Many commentators are comparing the current potential for a couple to place over $1 million into super by 30 June 2017 with the Peter Costello top up of a decade ago. On 5 September 2006, the then-Treasurer said, "People will be able to make up to $1 million of post-tax contributions between 10 May 2006 and 30 June 2007." The inflow to super was unprecedented, as documented in this article. In 2007, SMSFs alone received contributions of $70 billion compared with only $20 billion in 2006.

The timing could not have been worse. It was at the end of a massive bull market which had started over four years earlier in March 2003, creating great confidence in equities as a place for retirement savings. We all know what happened next.

Source: Yahoo Finance

On 1 November 2007, the All Ordinaries Index peaked at 6,873 (versus its current level of about 5,800) and then the GFC hit, destroying the retirement plans of thousands.

Anecdotal evidence from super funds and advisers this time confirms the flows are strong but nowhere near the levels of 2007. Most of the investments are into balanced funds or in line with the usual allocation weightings where the Australian shares component is less than 30%. There is also far greater wariness of super following years of rule changes, and less of the blind optimism of 2007 as we are not on the back of a confidence-inducing rally.

According to the latest Westpac/Melbourne Institute survey of the 'Wisest place for savings', desire for shares has been falling since 2004 while bank deposits and repaying debt are strongly favoured. Superannuation (which is an investment vehicle, not an asset class) has kicked up strongly recently but from a low base (data is for the general population, not retirees and high net worths).

Source: Westpac/Melbourne Institute, AMP Capital

There's little evidence of super-injected flows pushing up Australian shares this year, perhaps also countered by tax-selling to realise capital losses at this time. Those who were hoping for a supercharged rally in the ASX underestimated the structural changes since 2007.

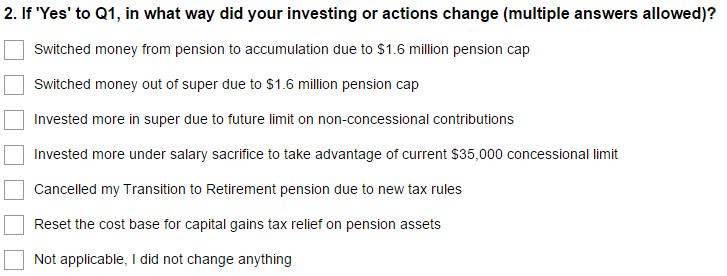

To find out what our readers did with their super as a result of the changes, we are running this short survey, and the results will be published next week.

To show the opportunities available prior to 1 July, here's a peek at one of the questions:

Graham Hand is Managing Editor of Cuffelinks.