An SMSF needs a balance of at least $200,000 to be cost-effective and sustainable, new research by SuperConcepts and The University of Adelaide’s International Centre for Financial Services has found.

A major study, When Size Matters: A closer look at SMSF performance, based on more than 88,000 fund-year observations, examined the performance of four fund sizes. The study found that SMSFs with balances over $200,000 significantly outperformed smaller funds in both cost-effectiveness and investment diversification. All SMSFs in the study had outsourced their administration.

Just over 20,000 individual funds, with an average asset value of $845,000 and average annual expenses of $8,919, were examined using figures from the 2008-9 to 2014-15 financial years.

The fund sizes were:

Size 1 funds: Asset values less than $200,000

Size 2 funds: Asset values between $201,000 and $500,000

Size 3 funds: Asset value between $501,000 and $1,000,000

Size 4 Funds: Asset values greater than $1,000,000.

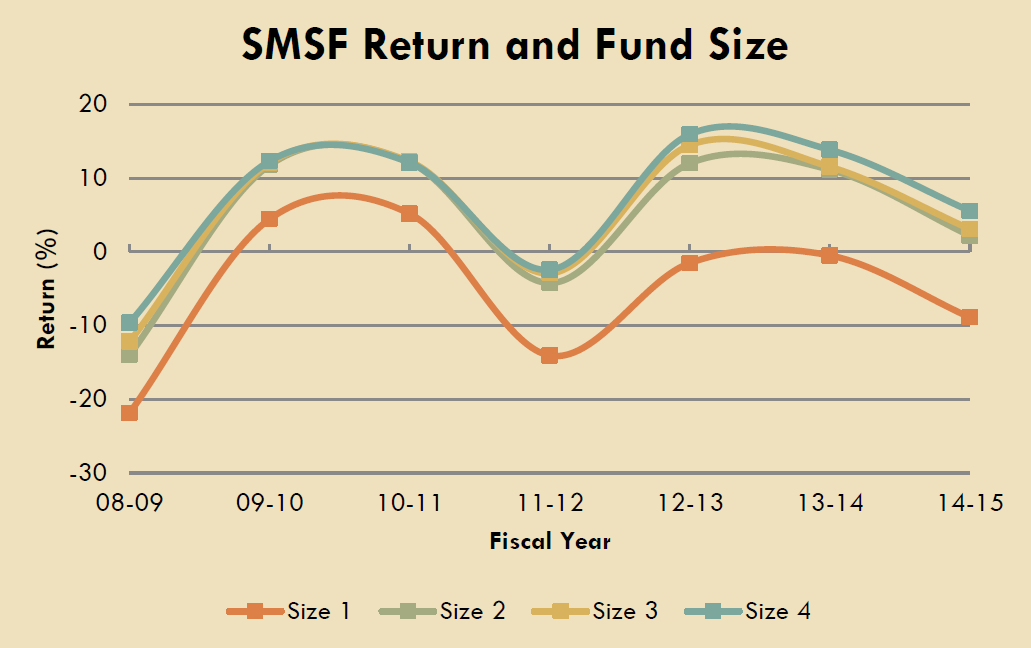

As shown below, SMSF performance was found to be relatively similar for size 2 to 4 funds, although fund size 4 outperformed the others slightly during the last three fiscal years of the study period. The smallest size 1 funds consistently underperformed against all other sizes, and posted negative returns in five of the seven sampled financial years, including the last four.

SMSF performance

Diversification into asset types

The study measured diversification by the number of asset classes in which a fund had invested with a weighting of 10% or more.

The largest size 4 funds held significantly more asset classes than size 1 SMSFs and, in fact, a balance of less than $200,000 showed deterioration in asset diversification.

“Fund diversification has, on the whole, marginally improved over time,” the report says. “At the beginning of our sample period, the average fund held investments in 2.06 asset classes, and this has increased to 2.15 at the end of our sample period. We observe an inverse relationship between the level of diversification and the volatility of fund returns.”

Expenses come in many guises

SMSFs incur many establishment and administration costs. The ATO’s list of common costs include:

- costs of complying with Government regulations

- SMSF’s annual lodgement fee

- life insurance or total and permanent disability insurance premiums

- investment research subscriptions, and

- costs for amending a trust deed.

As funds grow larger, the expense ratio drops due to greater operational efficiency.

“Expense ratios for the largest funds (size 4) are significantly lower than the expense ratios for the smallest funds (size 1). When a fund passes a threshold of having $550,000 under management, its expense ratio dips below 2%, whilst diversification and performance of the fund is comparable to any of the larger funds. Below this threshold, performance, diversification and expenses begin to deteriorate”.

The study concludes that while performance, diversification and expense ratios continue to improve as funds grow, these traits deteriorate in funds with asset balances below $200,000, making smaller funds inefficient. Some commentators suggest that small SMSFs are not sustainable and that the government should legislate a mandatory minimum size to start an SMSF.

Lee Anthony is studying for her Masters of Publishing at the University of Sydney. The full report can be downloaded here: 'When size matters: A closer look at SMSF performance'.