Our Reader Survey on retirement experiences drew about 700 responses, an excellent sample given it was limited to retirees.

We also received thousands of comments, and we are honoured that so many readers allowed a glimpse into their personal experiences. The comments are collected into this document. (Please note, this is a large document but we wanted to include all comments since people went to the effort to write them).

Of course, we must have a favourite comment, thanks for this:

"Reading and keeping informed is very crucial to good management. eg Firstlinks takes 30min~1hr per week. Thank you Firstlinks for a great, and free, informative, professional newsletter :)"

Here are the survey results. We include a chart for multiple response questions, and a word cloud for open questions.

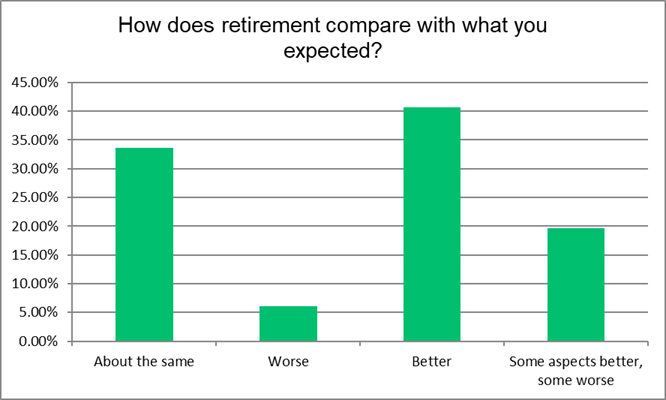

Q1. How does retirement compare with what you expected?

In an encouraging note, only 6% responded that retirement is worse than expected, while an optimistic 40% think it is better and 34% about as expected. Another 20% were more mixed, with some aspects better and some worse. See the full document for hundreds of explanatory comments.

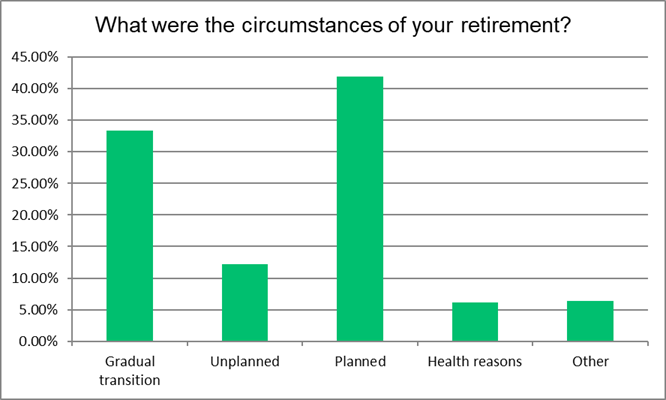

Q2. What were the circumstances of your retirement?

It was good to see that 42% planned their move from paid employment and 34% enjoyed a gradual transition. Only 12% said it was unplanned due to loss of a paid job, while another 6% retired for health reasons. Another 6% had 'other' reasons for retirement, perhaps such as: "Fed up with neighbours, noise and inconsiderate people and opted for 44 acres in the bush!".

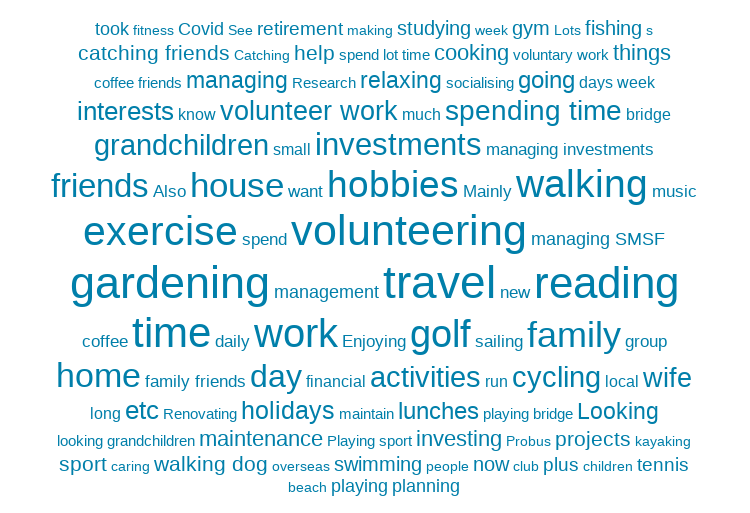

Q3. How do you spend the time previously occupied in paid employment?

