For those that can, it’s very satisfying to put away a little money each month for the benefit of our kids. It’s fun to imagine the look on your child’s face when gifting the money on their 18th or 25th birthday, or to teach them about investing from a young age.

However, there’s more than one way to make this money grow, and there are tax implications to consider. It’s a long term investment – usually over 10 years – so leaving it in cash isn’t necessarily giving it the best opportunity to grow into a real nest egg.

Savings accounts

If you’re starting when the child is very young with a small monthly saving, the simplest way is probably a child savings account. For our four-year-old daughter, we have a child account in her name and $50 a month goes into it from our bank account. The standard interest rate is 0.01% unless there is a monthly deposit and no withdrawals, in which case an extra bonus rate of 3.8% applies (3.81% total).

Where an account is held in the name of a child under 16, they are entitled to a PAYG tax free threshold of $420 where no tax will be withheld if their date of birth has been quoted. In our case, with a balance of around $2,500 and interest of $95 or so a year, no Tax File Number (TFN) is required.

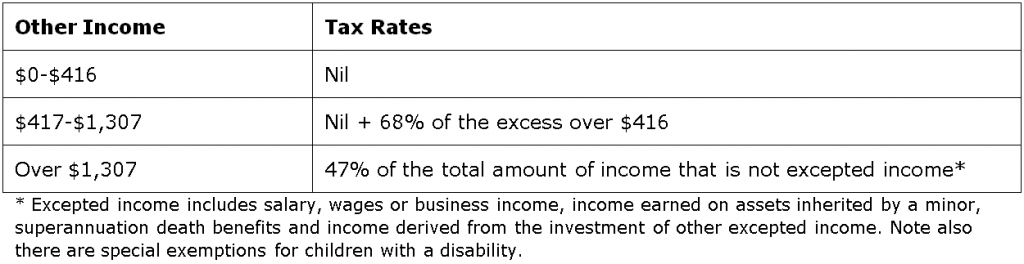

Regarding the declaration of the interest income, there are ‘special’ tax rates that apply to the unearned income of a minor:

* Excepted income includes salary, wages or business income, income earned on assets inherited by a minor, superannuation death benefits and income derived from the investment of other excepted income. There are special exemptions for children with a disability.

When our daughter’s balance reaches $10,918, the interest will exceed $416 and the 68% kicks in, obviously something to watch for.

The ATO has provided some common examples of who actually owns the money in a savings account and therefore who should declare the interest. Whether the account holder is the parent, the parent in trust for the child or the child, look to who provided the money and who makes the decisions on the account.

If the account is in the name of the child and the child provided the money, for example from employment earnings or birthday gifts, and the child makes the decisions on the account, it is the child who declares the income.

In most other cases, it is the parent who should declare. That solves the 68% problem, but for those accounts where the child must declare the income, the child needs a TFN and needs to start lodging tax returns. Might be time to look at other options.

What are other options?

If the savings account starts earning interest above $416, or you are seeking superior returns elsewhere, you might consider alternatives to interest bearing savings accounts.

Listed securities (shares)

Shares are a good investment choice for long-term growth and tax-effective dividend income. A well-chosen portfolio of solid, blue-chip companies held over the long-term is likely to provide a superior return than most other investment options.

As your child grows, they can become more involved in the investment process and decision making. It’s a fantastic way to learn about money and investing from an early age which will serve them well in their adult years.

The downside is that small investment amounts make it hard to adequately diversify. It is not cost effective to buy a few shares in several companies, paying brokerage on each trade. This is where other options such as Listed Investment Companies (LICs) or Exchange Traded Funds (ETFs) might be better. They can provide exposure to a broad range of companies in one trade.

The tax implications are similar to those of savings accounts. If held for the child’s benefit, the child declares the dividend income and capital gains, but if the parent spends or uses the income for themselves, the parent does. It will likely require the child to lodge tax returns in order to declare dividends and capital gains, and to claim franking credits.

Overall, if the child’s income is likely to be over $416 a year, it might be best to keep the investment in the name of the parent who has the lower marginal tax rate.

Insurance (investment) bonds

This largely forgotten investment vehicle has merit for investing for children, mainly due to the convenience. An investment bond is a ‘tax paid’ investment meaning that tax on investment earnings is paid by the product issuer at the company tax rate (currently 30%).

All returns within the bond are net of tax so while invested, and upon withdrawal after the tenth year, there is no need to include earnings in personal tax returns. This means no TFN required, no child tax returns, no special tax rates and no administration. Furthermore, you can access it at any time: it’s not like super where the money is locked up until retirement. You can also choose the investment option, such as Australian shares, fixed interest, high growth, cash etc.

