Since the concept emerged in the late nineteenth century, retirement has evolved from a point in time to a short period before death to a multi-phased time of renewal, reinvention, and discovery.

The main drivers of change have been lengthening life spans and health spans and, with that, changing expectations for life after full-time work. Many people will choose not to follow conventional retirement patterns, and the economy and business must adapt, including valuing mature workers. Some people have even observed that the word ‘retirement’ may have certain unfortunate connotations and that we should consider retiring the word ‘retirement’!

Beyond Three Pillars

In the same way the retirement income system increased from one pillar to three pillars to adapt to changing conditions, it needs to keep evolving.

Several submissions to the Retirement Income Review (RIR) in 2020 said there were more than three pillars in Australia’s retirement income system. Additional pillars include work, equity release, non-financial arrangements such as pensioner discounts, other government payments, and inheritances. These are all sources of income that people may be able to draw on in their retirement.

We should no longer talk about a three-pillar retirement income system. It is time to give more voice to additional sources of retirement income, such as home equity and part-time work, providing an additional two pillars.

Accessing equity in the home was one of the options listed in the RIR for boosting retirement outcomes. It observed that:

“For most retirees, the family home is their main asset. Using relatively small portions of home equity can substantially improve retirement incomes.”

As well as introducing a new source of retirement funding, there is the added benefit of potentially staying in familiar surroundings (both home and neighbourhood) for longer.

As well as commercial providers of equity release products, the Federal Government, in recognition of the importance of home equity, also runs a scheme that allows senior Australians to supplement their retirement income by accessing the equity in their home through a government loan.

The Actuaries Institute’s public policy position on home equity supports measures that allow retirees to keep their home but access the equity to boost retirement incomes effectively, whilst acknowledging that the home provides significant financial and emotional benefits to retirees.

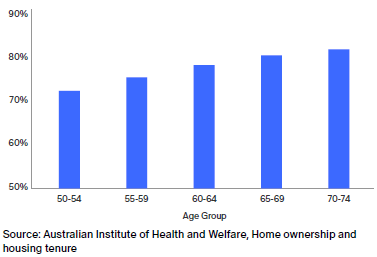

It is important to note that, while levels of home ownership are strong for current retirees, home ownership rates have been falling for several decades for those of pre-retirement age. The retirement planning needs for retirees who do not own their own home are very different. There is a high rate of poverty amongst retirees who are renters. The Institute’s public policy position supports measures that aim to improve the retirement outcomes of retiree renters, such as significantly increasing the rate of Commonwealth Rent Assistance.

Home ownership by age group

Financial advice, where art thou?

The RIR said that “the retirement income system is complex”. Add that complexity to longevity and other risks, and it is no wonder that Investment Trends research found that only 37% of non-retirees felt prepared for retirement.

It is as if we expect individuals to become experts in risk management — maybe even become their own defined benefit actuary!

The big challenge for individuals is effectively transitioning into retirement, including efficiently converting their retirement savings into retirement income. Alexis George, CEO of AMP, says: “We’re financially illiterate when it comes to retirement and the financial solutions available to us”.

Complications include:

- the need to optimise the use of their assets and access social security.

- how to best navigate health care and, ultimately, aged care.

- the uncertainty of future lifespan and whether their money will last.

- the disruption and emotional stress that can often be associated with retirement relate to both financial and non-financial issues.

The RIR noted that:

“Complexity and uncertainty, a lack of financial advice and guidance, and low levels of financial literacy are impeding people from understanding the system. As a result, some people fail to adequately plan for retirement and make poor decisions about how to use their savings in retirement.”

How can we better support individuals with their transition from full-time work? With a combination of timely and targeted Help, Guidance and Advice (HGA).

The gap between advice supply and demand

A great deal has been written on the gap between the demand and availability of financial advice. Less is said about the demand and availability of Help and Guidance.

Some Quality of Advice Review (QAR) recommendations risk categorising nearly all one-to-one interactions between superannuation funds and members as personal financial advice based on presumed knowledge. This compounds the challenge of identifying when simple guidance approaches would be helpful.

Fundamental to expanding the availability of advice, let alone the help and guidance components, is streamlining advice processes for financial advisers without compromising quality and expanding advice through superannuation funds.