An open-ended question, with a common reponse that there is now time for activities that were missed when working:

"Renovating, caring, animals, growing vegetables, relaxing dealing with day to day tasks."

"Live on small lifestyle property with large lawn/trees/garden. Reading books and articles non profession related. Manage SMSF funds and bookkeeping of such for accountant/auditor. Genealogical research and writing account of same."

"Working! But in different ways. We run an Air BNB inc doing maintenance and cleaning. Help with care of grandchildren , run two houses, do charity work and am doing a book of family history. No shortage of things to do."

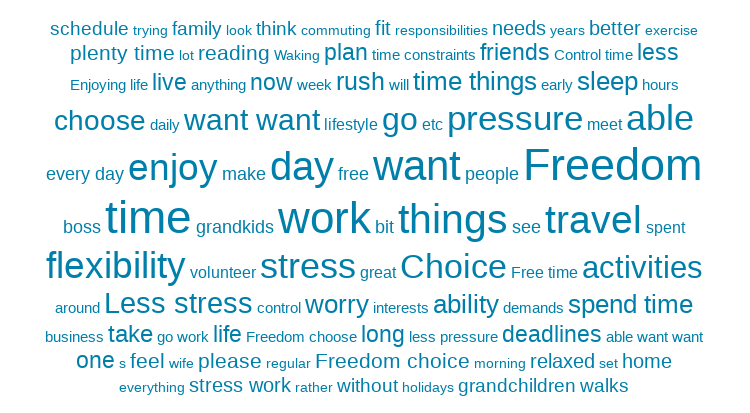

Q4. What are the best aspects of retirement?

Another open-ended question, many of you find retirement liberating:

"No tax, no pressure, no being told what to do or what not to do and a said above freedom to make your own choices."

"Sleeping in in winter, playing golf 2 or 3 times a week, swimming in the pool in summer every day. Cameraderie of the golf club."

"Last minute decisions to see shows or travel etc."

"Introspection that is not employment focussed. Feels like I had an imagination budget, and the large part of that used to be spent on work thinking. Now that’s so broad!"

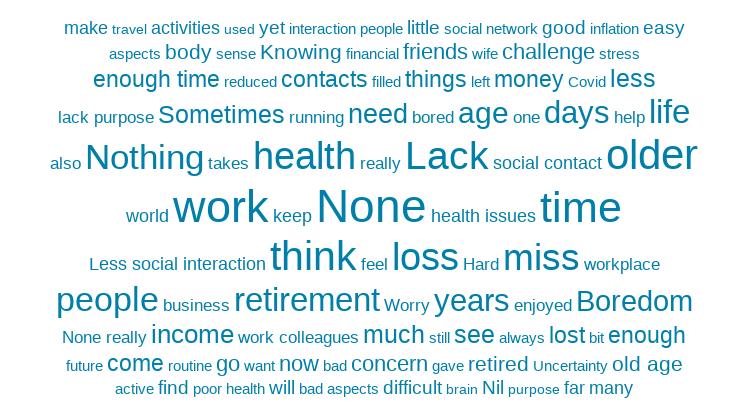

Q5. What are the worst aspects of retirement?

Although most people said there are no downsides to retiring (and many said there are not enough hours in the day), others report that it's not all 'smelling the roses', with some warnings, especially around health. Enjoy it while you can:

"Our golden years were cut short by health issues. Boredom is now my major problem."

"Dealing with doctors and all the time spent in waiting rooms."

"Some friends still work and not available. Also being single, I need to factor in friend's partners as well."

"Sometimes I feel a lack of mental stimulation."

"Knowing that this is it! When working it didn’t matter if you were ill, thanks to sick pay it didn’t feel like a dead loss. Likewise if the weather was foul you could still go to work and feel purposeful. When retired these days feel like lost opportunities."

Q6. Do you have any tips for people approaching retirement?

This question is covered fully in its own article.

