The claims and counterclaims about the impact of the proposed superannuation changes on the 2016 Federal Election result have become as common as the retributions over the Government’s struggles to achieve a majority. On 6 July 2016, The Australian Financial Review ran an article titled, ‘No surprise that voters left Coalition thanks to super changes’ which cited many examples of disenfranchised supporters and the betrayal of principles.

Two pieces of evidence take opposite sides of the debate.

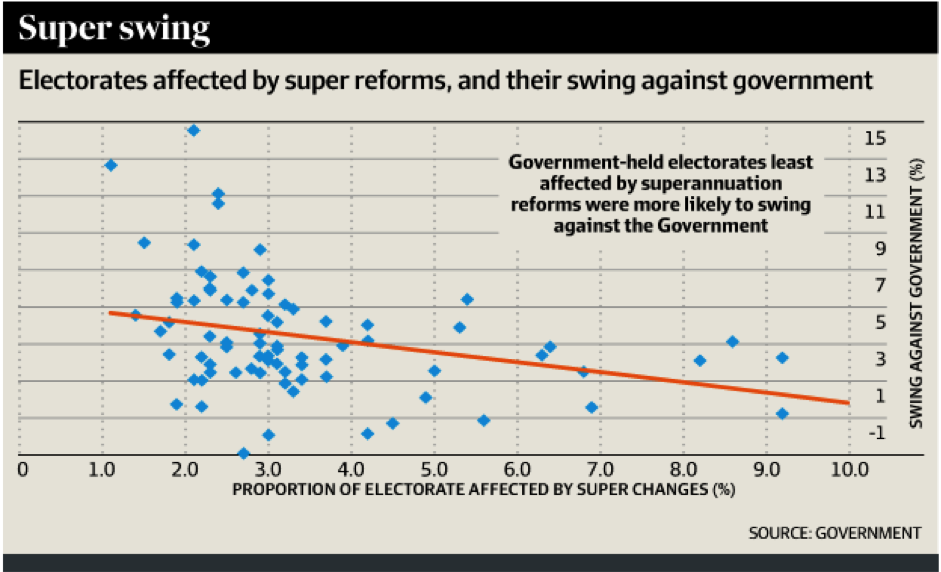

Treasurer Scott Morrison used electoral data to show there was no correlation between swings against the Government and the proportion of the electorate affected by super changes.

The statement from the Treasurer was partly in response to Liberal Senator, Eric Abetz, who had said:

“The issue of superannuation is very dear to the core base of the Liberal party. To have the certainty of that being compromised did send shock waves through that sector of the community that are our core supporters. From right around Australia I got very strong feedback that that was not the way to go forth and I trust that we will revisit aspects of that policy.”

Supporting claims of the impact on voters were exit polls taken by Nine-Galaxy in the 25 most marginal seats. It showed that superannuation changes rated as very important for 37% of voters, the fourth most important issue after health and Medicare, education and economic management.

Amid all the anecdotes and anger, we have prepared a short survey to gauge your reaction to these claims, on both your own voting intentions and the overall impact on the election results. We will publish the results next week.