The machinations that have now led to changes to the originally declared purpose of the Future Fund (Fund), treat the Australian taxpayer with utter disdain.

The Government and the Parliament of 2006 entered into a clear ‘agreement’ with Australian citizens that is not being honoured. The conduct by successive governments in overseeing the Fund exemplifies why there is widespread distrust in politicians.

In 2006 the Fund was created and seeded with approximately $60 billion of Australian citizens capital. It was created with a clear purpose as declared by the public statements of the Howard Government that was notably omitted in the legislation. That declared purpose was to create a financial mechanism to meet the burgeoning unfunded liabilities of the defined benefit schemes of politicians, bureaucrats (including judges), and defence personnel.

The Future Fund was established as part of a broader strategy to improve the long-term financial position of future Australian taxpayers. The Fund aimed to cover the largest liability on the government’s balance sheet that existed in 2006.

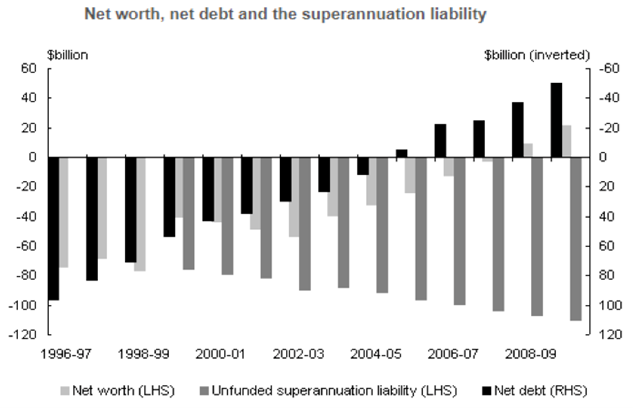

Readers may recall that in 2006, the Commonwealth had no net debt whilst the Commonwealth Defined Benefit Scheme was an actuarial assessed superannuation liability. The table below — published by the Australian Treasury in 2006 — disclosed the position and the projected outlook at that time.

By 2006, the government had taken a number of decisions to reduce the burgeoning cost of the unfunded superannuation liability. These included:

- Closing the Parliamentary Contributory Superannuation Scheme to new members of Parliament from 9 October 2004;

- Closing the defined benefit Public Sector Superannuation Scheme to new members from 1 July 2005; and

- Making one-off payments totalling $5 billion to extinguish fully the government’s liabilities relating to the Telstra and Australia Post Superannuation Schemes and various state rail employees.

Shifting public service employees from defined benefit to accumulation schemes reduced the fiscal risks to the taxpayer and checked the growth of the superannuation liability arising from civilian public sector employees. The sole remaining defined benefit scheme of any significance still open to new members was (in 2006) the Military Superannuation and Benefits Scheme.

In a report to the Parliament in 2017 the former Fund’s chair Peter Costello, noted that the liabilities lay in defined benefit schemes that had been closed, but which continued to accumulate liabilities from public servants still working under the scheme. He noted that paying out those liabilities could run until 2085 — depending on the lifespan of eligible members and (presumably) their surviving partners!

The original actuarial assessment

In 2006, the Commonwealth actuaries estimated (and documented) that the Commonwealth (i.e. taxpayers) liability for unfunded defined benefits was approximately $100 billion, or 10% of Australia’s 2006 GDP.

Therefore, a strategy had to be urgently developed to secure the servicing of these liabilities. More so because demographic research indicated that fiscal stress would be created by the ageing Australian population that would progressively retire from the tax paying workforce from 2010.

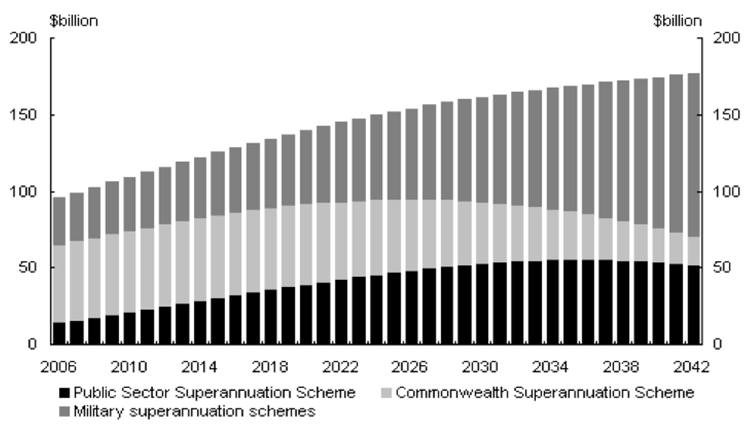

The next chart shows the 2006 actuarial forecasts of the ballooning liability, as more public servants moved into retirement with defined benefit pensions. Of note is that in 2006, when the Fund was set up, it was forecast that the liability would be about $140 billion (in 2020). The target set by the parliament for the Fund’s size was to aim for this amount. To achieve this targeted value, the targeted return (portfolio return target) was set at an average of 5 per cent above inflation. The target was set for 2020, and it was achieved!

