Did you know that 78% of SMSFs are set up with individual trustees but that over 90% of professional advisers I have canvassed would always recommend a Sole Purpose Company trustee? In the haste to set up funds, most people miss this vital step with many having to pay high fees to change trustee later.

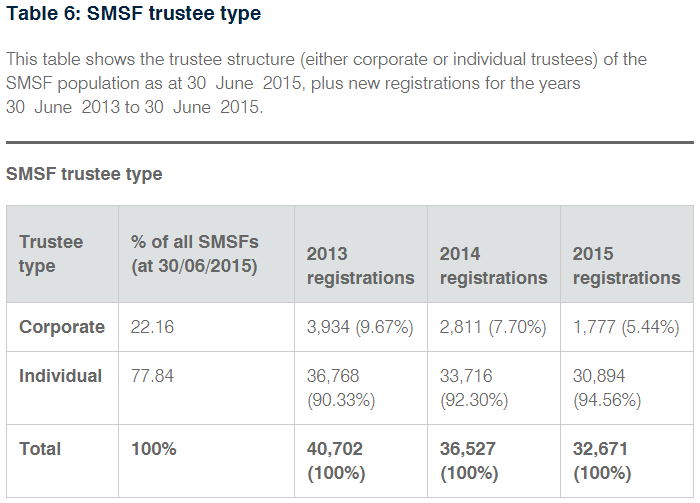

The issue is worsening as in the three years to 2015, there was a 4% decline in SMSFs registering with a corporate trustee. Of newly registered SMSFs in 2015, an incredible 95% had individual trustees (see: ATO Self-managed super fund statistical report – June 2015 appendix 1, table 6)

I believe it is essential to have a company as trustee and that the option to have individual trustees is short-sighted.

Benefits of a corporate trustee

A corporate trustee facilitates:

- Time to grieve or adapt. The strongest reason from 10 years’ experience with SMSFs is respect for your spouse or family’s needs in times of grief. Do you really want to leave them an awkward and expensive set of tasks to carry out just to save $700?

- Continuous succession. A company has an indefinite life span; it does not die. A corporate trustee can ensure control of an SMSF is more certain following the death or mental or physical incapacity of a member.

- Administrative efficiency. When members are admitted to, or cease, membership of the SMSF, all that is required is that the person becomes, or ceases to be, a director of the corporate trustee. The corporate trustee does not change as a result. Therefore, title to all the assets of the SMSF remains in the name of the corporate trustee, especially useful when dealing with property in an SMSF.

- Sole member SMSF. An SMSF can have one individual as both the sole member and the sole director. Likewise, if a spouse is incapacitated, then the husband or wife can act as director under an enduring Power of Attorney to run the fund on their own without the need for interference by others.

- Meets lenders’ requirements. Most lenders require a corporate trustee in the SMSF as it is easier to deal with.

- Higher Loan to Valuation Ratios accepted. With a corporate trustee, many lenders will go to 80% on residential loans and 70% on commercial real estate.

- Greater asset protection. As companies are subject to limited liability, a corporate trustee will provide improved protection for the directors where a party sues the trustee for damages. I use an electrician as an example here when I discuss this with clients. If he is on your property and is electrocuted because of the owner’s (SMSF) negligence, then the SMSF may be sued but your own personal liability is limited to your shareholding and member balance rather than your entire wealth

Problems with individual trustees

Individual trustees cause issues with:

- Paperwork at the worst time. Welcome to a nightmare. When a spouse has barely had time to start grieving, they need to manage the SMSF and administer pensions, investments and deeds. Minutes to record death of trustee, deed update to add a new trustee or move to a corporate trustee, off-market transfer forms and identity forms and probate forms to put every investment in correct name(s). Worse still, deal with the Land & Property Management agency or Office of State Revenue and their endless forms!

- Complexities relating to death. If the SMSF has individual trustees, e.g. a husband and wife, then timely action must be taken on the death of a member to ensure the trustee and member rules are adhered to properly. For example, SMSF rules do not allow a sole individual trustee/member SMSF.

- Extra and costly administration. To bring in a new member to an SMSF with individual trustees requires that person to become a trustee. As trust assets must be held in the names of the trustees, the title to all assets must be transferred to the new trustees.

- Sole member SMSF. A sole member SMSF must have two individual trustees. Does a spouse need to rely on the children, possibly from the first marriage? That’s really not going to work as we know what a problem blended families are when it comes to estate planning.

- Tighter lending rules. Lower LVRs are common, due to legal concerns, lenders restrict the maximum borrowing of an SMSF with individual trustees to 70% for residential properties and 55-60% for commercial real estate.

- Less asset protection. If an individual trustee suffers any liability, the trustee’s personal assets may be exposed. The trustee as well as the SMSF may be sued by someone doing work for the SMSF.

What do the ATO and ASIC think?

The Australian Securities & Investments Commission (ASIC) and the Australian Taxation Office (ATO) prefer corporate trustees. Last year, ASIC released a number of documents which outlined the advantages of an SMSF corporate trustee.

More recently, the ATO released an article and video on SMSFs titled Choose individual trustees or a corporate trustee that objectively outlines the pros and cons.

And even more advantages of a corporate trustee

With a bit of preparation and planning, combining your will and enduring powers of attorney, minuted resolutions and if needed clauses written into the deed, a person (usually the Executor or Legal Personal Representative) can be immediately appointed as a director so that the fund can continue to operate in the event of death regardless of whether a death certificate or probate have been granted.

Likewise, a person who loses mental capacity needs to be replaced if they were individual trustees. With a company, the constitution can immediately have a mechanism which allows the person holding the enduring power of attorney to be appointed as a replacement director, resigning the incapacitated director at the same time.

Under ASIC’s new administrative penalties, if a fine is made in relation to an SMSF that has individual trustees, then each trustee will be fined in their personal capacity. The fine is personally payable and cannot be reimbursed by the fund. Only one fine is payable by a corporate trustee.

It is also easy for Superannuation Industry Supervision (SIS) regulation 4.09A(2)(a) to be contravened by an individual trustee. It says:

“A trustee of a regulated superannuation fund that is a self-managed superannuation fund must keep the money and other assets of the fund separate from any money and assets, respectively: … (a) that are held by the trustee personally …”

For example, if individual trustees receive rental property income or a dividend into a personal account in their own names instead of an account in their personal names but with the account designation of their SMSF, it is a contravention. With a corporate trustee, it’s far less likely to mix fund assets with personal assets.

Summary

It’s difficult to believe that 90% of SMSFs are currently being established with individual trustees. Even if some costs of registering a company are initially avoided, the trustees are almost certainly inviting complications later in the life of the SMSF.

Liam Shorte is a specialist SMSF advisor and Director of Verante Financial Planning. This article contains general information only and does not address the circumstances of any individual. Professional personal financial advice should be sought before taking action.