The Your Future, Your Super (YFYS) annual performance test will apply to MySuper products from 1 July 2021 and ‘trustee directed’ products from 1 July 2022. Some of its key features are:

- Product performance is tested against a benchmark comprising prescribed indices weighted in line with a fund’s strategic asset allocation (SAA). This means that the test measures the effectiveness of a fund’s implementation of its strategy relative to its YFYS benchmark, not the suitability or performance of the strategy itself.

- The performance measurement period is generally eight years (seven years for the first test). While a year of ‘good’ performance helps, each year is the start of a new performance period and so consistency of performance will be rewarded.

- A product passes the test provided the product return (including allowance for administration and advice fees) does not underperform the benchmark by more than 0.5% pa.

A test with teeth and major consequences

The result of failing the performance test is highly visible. Funds must send their members a notice (by paper mail, adding another expense) commencing with the words:

'Your superannuation product has performed poorly. You should consider moving your money into a different fund'

It's an unpalatable action for any fund. Two successive years of failure will see a product barred from accepting new members, which would damage cash flow and destroy the viability of most funds in a reputational sense.

So, this is most definitely a test with ’teeth’. All funds will weigh up the priority that should be given to meeting the performance test relative to other objectives. Some, perhaps most in the longer term, will change how their investment portfolios are designed and managed.

The risk of underperformance

As an indication of what might be in store, using APRA’s December 2020 MySuper Product Heatmap, 11 single strategies, and a similar number of lifecycle strategies, were more than 0.5% p.a. behind the Listed SAA Benchmark over the six years to 31 December 2020. It’s important to note however that the YFYS performance benchmark differs slightly from the Heatmap benchmark.

Looking forward, a year-by-year approach which blends past performance with forward-looking modelling will be required for products that have experienced underperformance in the past eight years.

Longer term, our analysis of a subset of MySuper options suggests a typical forward-looking probability of failing the performance test over a single eight-year period falls in the range of 10-15%. There is obviously some variability between products, with estimated tracking errors relative to the YFYS benchmark ranging from 2-4% per annum and probabilities of failing the performance test over a single eight-year period ranging from 6-16%.

While the likelihood of failing the test over a single eight-year period is a useful starting point, it doesn’t accurately represent the prospect of the fund failing the performance test over a longer time period that incorporates a number of rolling eight-year time periods.

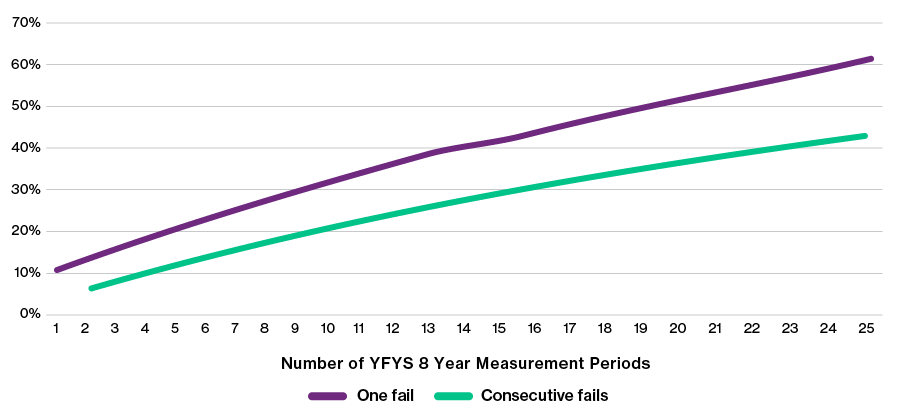

The chart below demonstrates the cumulative probability of failure over longer periods, assuming a 10% likelihood of failure over a single eight-year period.

Cumulative probability of failing the performance test

If we look at 10 consecutive performance measurement periods, covering a total of 17 years of fund performance (i.e. the first test covers years one to eight, while the 10th test covers years 10-17), the cumulative probability of underperformance reaches 35%. If we extend this to 20 measurement periods, then the cumulative probability of underperformance increases to over 50%.

Over the same period, the likelihood of failing the test in two consecutive years is also around 35%. The longer-term risks of falling foul of the test are clearly material.

Implications for super funds

We have already seen funds make portfolio and product changes, in anticipation of the test becoming law. Conceivably, we could see a bifurcation of strategies adopted.

Those with a strong brand name and market presence, or a well-defined and ‘sticky’ membership base, may consider a failure of the test (at least for one year) to be manageable and hence may be comfortable sticking with their existing investment approach and strategy.

Those with a weaker franchise might make passing the test their highest priority, dialling down the underperformance risk to an acceptably low level.

The broader implications of the YFYS package will play out over several years. It seems clear though that prioritising investment objectives, including determining how much emphasis to place on the YFYS performance test, will become a top tier issue for all funds.

Nick Callil is the Head of Retirement Solutions and Tim Unger is Senior Investment Consultant at Willis Towers Watson Australia. This article is general information and based on a current understanding of the YFYS legislation.