You can also make regular investments and after ten years there is no personal income tax liability for withdrawals. Watch out for the 125% rule that applies to additional investments – I’m not going to cover it here, but it’s important to know.

The low entry point suits child investments. The minimum deposit for some is only $2,000, with a minimum monthly investment of $100. If you commit to a regular investment plan, you could start with just $500. This makes it easy to achieve a diversified investment in the Australian share market with no exposure to special tax rates, capital gains tax (CGT) or brokerage. You will, however, be paying management fees in the range of 1.5% - 1.8% pa.

The minimum age at which a child can hold the bond directly is ten years. For younger children, an adult owns the policy with the child nominated as the life insured. The bond then vests or transfers to the child when they meet a pre-determined age (between 10 and 25, but the child doesn’t have the power to exercise their investment rights until they turn 16). The (adult) policy owner has full control over the investment and can make switches and withdrawals or change the vesting age at any time.

Investment bonds are an appealing option for future education expenses, but check the tax consequences of making a withdrawal before year ten. Also, they may be less tax-effective if one of the parents is in a tax bracket of less than 30%.

Managed funds

Managed funds provide access to a diversified range of investments and allow regular contributions. Most managed funds require an adult to be the legal owner and provide their TFN. They tend not to allow child investors.

When using managed funds for a child investment, open the account in the name of the spouse on the lowest marginal rate to minimise income tax or CGT liabilities from the investment.

It is possible for an adult to hold the investment in trust for a child (where the child is nominated as the account designation) however the 68% special tax rate rears its ugly head in this case.

Management fees apply in the range of 1.5% - 2%, although index funds on some platforms are less.

So what to do?

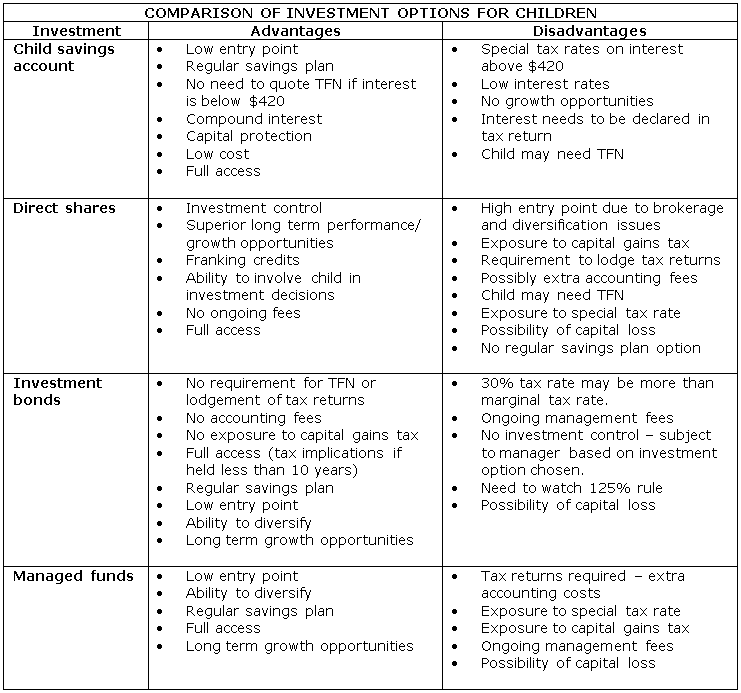

You need to weigh up the tax issues including CGT and special tax rates, long-term performance, diversification, fees, simplicity, and investment control amongst other things. The table at the end of this article might be a good reference point.

Now that the balance of my daughter’s savings account is $2,500, I am leaning towards an insurance bond into a high growth or Australian shares option, with a regular investment amount of $100 a month (if you have a lot of kids, $100 a month for each might not be feasible. You can have multiple beneficiaries on one policy so the regular savings amount goes to all.)

When Miss 4 is older, we might decide to go to direct shares, and start her on the journey to learning about investments, the economy and the markets.

Or we might keep going with the investment bond. The ease and lack of tax return obligations are very appealing to me. But that’s just me – every situation is different, so please seek your own advice.

General advice disclaimer: Information is of general nature only and is not intended as personal advice. It does not take into account your particular investment objectives, financial situation and needs. Before making a financial decision you should assess whether the advice is appropriate to your individual investment objectives, financial situation and particular needs.

Alex Denham was Head of Technical Services at Challenger Financial Services and is now Senior Adviser at Dartnall Advisers.