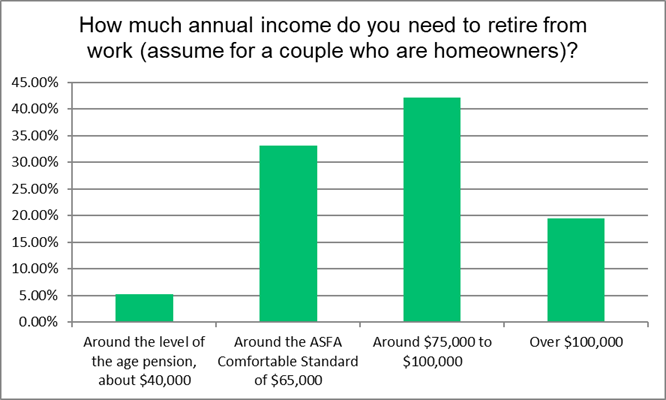

Q7. How much annual income do you need to retire from work (assume for a couple who are homeowners)?

Firstlinks readers hold above-average wealth, and it is not surprising to see about 20% need over $100,000 a year in retirement, and another 42% are $75,000 to $100,000. That's almost two-thirds needing more than the ASFA Comfortable Standard which is sufficient for 33% of respondents. Only 6% accept the age pension level. All amounts assume home ownership.

There is a strong preference to self fund retirement, even if it means working longer or saving more, and seeing the retirement years as an opportunity rather than a post-work drag.

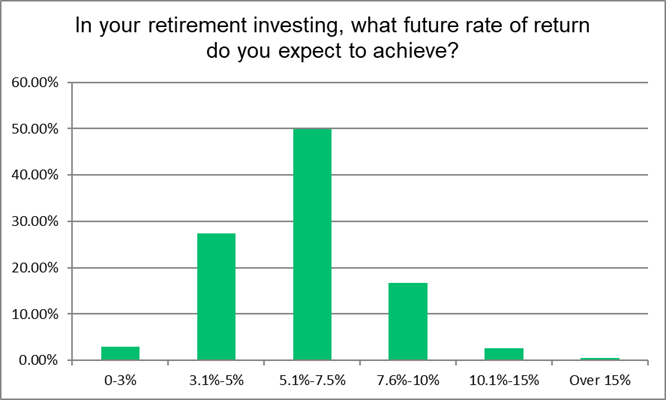

Q8. In your retirement investing, what future rate of return do you expect to achieve?

Most people expect a return on retirement savings of over 5%, with almost 20% aiming for a more optimistic 7.6% or more. Perhaps this question should have been asked in real terms, because if inflation hits 7%, strong returns may be flat in real terms, at least for the next year or so. High inflation is not expected to last forever, even if the days of ultra-low interest rates are gone.

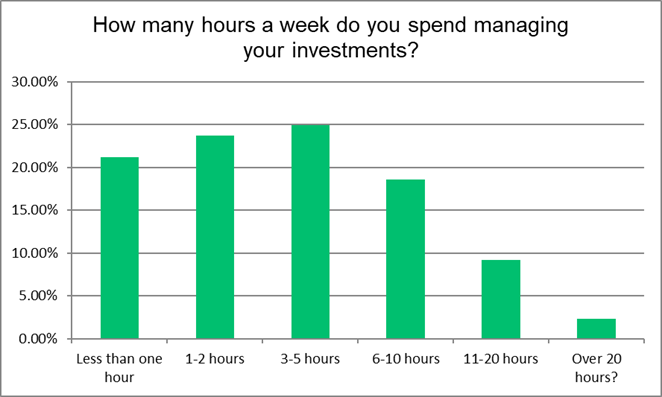

Q9. How many hours a week do you spend managing your investments?

Managing investments occupies a decent chunk of the lives of many retirees, with 30% spending six or more hours a week on their portfolio. For a small minority at over 30 hours a week, it's a main activity. Some of the comments are:

"I enjoy economics and finance. I read and listen a lot but leave my investments alone. Inflation has eroded less of my cash position (30%) than the fall in my equities. Waiting for equities to approach fair value before buying selectively."

"Went to a financial adviser and got things sorted out just the way we like them. Doesn’t require too much managing now."

"This includes reading the Australian Financial Review, Firstlinks, Morningstar."

"My partner loves doing this for our SMSF so I just keep up with my reading on financial affairs and attend monthly investment meetings."

Thanks again to everyone who participated.