More than 20% of Australians believe they won’t achieve their desired retirement standard of living, and half of those who are currently working admit they are unsure how much they will have, or need, when they retire. Some of the risks facing Australians who are nearing, or who are in, retirement are outlined below - as well as several ways to mitigate each of these.

The risks

The 2022 Natixis Global Retirement Index (GRI), now in its tenth year, is a multifaceted research tool that examines the factors driving retirement security. The 2022 GRI identifies three key risks - inflation, interest rates, and longevity risk.

1. Inflation

If you were unaware of what inflation was prior to 2022, you undoubtedly know what it is now. Simply put, inflation refers to the average price increases over a given period, typically a year.

The measure of inflation and deflation - the consumer price index (CPI) - rose 1.8% across the September 2022 quarter, and 7.3% annually; this marks the highest annual CPI increase since 1990. Further, the 9.6% annual increase in the price of goods was the highest since 1983. The price of non-discretionary goods and services increased 8.4%, with discretionary goods rising 5.5%.

Inflation can be particularly detrimental to those in retirement, as it not only chips away at savings and investment returns, but it does so to those with limited means to recoup that lost purchasing power.

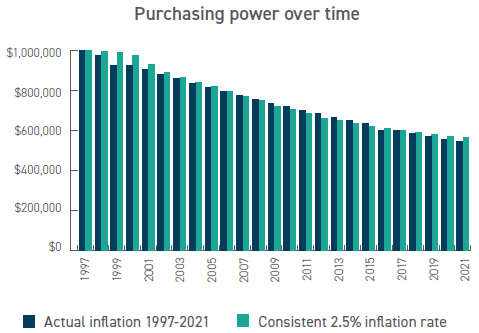

The Reserve Bank of Australia (RBA) maintains that the optimal target for monetary policy is to achieve an average inflation rate of 2% to 3% over time. However, even when inflation sits within the RBA’s target range, it can still be detrimental to savings over the long-term, as demonstrated in the chart below.

2. Interest rates

No Australians are more acutely aware of interest rate fluctuations than those in retirement, as the low rates of the past decade have made it difficult for retirees to generate income from their savings.

Many retirees who were unable to wait for bonds to begin returning a sustainable yield were forced to dip into the principal of their nest egg. This practice puts these people in the difficult position of lowering income expectations, accepting their assets might run out early, or raising risk profiles in an attempt to reduce losses.

However, there is a light at the end of the tunnel. As inflation has spiked across the globe, central banks have raised interest rates.

In Australia, the RBA has raised rates across the last six consecutive monthly interest rate decisions - from the historically low 0.10% in May to 3.1% this month.

However, raising rates, even quickly, is not an instant fix for spiking inflation. The RBA’s forecast is for CPI inflation of 7.75% this year, 4% in 2023 and 3% in 2024. Retirees relying on fixed income investments are not quite out of the woods just yet, as nominal bond returns are unlikely to outpace inflation for positive real returns for some time.

3. Longevity risk

Medical, economic, and societal advances mean people are drastically outliving life expectancy estimates from this time last century. While longevity is unequivocally good news for individuals, living a longer, healthier life requires people to have more financial resources.

For example, if you are currently 65 years old, your life expectancy at birth was around 68 for males and 74 for females. But due to significant social and medical advancements since the 1950s - when these estimates would have been made - healthy men and women in their 60s are now statistically expected to live for another two decades.

Longer lifespans mean many are faced with longevity risk, whereby a retiree runs out of money because they have lived longer than expected. The challenge becomes maintaining a comfortable, desired retirement lifestyle, while ensuring you will have the means to do so for the rest of your life.

The good news

While the three risks outlined above are daunting, and not to be taken lightly, there are few better countries to approach these challenges than Australia. Australia ranked fifth in the GRI’s rankings for global retirement security, behind only Norway, Switzerland, Iceland, and Ireland.

Australia ranked eighth in the 2012 GRI – remaining consistent over the decade - before jumping from seventh in 2021 to fifth in 2022. Scoring consistently high in health, quality of life, material wellbeing, and finances in retirement year-on-year, Australia and its well-rounded approach to retirement arguably sets the standard for much of the rest of the world.

Navigating the challenges

There are a number of ways investors can safeguard against the above risks and maintain their desired quality of life in retirement.

Make a plan

A November 2020 Australian Government report into retirement planning, saving, and attitudes found that many respondents were unprepared for life beyond work, with 68% of respondents admitting they had never considered how much they would need for retirement.

The majority (80%) of the remaining 32% of respondents who had estimated a retirement savings goal understood how much they needed to save per year to reach this goal, with 60% changing their behaviour after calculating how much they needed for retirement.

These statistics show the importance of planning. Understanding what is required to achieve your desired lifestyle in retirement will greatly help you to put together an accurate plan. There are countless resources available to help you, including the Moneysmart retirement planner and Cromwell’s ‘Countdown to Retirement’.

Don’t underestimate the impact of inflation

It’s important to understand the impact of inflation on your purchasing power, and the way in which it can chip away at savings, as well as understanding its impact on your investment portfolio.

Inflation above anticipated levels is generally considered detrimental to stocks and fixed income investments; however, real assets, including real estate, land, precious metals, commodities, and natural resources tend to fare well in times of high inflation.

Income from real assets is generally linked to inflation. For example, it is common for commercial real estate leases to have annual rent increases tied directly to increases in inflation - this is why commercial property is regarded as an inflationary hedge.

Understand your investment income

Understanding your investment income is straightforward, but it is the most important factor throughout retirement. Not only should you understand your income sources, but it is important to set realistic expectations that will allow you to live comfortably.

Retirement casts a new light on investment opportunities, particularly relating to an investor’s risk profile and unfamiliar tax scenarios: it is important for investors to look beyond familiar investment options to diversify and spread their risk across multiple sectors, geographic regions, and asset classes. Without a regular source of income, retirees need to minimise their longevity risk by looking for investments that offer both returns and capital growth.

Don’t underestimate how long you will live

Consider this: The retirement age in Australia is generally understood to be 67 years old, which is when an individual qualifies to receive Government Age Pension benefits - the main source of income for most retirees. However, according to the ABS, the average retirement age of all retirees as of May 2020 (the most recent information available) was 55.4 years, with 55% of people over 55 retired.

By the time most individuals reach 65 years of age, they are now expected to live for another two decades. This means a person retiring at age 55 must stretch their finances for, on average, another 30 years.

It’s important to note this is merely an average, many will live far longer than two decades from their 65th birthday. Therefore, it is vital to overestimate your own life expectancy, rather than underestimate it.

Consider unforeseen expenses

With luck, unforeseen expenses can be kept to a minimum; however, it is important to factor these in. Whether these costs are associated with real estate maintenance or repairs, having to care for a loved one in a crisis, or looking after your own personal wellbeing, unforeseen costs can be significant and need to be a key consideration.

Peta Tilse is Head of Retail Funds Management at Cromwell Funds Management, a sponsor of Firstlinks. This article is not intended to provide investment or financial advice or to act as any sort of offer or disclosure document. It has been prepared without taking into account any investor’s objectives, financial situation or needs. Any potential investor should make their own independent enquiries, and talk to their professional advisers, before making investment decisions.

For more articles and papers from Cromwell, please click here.