Responsible investing is on the rise. According to the Responsible Investment Benchmark Report 2018 Australia, more than half of all professionally managed assets in Australia fall under a responsible investment umbrella.

In years gone by, conventional wisdom was that acting in accordance with ethical principles involved a trade-off against portfolio returns. However, the figures do not bear this out, and present a compelling argument for investing in a socially responsible way.

What is responsible investing?

The Responsible Investment Association Australasia (RIAA) defines responsible investing, also known as ethical investing or socially responsible investing (SRI), as ‘a process that takes into account environmental, social, governance (ESG) and ethical issues in the investment process of research, analysis, selection and monitoring of investments.’

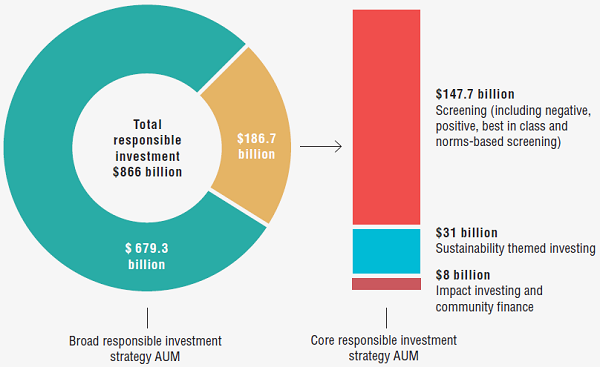

Broad responsible investment is a broad-brush approach where investment managers systematically include ESG factors in traditional financial analysis and investment decision-making.

Core responsible investment goes further. The investment manager employs one or more responsible investment strategies, including screening, sustainability-themed investing, and impact investing and community finance.

For example, the manager might apply investment screens, such as:

- Negative screens – systematically filtering out specific industries, sectors, or companies, such as those involved in gambling, alcohol, tobacco, weapons, pornography or animal testing.

- Positive screens – selecting sectors, companies or projects that demonstrate ESG focus that is superior to industry peers.

This category of investing is growing strongly. For example, in 2017, assets under management by Core responsible investment funds in Australia increased by 188% to $186.7 billion.

Fig 1: Responsible investment by approach

Source: Responsible Investment Benchmark Report 2018 Australia (RIAA)

Does responsible investment mean sacrificing performance?

In previous years, there was a belief that investors had to choose between principles and performance, that giving priority to ethical considerations meant trading off financial returns.

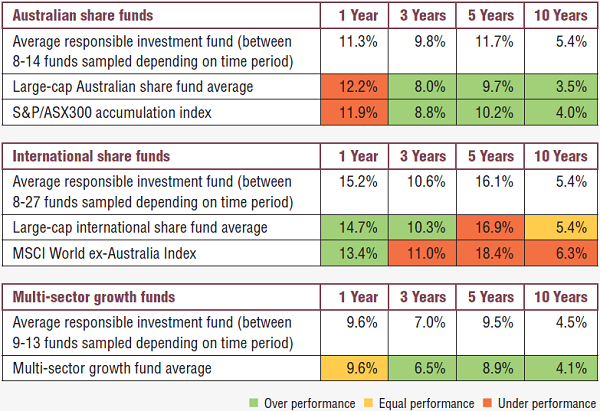

The RIAA’s research does not bear this out. The RIAA found that, as at 31 December 2017, Core responsible investment:

- Australian share funds outperformed the average large cap Australian share funds over three, five and ten-year time horizons.

- international share funds outperformed large cap international share funds over one- and three-year time horizons and matched the ten-year performance.

- multi-sector growth funds (balanced funds) outperformed their equivalent mainstream multi-sector growth funds over three, five and ten-year time horizons.

Source: Responsible Investment Benchmark Report 2018 Australia (RIAA). Past performance is not an indicator of future performance.

How do I know I’m really buying a responsible investment?

Investors who want to allocate their funds responsibly need to have confidence that investments are ‘true to label’. In the world of SRI, this can be easier said than done.

Take for example the ‘ethical index series’ of a large global index provider. The methodology of these indices avoids investing in ‘pure play coal companies’. However, major coal producers including BHP and Anglo American are included, on the grounds that they are ‘general mining’ companies rather than ‘coal miners’.

Some ethical investors may be comfortable with this, while for others such exposure would be inconsistent with their principles.

The RIAA runs a 'Responsible Investment Certification Program' which aims to help investors navigate these complexities to find investment options that match their beliefs, principles and personal values.

If an investment product has been certified by the RIAA it means it “has implemented a detailed responsible investment process for all investment decisions, clearly discloses what that process is, has been audited by an external party to verify the investment process, and has met the strict disclosure requirements of the program”.

Responsible ETFs in Australia

BetaShares offers two ethical funds, that can be bought in a single trade on the ASX, BetaShares Global Sustainability Leaders ETF (ASX:ETHI) and BetaShares Australian Sustainability Leaders ETF (ASX:FAIR). Both funds have been certified by RIAA as a ‘Certified Ethical Investment’*, supporting the view you are getting a ‘true to label’ investment.*

ETHI and FAIR employ some of the most stringent ESG screens in the industry. Companies are screened to exclude those with significant exposure to the fossil fuel industry, as well as those engaged in activities/products deemed inconsistent with responsible investment considerations, including gambling, tobacco, armaments, uranium/nuclear energy, destruction of valuable environments, animal cruelty, mandatory detention of asylum seekers, alcohol, and pornography. The funds have attracted significant investor attention since their launch, collectively growing to over $600 million in assets as at 3 June 2019. And as the tables below show, the indices which the ETFs aim to track have performed well too, allowing investors to well and truly 'profit from their principles'.

*ETHI and FAIR have been certified by RIAA according to the strict operational and disclosure practices required under the Responsible Investment Certification Program. See www.responsibleinvestment.org for details.

Richard Montgomery is the Marketing Communications Manager at BetaShares, a sponsor of Cuffelinks. This article is for general information purposes only and does not address the needs of any individual.

The Responsible Investment Certification Program does not constitute financial product advice. Neither the Certification Symbol nor RIAA recommends to any person that any financial product is a suitable investment or that returns are guaranteed. Appropriate professional advice should be sought prior to making an investment decision. RIAA does not hold an Australian Financial Services Licence. www.responsibleinvestment.org.

For more articles and papers from BetaShares, please click here.