A large number of readers shared their opinions and future intentions regarding Labor's proposed changes to franking credit refunds - almost 2,000 of you! Thanks for taking the time to participate in last week's survey.

For those who want to dive deeper into the debate, there are 25 pages of comments attached as a document at the end of this article. This subject really fires people up.

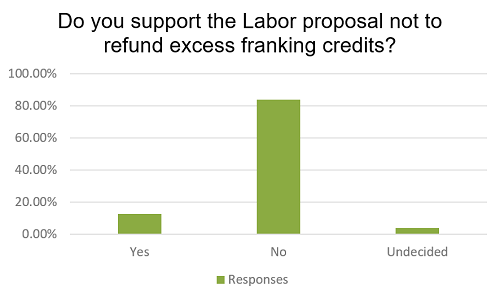

Overall, 12.5% support the proposed changes, 83.7% oppose and 3.8% remain undecided.

Respondents supporting the Labor policy proposal

The majority of people supporting cited paying a fair share of tax as an important factor (more than one choice was permitted).

| We all need to pay our fair share of tax | 69.4% |

| SMSFs in pension mode should not be taxed at zero | 26.5% |

| We should tax companies who make a profit | 34.7% |

| I am a Labor supporter and trust the party to do the right thing | 2.9% |

| Other (please specify) | 33.9% |

Some common reasons for supporting the Labor proposal included:

- Refunding franking credits to retirees (i.e. not paying any tax), especially with large SMSFs, is unsustainable.

- Do not believe in getting a tax refund on income I did not pay tax on.

- Why should someone over 65 (retired) on $75,000/$150,000 yearly not pay any tax?

- My assumption is that the zero rate of tax for pension phase superannuants will remain untouched (sacred cow), on which basis I think the priority is to make sure that every single dollar of corporate earnings is taxed.

Respondents opposing the Labor proposal

On the other hand, the majority of opposers cited avoiding double taxation as the main factor (multiple responses allowed).

| I agree with the principle of not taxing company profits twice | 75.8% |

| The franking credits system is a fair way to collect company tax | 33.9% |

| A better way to raise budget revenue would be a tax on pension super income | 16.3% |

| I don't think the Labor Party fully understands what they are proposing | 62.5% |

| The policy is divisive because it picks winners and losers | 69.1% |

| Other (please specify) | 23.5% |

Some common reasons for opposing the policy included:

- People have planned their super over a long period of time as this policy has been in place almost 20 years. We stand to lose 30% of our income because of this policy without any way to make it back up. We can’t go back to work. It is also very divisive.

- At least needs to be grandfathered or capped. I set us up over 25 years.

- I think the Labor party committed to this policy without having fully understood all the implications.

- The major impact will be with self-funded retirees on lower incomes. They've tried to do the right thing, the goal posts are moving and we'll all pay as some will become eligible for at least part pensions.

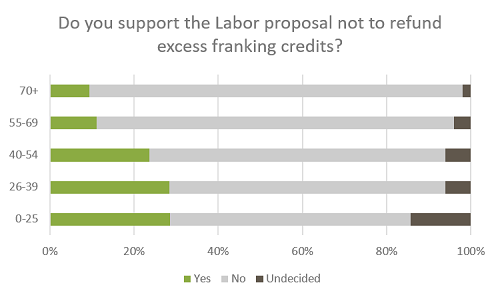

We also found that dissatisfaction rises with age. The under-40 years group were 65% opposed, the 40-54 years group 71% opposed, and 86% of people 55-and-over were opposed.

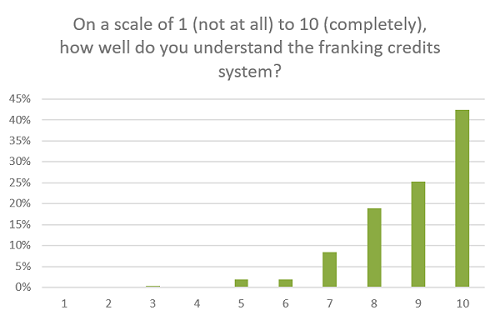

When asked how well the franking system was understood, over 40% gave themselves a score of 10 out of 10, with 95% giving themselves a score of 7 or more. Clearly, a well-informed sample group.

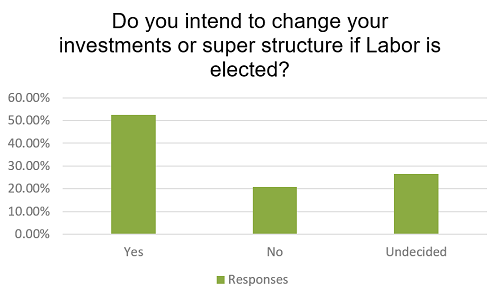

Lastly, we asked if there would be changes made to investments and super if the proposed policy were implemented. Over 50% said yes, while 21% said no changes and 27% were undecided.

The most common change will be selling shares that pay franked dividends (74.5%) and buying assets with unfranked income, which augurs well for flows to global equities and property trusts if implemented. The second most popular action was to spend money in order to qualify for the pension (26.6%).

| Sell my fully franked shares and buy assets with unfranked income such as global equities or property trusts | 74.5% |

| Switch my super to an industry fund or retail fund | 22.3% |

| Add my children as trustees of my SMSF | 17.0% |

| Spend my money to reduce assets so I qualify as a pensioner | 26.6% |

| Hold on to my house so my main asset remains exempt from assets test | 25.9% |

| Other (please specify) | 25.9% |

There were many additional comments provided, and an edited compilation of these is included here. Cuffelinks includes this in the spirit of sharing views and an open debate and takes no responsibility for the comments.