However, the bad news, that was kept away from the taxpaying public, was that the Commonwealth actuary had grossly underestimated the liability as at 2020. The mistake has never been fully investigated or publicly scrutinised. What assumptions were made that were hopelessly flawed? The $60 billion actuarial error passed by the financial and political press, with no commentary or assessment. There was no “jumping up and down” by the Labor Opposition - as some were and remain beneficiaries of the Fund.

By 2020 the estimated liability was increased to over $200 billion, and the Morrison government (with Parliamentary approval) had already declared that the Fund would have another six years (till FY27) to accumulate enough capital to meet the new assessed liability.

Thus, in 2020, the budget continued to pay out about $8 billion to beneficiaries of Commonwealth defined benefit pensions – whilst the Fund was left untouched. In the latest budget (FY24) these annual pensions appear to have ballooned to over $15 billion – some 2.5% of total budget outlays - whilst the Fund has grown to $230 billion.

After 18 years of accumulation from that initial ceding of $60 billion of taxpayer funds (some 6% of 2006 GDP), the laudable intention of the Fund — to free budgets from 2020 of the burden of making superannuation related payments — has not yet been activated.

(In passing I note that the $15 billion cash pension payment in FY24 is an estimate because it is hidden in the budget papers. No one in Parliament is concerned to question the actual defined benefit liability or how much pensions are paid each year. Meanwhile the national press seems challenged by the concept of unfunded public liabilities, assets and cashflows.)

Another delay in the payment of pensions by the Future Fund

Last week the Government announced that it will further delay Fund pension payments until 2033 when the fund (it is estimated) will expand to about $380 billion. This is $240 billion above what the actuaries originally forecast as to what was needed in 2006. It will be $180 billion above the forecast of 2020.

It begs the obvious question - what is the real liability for hard working taxpayers?

This week, the current Chairman of the Future Fund, Greg Combet declared that the current value of the Fund ($230 billion) covers 79% of the “estimated” superannuation liabilities. That would suggest the liability has now become $290 billion!

This declaration begs the further questions – Are Australian taxpayers being 'legged over' with the true hidden liability of nondisclosed defined benefits creating a liability that may never be fully met by the Future Fund? Are current and will future taxpayers pay for a superannuation scheme that benefits a few and is simply unaffordable?

Let's be clear - low income but essential workers - like aged care, childcare, cleaners, and nurses etc - pay their tax with little or no understanding that a part of that tax is constantly being allocated to pay the indexed lifetime defined benefit pensions.

Those taxpayers and particularly the latest working generation, can only dream of such a pension benefit. New taxpayers entering the workforce will surely object to their taxes being used to pay these indexed pensions as they struggle with cost-of-living pressures.

Time to come clean and fix this mess

The practical solutions for the Future Fund, that is for the benefit of the majority of Australians, are simple.

The Parliament needs to direct the Future Fund to either immediately begin to pay the pensions that it was set up to do, or to make capital payments to each beneficiary to extinguish the individual liabilities.

By the Fund paying the pensions then the annual cash savings to the budget could be redistributed as tax cuts to low-income earners. Also, for example, an allocation to the building of social housing - build to rent – could be undertaken. In that way the asset base of the Australian public can be replenished.

Through redirected budget outlays, essential assets would be owned by the public and not by a pension fund that is solely for benefit of retired politicians, retired judges and bureaucrats.

The payment of pensions could be made from the cash flows of the Fund as it is redirected to become the pension fund it was originally set up to do.

Alternatively, a mandatory capital payment to beneficiaries, would transfer the liability to their individual superannuation accounts. This is exactly what the overwhelming majority of Australians are required to do for their superannuation.

If the $230 billion sitting in the Fund is not enough to undertake either of the two options outlined above, then the public needs to know why?

The agreement and undertaking of 2006 needs to be honoured.

The public declarations of retired politicians, who continue to passionately argue for the Future Fund to be left alone, need to be factually examined with proper disclosures. What are their defined benefits? What superannuation or salaries do they or can they receive with those defined benefits? What benefits will accrue to their partners?

Also, what is the current highest annual defined benefit pension paid to any beneficiary? That would make an interesting disclosure given the current proposal to tax unrealised gains on $3 million pension funds.

John Abernethy is Founder and Chairman of Clime Investment Management Limited, a sponsor of Firstlinks. The information contained in this article is of a general nature only. The author has not taken into account the goals, objectives, or personal circumstances of any person (and is current as at the date of publishing).

For more articles and papers from Clime, click here.