance market, due to unfavourable weather conditions …”

Put simply, the company sold less air conditioners than it had budgeted in the 2018 summer because it was not as hot as the 2017 summer.

So was 2018 too cool or 2017 too hot?

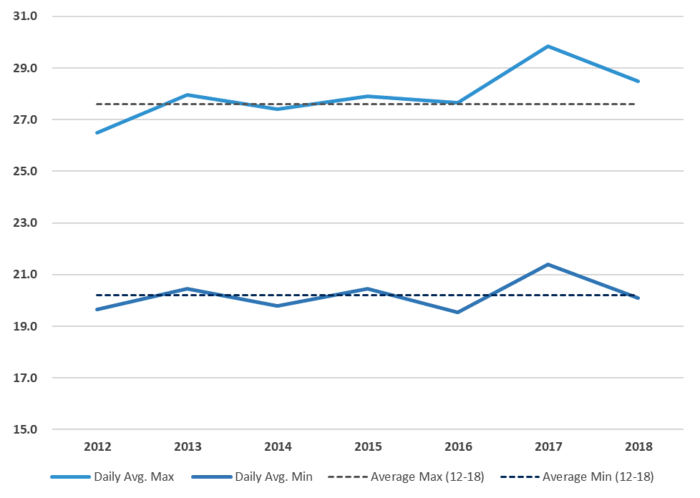

So, was it actually hotter in the 2017 summer? We looked at the average temperatures in January 2017 and January 2018. The only city where there was a material change in temperature was Sydney. In January 2018, the average daily maximum temperature fell from 29.9 to 28.5 degrees Celsius. That may not seem like much but it is enough to make a meteorologist blush.

January Average Temperatures for Sydney

Source: Bureau of Meteorology

Therefore, if The Good Guys is represented in New South Wales (which it is), there is some justification that a material part of its downgrade was due to the cooler weather in 2018 relative to 2017. However, what we find interesting about the above chart is that 2018 was just a regression to the average temperature. It seems that rather than 2018 being colder than average, 2017 was materially hotter than average.

So, did JB Hi-Fi highlight that 2017 profit benefitted from unusually hot weather in 2017? Alas, No. In fact, when asked on a conference call, the company played down the positive impact the weather had on their sales due to the fact that they are underrepresented in NSW:

“…the only note of caution in a sense of attributing too much to seasonal is we are underrepresented as the proportion of our portfolio in New South Wales … so we haven’t seen quite the same uplift that maybe Harvey’s had.”

So, on the one hand the company called out the cooler weather in 2018 as to the reason for the downgrade when it was actually a normal summer, but on the other hand played down the positive impact of what was an abnormally hot 2017 summer. They can’t have it both ways.

Companies and fund managers both do it

We don’t mean to pick on JB Hi-Fi. The downgrade was not even that big. It is just an example of something we are seeing more in company announcements. Companies are quick to blame uncontrollable headwinds for poor short-term earnings and play down uncontrollable tail winds which help performance. It could be weather, FX movement, irrational competition, or market dislocations.

Fund managers are no different. When our style is out of favour, we blame the market conditions, but when our style is in favour, we attribute all the alpha generation to our superior skills. What we are pointing out is just human nature, however it is an asymmetry across most companies we analyse in Australia.

The point of this is not to focus too much on whether or not a company makes its short-term earnings forecast. We believe that the market puts too much emphasis on next year’s earnings and not enough time on understanding longer-term value drivers of a business. More important to us is the implication this sort of behaviour may have on the internal culture of a company. Just like in funds management, we believe intellectual honesty is important.

It is hard as an outsider looking in to get a good feel for the culture of a company. We need to rely on signals. We like a culture where mistakes are owned by management and excuses are not made for poor performance. In that sort of culture, people don’t make the same mistake twice and problems are fixed. Companies and employees which make excuses for not meeting goals tend not to result in great cultures.

“Whatever you do, don’t put the blame on you.”

Anthony Aboud is Portfolio Manager at Perpetual Investments. This article was written for educational purposes and is not meant as a substitute for tailored financial advice.

Perpetual is a sponsor of Cuffelinks. For more articles and papers from Perpetual, please click here.