A summary of our survey results and additional comments is provided below, with the full version linked here.

Why have Australians and French people reacted differently to increasing the eligibility age for pensions?

The main themes explaining French and Australian reactions to changes in pension eligibility ages include cultural differences, prior history of fighting for rights and freedoms, each country’s existing retirement and taxation systems and the perceived fairness/unfairness of the change.

- It’s more about Macron and the political landscape than about the retirement age.

- French people are used to the age pension starting a lot earlier. No one probably has tried to increase the eligibility age at all and this was a shock. Australians have become conditioned to increases in the eligibility age.

- Ours has been increased gradually over time. France went from 65 to 60 and are now battling to raise it back up.

- Largely national character. Australians are mostly accepting of change and more moderate in response, coupled with often debt being carried into near retirement age, necessitating working longer anyway. The French are more passionate, expressive, and volatile by nature. Not a bad thing, just different, but it's historically how they react.

- The French tend to have a negative view on many issues. Macron is actively disliked by most French people, but the other presidential choices were considered worse. French people have a history of being informed and more active in the expression of views than Australians who use terms like, 'the silent majority'. The French pension reform is more immediate than the Australian introduction to raise the eligibility age. It was not approved by parliament and was enacted using a special presidential power. Most French people will rely almost completely upon their govt. pension that they have financially contributed to unlike Aust. People in France tend to strongly believe that retirement life is very special after a more rigid employment system. Transitioning to retirement is not as common as Aust. I am Australian and have been living mostly in France/Switzerland since retirement over 6 years ago.

- The French have a history of revolution and protest - it's part of their nature; not so for Aussies, or much less so.

- Because the French pension system is "pay-as-you-go" they have paid directly for it so feel more entitled to its timing. Ours comes out of consolidated revenue so there is a lesser sense of entitlement.

- A case was presented to the Australian people outlining the reasons for the increase. One reason being we can't afford to pay the pension to retirees from such a young age. It was a reasonable argument and made sense to most people.

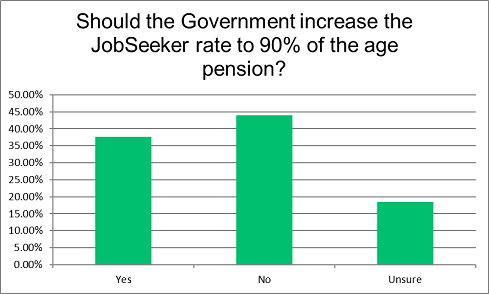

Should the Government increase the JobSeeker rate to 90% of the age pension?

While more people answered ‘no’ to this question than ‘yes’, the comments reveal that many would still prefer to see an increase, but for a lesser amount. Some suggested a tiered approach, where there are larger payments to begin with to assist with job seeking, reducing in time to a more basic level. Another common concern was the need to avoid creating a disincentive to find work, while not leaving people to live in poverty.

- JobSeeker is short-term welfare to bridge involuntary employment while the age pension is a long-term safety net for the aged.

- There are expenses that are unavoidable on JobSeeker, such as a working mobile phone, internet and a computer to apply for jobs and lodge Centrelink forms, transport to interviews and decent interview clothes that those on a pension can avoid.

- If age pensioners find it hard to live on the pension how can younger people get by on less?

- My answer would be yes, provided it did not diminish the desire to look for a job.

- The JobSeeker rate should be set to encourage people to return to the workforce. I would suggest a tiered payment system that reduces the longer you are using the supplement.

- JobSeeker rules, requirements and dollar amount are criminal. More needs to be done about financial education in formative years so that as adults people stand a chance at achieving.

- I really struggle to understand how anyone is on JobSeeker in 2023 when most businesses are crying out for reliable workers? I strongly suspect there is a large group who should be on a disability pension or more appropriate benefit for their circumstances with a very small cohort of diehard slackers who have no genuine intention of contributing to society and they don't deserve rewarding. Thus, has it always been.

- The current level is insufficient for a basic standard of living.

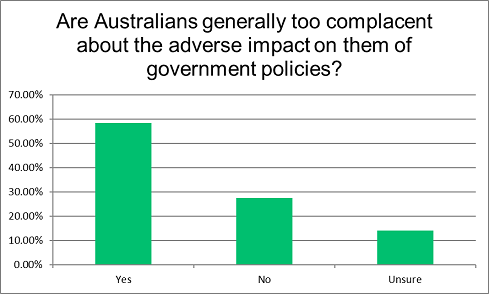

Are Australians generally too complacent about the adverse impact on them of government policies?

Most respondents agreed that Australians are generally too complacent when it comes to government policy changes, but there were also those that were more pragmatic, reflecting on our governments being more ‘centre’ than far left or right, and that Australians pick their battles. Some policy changes are more palatable than others, and the ones that aren’t, are protested against (generally in a non-rioting way) or the party voted out next election.

- Whilst the protest movement that characterised the 1970s has long gone, I wouldn't call us complacent. We simply respect an orderly society, and store up the pluses and minuses until we get to the ballot box.

- Our political system of compulsory voting and proportional representation ensures politicians remain sensitive to the views of the electorate, of voters.

- We understand both sides of the argument we don’t just think how does this affect me we also understand that some policies need to be changed because they are unsustainable in the long run.

- Politics in Australia is very centrist, and policies don't differ too much between the main parties, so the majority of people can accept any initiative, regardless of the government of the day. European politics is far more a question of left or right / socialist or liberal.

- Yes, sometimes. Despite many posthumous bad or average outcomes, the majority aren't prepared to get fully across the issues and determine the likely impact of policy changes. Much of it is maybe because of the type, course and nature of media consumed to stay ‘informed’. Nowadays, perhaps more than before the media can be extremely biased, often supporting or pushing a government agenda because their politics is aligned. Often all the facts or a balanced presentation are deliberately omitted.

- This is a very broad question, but it is characteristic of Australians to trust authority and be prepared to contribute at some cost to themselves. This has social cohesion benefits by accepting 'the decision' while not really liking it.

- It seems to vary considerably from issue to issue. I would love to understand why some changes in government policy attract aggressive responses while others are more muted. What drives the bandwagon effect?

- We believe in Democracy so unless it's really ridiculous we accept it. Next election sorts them out.

Leisa Bell is Assistant Editor for Firstlinks. The views of our readers do not necessarily reflect those of Firstlinks.