Developing retirement solutions is the next big challenge facing the superannuation industry. And it is about to get serious. The Government is currently framing a Retirement Income Covenant (RIC), expected to come into operation on 1 July 2022. Treasury recently released a Position Paper that states the intent of the RIC is to:

“codify the requirements and obligations of superannuation trustees to improve the retirement outcomes for individuals”.

The RIC will require trustees:

“to formulate, review regularly, and give effect to a retirement income strategy”.

The impending codification will act as a catalyst for the major super funds to move from navel-gazing towards taking action over their retirement offerings. The focus of this article is how the framework might work for these funds. The RIC will also cover SMSF trustees who will need to consider whether their retirement strategy should be more formalised.

Principles for design, not a prescription

Rather than prescribing a retirement product, the RIC Position Paper focuses on the principles for strategy design. It discusses how funds might develop retirement strategies to balance the provision of income, management of risk (specifically investment and longevity risk), and flexible access to some funds.

We believe the RIC should also address how retirement strategies are delivered. Arguably matching retiring members with suitable retirement strategies is at least an equal, if not greater, challenge than designing those strategies in the first place.

The Government has intimated they want member choice to sit at the foundation of the retirement system. Indications are that they envisage individuals selecting a retirement strategy for themselves. This might occur through accessing information and decision support tools such as interactive financial calculators, which could be made available by their fund or other providers (perhaps ASIC MoneySmart).

Or it could occur under the guidance of financial advisers. Eventually, robo-advice might even play a role. Basically members would be expected to directly exercise choice over their retirement solution, including the products making up the strategies and their providers.

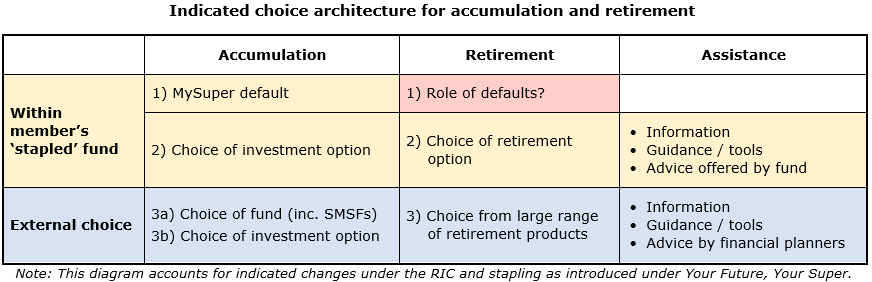

A purely choice-based architecture of this type would create some dissonance with the framework prior to retirement with which fund members are familiar. The figure below describes what the currently envisaged retirement framework might look like, and how it compares to the accumulation phase. A key point of distinction is that defaults play a central role in accumulation. Nearly 60% of pre-retirement assets of the major super funds are invested in MySuper defaults.

Capacity of members to select a retirement product

Thrusting members into an environment where they need to choose for themselves after they retire gives rise to a number of issues. An important concern is the willingness and capacity of members to engage with financial decisions. Research finds that most individuals have relatively low financial literacy. They can also be subject to various behavioural influences that may lead to sub-optimal decisions. This includes difficulties in processing information, anchoring on obvious choices, myopia and cognitive decline with age – just to name a few.

The difficulty of exercising choice in retirement is only compounded by the complexity of the problem. Managing finances in retirement requires deciding where to invest and how much to draw over a few decades, while accounting for other assets and income sources such as the age pension. Market returns are uncertain and people don’t know how long they will live. The difficulty will only be further exacerbated by a likely proliferation of available retirement products, which the Government seems keen to encourage in order to spur innovation and create competitive tension.

The hurdles to effective self-choice might be overcome if people were willing to seek professional financial advice. Unfortunately, this is not likely to provide a solution for the masses. A full Statement of Advice reportedly costs $3,000 to $4,000, a price many retirees are not willing to pay. Further, the financial planning community is constrained in providing advice at scale. Personal advice is time-consuming, and adviser numbers have fallen sharply post the Royal Commission.

There is another way of matching retirees with suitable retirement solutions apart from relying on either financial advice or making a self-directed choice. Retiring members could also be given an option to request that their super fund selects a retirement solution on their behalf. We call this ‘fund-guided choice’.

The selection could be framed as a recommended retirement solution that the member can decide to accept or not. Alternatively, the member might choose to ask their fund to assign them to a solution, followed by sign-off to confirm acceptance.

Some members will trust their fund to make a selection

We suspect that many retirees might welcome the opportunity to ask their fund to make a selection for them. Research indicates that a substantial portion of fund members are willing to trust their fund, and are content to accept options put in front of them due to a lack of confidence to decide for themselves. Fund-guided choice would be closer to what happens prior to retirement for those members who have willingly accepted the default.

Fund-guided choice could also introduce some useful nudges into the decision process that may improve member outcomes. Many retirees arguably limit the amount of value they extract from their retirement savings due to reluctance to draw down on savings to the extent affordable, minimal take-up of longevity insurance and investing too conservatively. Fund-guided choice could assist in addressing these issues through offering solutions to member that embed a suitable mix of higher drawdowns, longevity insurance and growth asset exposure.

The choice framework we suggest might operate through funds asking retiring members to choose one of the four options listed in the figure below. The election of option A or B invokes fund-guided choice, which might be followed by an invitation to furnish additional information to assist the fund to select a suitable solution. The menu of options might be supported by the provision of general and product information and various decision tools.

Choices that might be put to a retiring member by their fund

Please choose one of the following options:

A. Please assign me to a retirement solution

B. Recommend a retirement solution to me

C. I want to choose a retirement solution for myself

D. Please refer me to a financial planner

Note: A prior step would establish the balance that the member wishes to transfer into a retirement solution with their fund

The question arises as to what happens when members don’t make a choice, perhaps because they are heavily disengaged. At a minimum, the fund might continue to attempt engagement. It might also be helpful for funds to have the scope to assign members to a retirement option under certain conditions, although this would run counter to a purely choice-based system.

Obligation to engage at retirement

The RIC offers an opportunity to establish a framework that caters for various types of retiree according to how they prefer to engage with choosing a retirement solution. This could be achieved through placing an obligation on fund trustees to engage with members at retirement to establish their preferred mode for choosing a suitable retirement solution and giving effect to their choice. These obligations might be included alongside those to develop retirement income strategies. Doing so should ensure that funds not only develop retirement solutions, but also that retirees can engage with the process in the way they feel most comfortable.

Dr Geoff Warren is an Associate Professor at the Australian National University's College of Business and Economics and sits on a number of advisory boards. David Bell is Executive Director of The Conexus Institute, a not-for-profit research institution focused on improving retirement outcomes for Australians. This article does not constitute financial advice.

Further detail can be found in this opinion piece.