Trustees currently face a conundrum: on the one hand, they are obliged by the Retirement Income Covenant to have a strategy that “identifies and recognises the broad retirement income needs of the members of the fund; and presents a plan to build the RSE’s capacity and capability to service those needs”. On the other hand, they must navigate the dangerous waters of personal advice obligations.

The interaction between the Retirement Income Covenant and the changes in financial advice regulation arising from the QAR is essential. The QAR has the potential to improve access to advice, specifically for advice related to retirement planning. Recommendation 6 is that “Superannuation fund trustees should be able to provide personal advice to their members about their interests in the fund, including when they are transitioning to retirement’.

The QAR views all advice to members as personal advice in the following circumstances: “the provider of the advice has considered one or more of the person’s objectives, financial situation and needs”. If these recommendations are accepted and legislated, it is likely that the vast majority of advice provided by superannuation funds and one-to-one interactions with members, including intra-fund advice, would be classified as personal advice and subject to the QAR “good advice” recommendations.

General advice will tend to be limited to other than one-to-one interaction between funds/trustees and members. As noted by the QAR, “Research reports, seminars and newsletters that are not individualised – directed to individual clients or adjusted or otherwise personalised for individual clients – will continue to be general advice”. Other examples may include websites.

For personal advice, the QAR recommends a shift from a prescribed “best interests” advice standard (with safe harbour steps) to a “good advice” standard and a fiduciary best interests duty for financial advisers. But what is “good advice”? The QAR suggests that it is “fit for purpose” and has the “usual consumer protections”. However, this is arguably ill-defined, subjective and untested (in courts). The apparent caution by many superannuation trustees regarding the QAR advice recommendations is understandable if most advice is deemed personal and a “good advice” standard is not yet defined.

An issue for both the Retirement Income Covenant and the QAR is the challenge for trustees to know enough about their members. Trustees only have a limited window into their member’s financial affairs and other important considerations such as home ownership arrangements and marital status. Furthermore, where a member is in a relationship, retirement planning is best done as a couple, and, as Wayne Swan, Chair of Cbus and former Treasurer, said at the recent AFR Wealth Summit, “We need to have a situation where we can provide financial advice to couples, but you can’t do that at the moment. [Plus] the social security system works on couples”. This requires further work.

Thoughts for Moving Forward

The future of Help, Guidance and Advice is a big discussion and here are a few ideas to get the ball rolling:

- Develop a well-defined HGA Framework. Actuary Michael Rice recommends matching regulatory requirements with the risk from the consumer’s perspective—for example, with requirements varying depending on whether personal advice is Simple (low risk), Comprehensive (medium risk) or Complex (high risk). The aim of this framework should be to expand the supply of HGA, making it easier for consumers to obtain the support they need, when they need it, and in a format that makes sense to them. The RIR contends, “While guidance of this nature is unlikely to fall with the definition of regulated financial advice, the definition of what constitutes financial advice is not always clear, and this ambiguity may explain funds’ reluctance to offer guidance”.

- Address barriers to superannuation funds knowing more about their members. Many trustees are reluctant to collect too much data from members directly due to concerns they may inadvertently be providing personal financial advice. In addition, trustees and members have privacy and information security concerns that must be addressed. Surely, it should be in members’ best financial interests for trustees to know as much as possible about their members to provide the best support possible as they make the difficult transition to retirement.

- Consider innovative regulatory approaches to expand the use of digital tools and technologies. While HGA offerings will always require a hybrid approach, we see the role of tools and technologies continuing to evolve, often involving triaging or providing initial guidance and advice before passing the consumer on to a personal advice provider, according to their needs and preferences. There is also a role for tools and technologies to support the personal advice provider.

- Be bold with advice reforms, including finding a new home for financial advice legislation.

We acknowledge that these initiatives are not straightforward and not without risks requiring careful management. The environment is constantly changing, and the demand for retirement planning support is growing. The time to act is now.

This is an edited extract from the Actuarie Institute's Retirement Matters paper.

Andrew Gale is an actuary, public policy expert in financial services, a non-executive director and a former Chairman of the SMSF Association. Stephen Huppert is a superannuation adviser.

The views expressed in this article are focussed on public policy and are personal views not made on behalf of any organisation. This article is not financial or tax advice and it does not consider the individual financial circumstances of any person.