From 1 July 2016, the Australian Financial Services (AFS) licensing regime applying to SMSF services provided by accountants changed such that they can no longer provide recommendations around establishing or winding up an interest in an SMSF unless they are appropriately licensed to do so.

For those holding licenses, a new “educational, experience and ethical standards” regime came into play from 1 January 2019, lifting the educational and experience requirements to be a licensed financial adviser.

Mainly for this reason, many accountants have chosen not to go down the licensing path and stick to what they do: accounting. Some – who had been setting up, running and winding up SMSFs for their clients for years with no input from licensed advisers - have been forced to significantly change their practices as a result.

At the same time, there were substantial changes to the superannuation laws in 2017 with the introduction of concepts such as Transfer Balance Caps (TBC), transitional CGT relief, and Total Superannuation Balances (TSB) as well as complexities around Exempt Current Pension Income (ECPI). These all have direct and substantial impact on SMSF trustees and members.

Never has it been more important for a collaborative approach between accountants and advisers on SMSF advice and services. And yet, in my experience as both an adviser to SMSFs and more recently as a technical SMSF specialist working with accountants, there is still push back between the two professions in some pockets of the industry.

(Big, fat disclaimer here: #notallaccountants #notalladvisers)

Friction between professionals

Just as the builder and the architect mix like oil and water, so too do the accountant and the adviser often clash. The accountant seeks the best tax outcome for their clients within the framework of the relevant laws. The adviser does too, whilst applying sensible investment outcomes and seeking to ensure solutions remain workable, understandable and affordable.

The goals of each profession are intersecting and certainly both parties are working for the common good of the client’s best interests. Why can’t they get along?

The problem is that the lines between the two functions have blurred. The regulatory system is not perfect and advisers are stepping into areas that were traditionally the domain of accountants.

We have moved into an era where different specialists either have to work together hand-in-glove, or upskill and deliberately cross over into each other’s territory.

Consider the introduction of the $1.6 million transfer balance cap

Most retirees with substantial superannuation savings needed advice and assistance to prepare for the new rules and avoid penalties, and SMSF trustees in particular. Who do they turn to for this assistance?

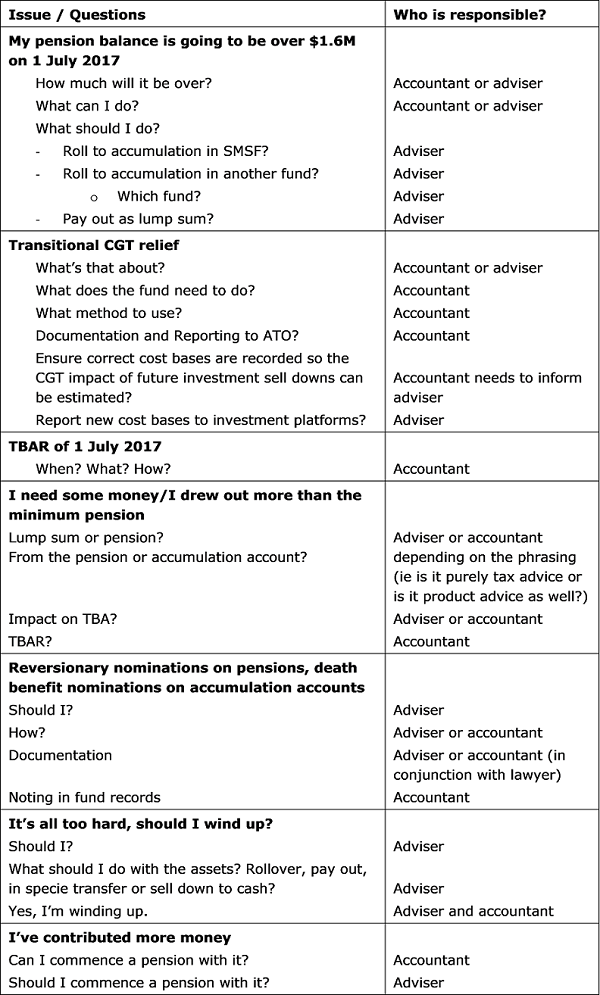

This table summarises some of the issues involved in getting a fund TBC-ready.

And on it goes. Both the accountant (or SMSF administrator) and the adviser play complementary and vital roles, but with grey areas and crossing-over of responsibilities. Where once it was quite separate, so it’s easy to see how friction can occur.

SMSF trustees are caught in the middle

It’s a new world for SMSF trustees, too. A trustee heading into retirement who prefers to be self-directed in investment selection may not have an adviser on an ongoing basis. In the past, they looked to their accountant for tax optimisation strategies. However, the regulatory system now prevents the accountant from advising on starting pensions and the trustee is forced to see an adviser and pay for a full Statement of Advice. It was previously done as part of the accounting service.

I’m not saying that the new licensing requirements are all bad. Several years ago, I had the heart-breaking experience of a new client, a widow, who with her deceased husband had built up their business. They had sold it in retirement and put the proceeds into an SMSF on the advice of their long-standing and well-meaning friend and accountant.

Their accountant recommended that 100% of the $2 million cash be invested conservatively into mortgage funds. Safe as houses, right? Then the husband died, comfortable with the knowledge that he had ensured his wife was set up for life. Then the GFC struck, and she's now on the age pension.

A collaborative approach

With the new licensing regime bedded down, it’s time to bury the hatchet and for both sides to recognise that each brings essential expertise, experience and professionalism to the table.

The SMSF trustee who aligns with an accountant (or SMSF service provider) and a licensed financial adviser that can take a collaborative approach will gain the most, well ahead of the trustee who relies on two people who work separately. As an SMSF adviser, fund accountants often worked against me not with me. It cost the trustees in missed deadlines and lost opportunities to optimise the fund’s tax position and it was (frustratingly) completely out of my control.

Equally, it's often the other way around, where an adviser has made recommendations that frustrate accountants because they completely ignore important tax planning which the accountant has carefully crafted with the client over many years.

Client education is essential

I am a strong believer in client education, and this is absolutely essential for SMSF trustees. They have serious legal responsibilities and obligations to uphold. Failure to meet these obligations can result in adverse consequences which may be extremely costly.

A well-educated trustee can recognise opportunities or threats as they arise through legislative developments. Education puts them in a position to take action when required. The possible removal of franking credit refunds case in point. The informed trustee will look for solutions in anticipation of a possible change, and talk to their accountant and adviser about the best strategies.

Both the fund accountant and adviser have an important role in providing this education to trustees.

The accountant’s intimate understanding of SMSF matters such as segregation (or not) of assets, ECPI, and inhouse assets (to name a few) is just as vital as the adviser’s focus on wealth creation and retirement income through contributions, pension structure and investments.

In the world of SMSFs, an aligned accountant and financial adviser can make a formidable, synergistic team. Specialists who can’t be friends can be just the opposite.

Alex Denham is a Senior SMSF Specialist at Heffron SMSF Advisers. This article is general information and does not consider the circumstances of any individual.